Advisor Pulse – Summer 2024

The latest views from financial advisors surveyed globally1

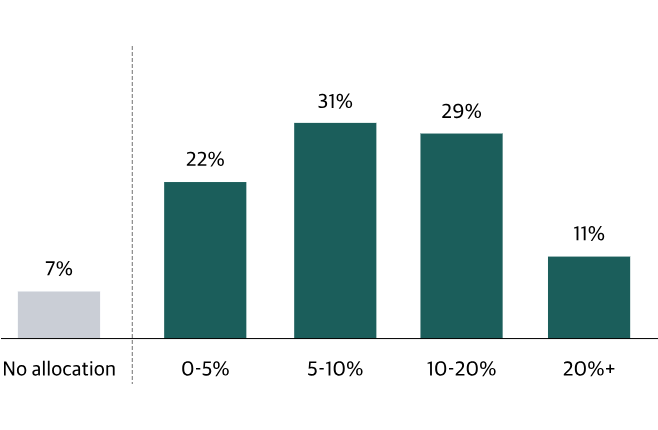

Over 90% of advisors have allocated to private markets in clients’ portfolios

Did you know?

Sophisticated investors such as endowments and pensions allocate over 50% and 20% of their portfolios to private markets, respectively. Average allocations by individual investors are relatively modest in comparison.2

What is the average private markets allocation in clients’ portfolios?

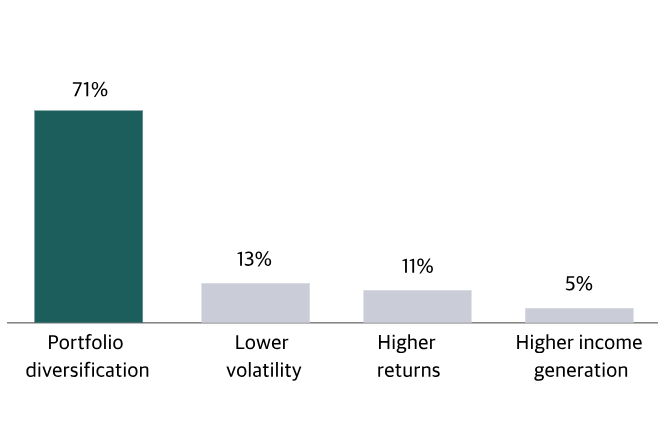

Highlighting the diversification benefits of private market assets may resonate with clients

How do you typically introduce the benefits of private markets to first-time investors?

Most advisors expect to increase allocations to private equity over the next 12 months

Did you know?

Around 90% of companies with annual revenues of $250 million or more are privately owned.5 Private equity offers a significant investable opportunity that has historically outperformed public markets by an average of 5% per year since 2007. 6

Which private market allocation are you expecting to increase the most over the next 12 months?

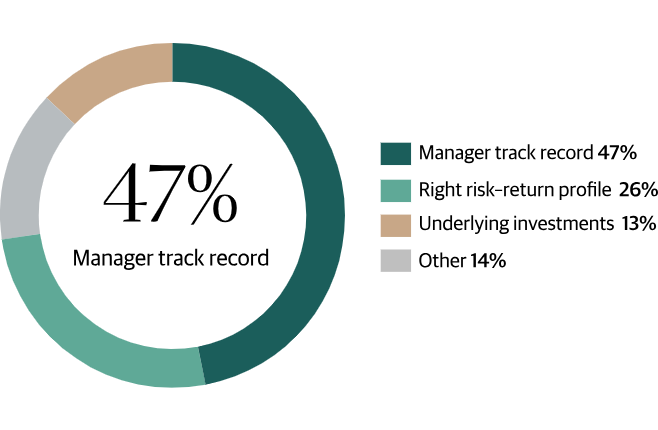

Nearly 50% of advisors cite track record as the most important factor when choosing a manager

What is the most important factor when choosing a private markets manager?

Did you know?

There is meaningful dispersion in private market manager returns compared to public market managers. For example, the gap between top quartile and bottom quartile manager returns in private real estate averaged 15.6% a year over the past 10 years, compared to 1.7% in public real estate.7 Manager selection is critical in the effort to achieve the intended outcome in private markets.

