Joe Zidle: A Year-End Look Around the World

We wish everyone a happy and healthy holiday season. We’re like many of you right now, rushing to finish year-end projects as we prepare to spend time with loved ones over the holidays. My family and I will travel to New Hampshire, where my aunt and uncle have hosted celebrations for nearly 50 years. Due to the pandemic, last year was the first time we missed gathering in person. If we never have to host another holiday meal over Zoom, it will still be too soon.

Here at Blackstone, the Investment Strategy team is cranking away on the annual list of Ten Surprises. This is the fourth year that I’ve been lucky enough to work on the Surprises with my partner, Byron Wien. His professional commitment amazes me, and his energy and creativity are boundless. Byron and I will publish the 37th annual installment of the Ten Surprises on January 3rd. In the meantime, we take a year-end look around the world and reflect on differentiated investment opportunities in the coming year.

Conviction in the US Remains Strong

If you’ve followed my work this year, it should come as no surprise that I maintain conviction in the strength of the US recovery. Personal consumption has soared with the reopening of the economy, though spending remains skewed toward goods as the services sector faces ongoing COVID-related operating restrictions and labor shortages. This imbalance placed significant pressure on global supply chains, which have struggled to meet demand given the limited availability of shipping containers, port berths, and transportation workers.

Despite Omicron, positive signs for US growth The emergence of the Omicron variant is concerning, and it reminds us that the fight against COVID is far from over. Vaccination progress and scientific advances should, however, propel the economy’s ongoing return to normalcy. Sixty-nine percent of Americans are at least partially vaccinated,1 and the Food and Drug Administration (FDA) recently approved booster shots for all adults. I’m even more hopeful about the imminent distribution of antiviral therapeutic pills, including those from Merck and Pfizer, which can treat COVID after the onset of symptoms. The US has already secured over 13 million courses of treatments from the two drug companies.2

The combination of immunity and improved treatments should further normalize daily life and cause spending to rotate away from durable goods back toward services, alleviating supply chain bottlenecks. Additionally, the Biden administration successfully passed its infrastructure spending bill, with further stimulus potentially forthcoming in the Build Back Better Act. Finally, even as the Fed becomes incrementally less stimulative as it begins to taper asset purchases and consider interest rate hikes, monetary policy will remain relatively accommodative for some time. Thus, both fiscal and monetary policy position the US economy well for continued growth in 2022 and beyond.

Global Outlooks Are Diverging

The positive outlook for the US economy contrasts with more concerning dynamics internationally, including China’s production slowdown amidst rising energy and commodity costs. Around the world, sovereign bond yield curves are flattening; and in several emerging markets, they’ve inverted. I do not expect a global recession, given historic stimulus and healthy consumption. I do expect, however, that certain economies will weather the coming headwinds better than others, creating differentiated global outcomes.

China’s reorientation: from old economy to new economy Many market watchers, me included, thought that China would be a driver of global economic growth as the first waves of COVID receded. Extensive lockdowns and contact tracing ensured that case counts remained low throughout 2020. And since then, China has administered over 2 billion vaccinations. However, China’s zero-tolerance COVID policy has been a headwind to household consumption, and broad lockdowns and strict quarantine requirements continue to hamper spending. This policy has created a particularly difficult operating environment for certain segments of the domestic economy, including entertainment, travel, and recreation.

In recent months, however, China’s economy began a once-in-a-generation reorientation around the concept of “Common Prosperity.” The goal of this policy pivot is to narrow the domestic wealth gap and promote sustainable growth that supports middle-class households. Though China’s industrial production and exports reached record highs over the past 12–18 months, I anticipate that Chinese policymakers will continue to strive for secular change that tilts the country away from the old model of heavy industry and towards a more knowledge-based and service-oriented economy.

This reorientation means that household consumption, not factory exports, will increasingly propel China’s growth. Chinese leadership knows that China’s role as the world’s “factory floor” helped lift the country out of poverty, but that further policy innovation will be required to escape the “middle income” trap. As a result, those countries and companies that have benefited from cheap manufacturing from China are at risk of being left behind by the country’s pivot. In comparison, China’s new economy will feature themes that contribute to long-term growth, including high-tech manufacturing and biotechnology.

Europe’s recovery: energy shortages and low rates Europe continues to battle energy shortages caused by the intersection of the continent’s rapid transition to green energy sources, depleted energy inventories, and slow delivery of natural gas from Russia. Inflation has soared, pressuring household budgets and inviting speculation of a hawkish monetary policy pivot.

However, the European Central Bank (ECB) has stated clearly that it does not intend to raise rates or end its massive asset purchases anytime soon. ECB President Christine Lagarde does not fancy herself a European Volcker, willing to drive growth into the ground in order to slay inflation. Monetary policy wards off inflation by depressing aggregate demand, which seems to be particularly ill-suited to combat the supply-side inflation currently pressuring the continent.

These dynamics reflect the compositional differences between inflation in Europe and the US. In the US, I expect price growth will be increasingly driven by higher wages and rents, which are more persistent forms of inflation than those caused by supply shocks and commodity volatility. In contrast, the current decade-high inflation readings in Europe will likely moderate as winter passes and supply chain bottlenecks ease. As a result, European rates should remain low for longer than those of other developed markets, including the US and the UK.

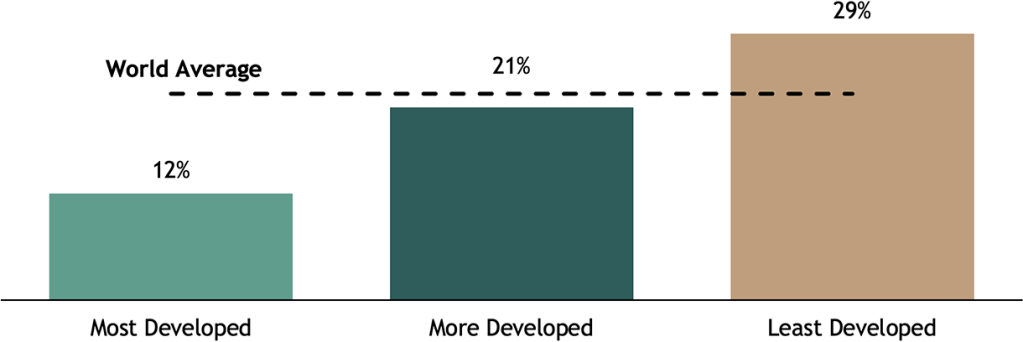

Emerging markets’ inflation: commodities apply pressure Prices for many commodities around the world soared this year, in some cases establishing new records. These dynamics have led to significant consumer price inflation, especially in emerging markets, where food and energy tend to comprise a much higher share of total consumer spending (see Figure 1). That exposure makes households more vulnerable to cost-push price shocks.

Figure 1: Share of Consumer Expenditure Spent on Food

Source: Blackstone Investment Strategy, Our World in Data, and the World Bank. Data as of 2016, which is the most recently available annual data compiled by the World Bank. Only includes food bought for consumption at home and excludes alcoholic beverages and tobacco.

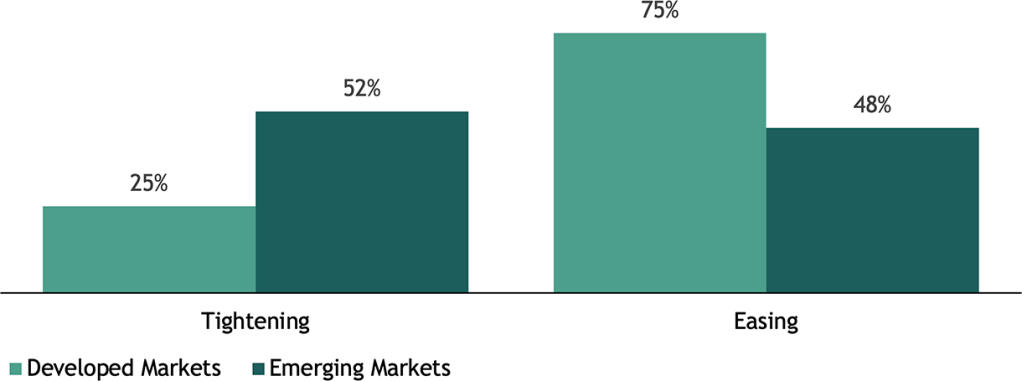

As a result, central banks in emerging market countries turned notably hawkish in recent months to fight significantly higher inflation (see Figure 2). The combination of rising prices, tightening financial conditions, and slowing growth may threaten emerging markets with stagflation. This view contrasts with my expectations for the US and most other developed markets, where generous fiscal stimulus, robust consumer spending, and accommodative monetary policy are likely to promote, not quash, growth.