Read previous editions of Advisor Pulse

Education Resources

Essentials

Learn MoreEssentials

Insights

Learn MoreInsights

- Based on surveys of financial professionals across the U.S., EMEA, and APAC participating in Blackstone programming over the period April-June 2024. Average number of respondents per question: 459. Any views or opinions expressed herein reflect solely the views of the advisors who were surveyed in connection with this survey and/or Blackstone, and such views or opinions are subject to change without notice and may differ from opinions expressed by others. Blackstone has not independently verified the information received from the advisors surveyed and no representation is made as to the accuracy of such information. Any projections, expectations or other forward-looking statements set forth herein are based on assumptions that are uncertain and are subject to many factors, changing market conditions and general economic conditions, and may vary materially from the themes set forth herein. Nothing herein constitutes investment advice or recommendations and this page should not be relied upon as a basis for making an investment decision.

- Thinking Ahead Institute, “Global Pension Assets Study,” 2023; National Association of College and University Business Officers, “2023 NACUBO-TIAA Study of Endowments,” 2023; For Individual Investors, Bain & Company, “Global Private Equity Report,” 2023. For Endowments, the alternative asset allocation is for the Public College, University or System only and represented by allocations to Alternative Strategies (includes marketable alternatives (hedge funds), private equity, private venture capital, and real assets). Averages provided are dollar-weighted.

- “The Trusted 60-40 Investing Strategy Just Had Its Worst Year in Generations,” Wall Street Journal, Oct. 19, 2023.

- Diversification does not assure a profit or protect against losses in a declining market.

- Capital IQ, November 2023. Represents the share of companies based on the total number of public and private companies in North America, Europe, and Asia that have reported revenues 2023, 2022, or 2021 fiscal year revenues greater than $250M per Capital IQ’s company database.

- Source: Cambridge Associates, as of December 31, 2023. Note: Growth of $100,000 based on cumulative returns from January 1, 2007, to December 31, 2023, in order to capture performance throughout the Global Financial Crisis. Past performance does not predict future returns. “Private Equity” is represented by the pooled returns of the blended Cambridge Private Equity Index which is comprised of buyout funds, secondary funds, and growth equity funds. “Public Equities” are represented by the Cambridge Modified Public Market Equivalent (“PME”) analysis of the MSCI ACWI Index. Comparisons of private equity performance to an index are therefore based on the difference in performance between Cambridge Private Equity Index IRR and the hypothetical PME return of the applicable public index. Hypothetical PME index performance may differ materially from the performance of such index during the same time period on account of the adjustments made for the timing of cash flows as per the PME analysis. Public Market Equivalent (“PME”) methodology replicates the date and amount of cash flows from Cambridge Global Private Equity Index capital calls or distributions in a public market index (i.e., Russell 2000, S&P 500). The hypothetical returns generated by these cash flows then track the public market index performance with the hypothetical PME NAV at the end of a given quarter used for the hypothetical PME Index IRR calculation. Comparisons of Cambridge Global Private Equity Index performance to an index is therefore based on the difference in performance between Cambridge Global Private Equity Index IRR and the hypothetical PME IRR of the applicable public index. Hypothetical PME index performance may differ materially from the performance of such index during the same time period on account of cash flow timing. Indices are provided for illustrative purposes only, and there are significant risks and limitations related to relying on comparisons to an index, including the PME adjustments. Indices are provided for illustrative purposes only, and there are significant risks and limitations to relying on comparisons to an index, including the PME adjustments.

- Past performance does not predict future returns. There can be no assurance that any Blackstone fund or investment will achieve its objectives or avoid substantial losses, or that alternative investments will generate higher returns than other investments. The information herein is provided for educational purposes only and should not be construed as financial or investment advice, nor should any information in this document be relied on when making an investment decision. Source: Morningstar, Cambridge Associates. Returns are over a 10-year period from January 1, 2014 to December 31, 2023. (Open-end funds): Public Real Estate (US Real Estate). Cambridge returns are for 2014 vintages that have last reported between January 1, 2014 to December 31, 2023. (North America, Closed funds): Private Real Estate (Real Estate). Investments in less liquid private market strategies are by nature risky and typically involve a high degree of leverage. The returns indicated are long- term and represent well-known asset class indices and are not meant to be predictive of the performance of any particular fund, nor are they meant to suggest that all private funds result in positive returns or would avoid loss of principal.