Figure 2: Share of Central Banks Tightening or Easing Monetary Policy

Source: Blackstone Investment Strategy, Ned Davis Research, and Haver Analytics, as of 11/23/2021. Based on central bank policy rates aggregated from 12 developed market countries and 21 emerging market countries.

One potential mitigant of commodity inflation is that supply chain congestion may peak soon: trans-Pacific ocean freight rates are down 29% from their September peak,3 and California ports have reported significant progress in unwinding ship backlogs.4 While shipping delays and prices could remain elevated for some time, the parabolic growth rates of the past year are unlikely to continue. Additionally, exogenous factors could boost commodity supplies. For example, energy producers like OPEC+ could choose to increase production, or the flow of natural gas from Russia to western Europe could increase.

Investment Implications of a Differentiated Environment

As I wrote last month with Prakash Melwani, Senior Managing Director and Global Chief Investment Officer of Blackstone Private Equity, the coming quarters will likely feature a differentiated market environment. Companies are likely to continue to grow earnings, but high valuations and compressing profit margins will make it difficult for public market multiples to expand. Against that backdrop, I think the ability to generate alpha will increasingly drive outperformance in the US. That scenario contrasts with the last cycle, in which beta-reliant strategies benefited from a bull market relatively undifferentiated across sectors, strategies, and asset classes.

On the hunt for global alpha Similarly, identifying pockets of the global economy that can outperform will be critical. This includes international markets with strong growth prospects fueled by robust consumer spending and relatively high inoculation against COVID. A prime example is the UK, where over 93% of the adult population has received at least one vaccine dose.5 The UK also responded to the COVID pandemic with fiscal spending totaling 36% of GDP, one of the largest stimulus packages in the world.6 Jointly, these factors should spur spending and growth over the coming cycle: household consumption is expected to rise by nearly 7% in 2022.7

Also watch out for developing markets with high potential to expand their middle class, which would enable consumption growth, and the physical and technological infrastructure to capitalize on foreign direct investment. One example is India, a market in which Blackstone has operated for 15 years. In fact, we’re one of the top business groups by total assets in the country and one of the largest owners of office, retail, and logistics real estate. Blackstone’s Private Equity business in India has also targeted investments in high-conviction sectors, including financial services, IT, consumer, and industrials.

Energy investment in a greener world Significant areas of the energy sector have experienced secular under-investment in recent years as the world pivoted toward clean energy sources, in most cases before production capacity was fully realized. This transition is, of course, the result of encouraging progress on tackling climate change. However, it also contributed to the resource bottlenecks that emerged in recent months. European energy shortages are an example.

As a result, investors should look for capital-poor segments of the energy sector, because returns there are likely to be high as demand rebounds amid the sustained shift toward renewables. It seems likely that natural gas, in lieu of less-clean hydrocarbon energy sources, will continue to play an important role as the economy transitions to green energy in the coming years.

Finally, certain segments of the energy sector are especially well positioned in the current inflationary environment. One example is midstream infrastructure, which involves the transportation, storage, and processing of energy products. Investors should focus on midstream MLPs and C-Corps with high distribution coverage ratios, which increase the odds of increased distributions and buybacks. Additionally, midstream is one of the few income-oriented asset classes with Producer Price Index (PPI) adjusters built directly into certain cash flow streams. Combined with the sector’s strong generation of free cash flow, that makes midstream an attractive option in periods of rising producer prices and scarce yield.

With data and analysis by Taylor Becker.

- Our World in Data, as of 11/22/2021.

- Merck, as of 11/9/2021; Pfizer, as of 11/18/2021.

- Freightos and Blackstone Investment Strategy, as of 11/28/2021. Represents the Freightos Baltic Index for 40-foot container ocean freight rates from China to the US West Coast.

- CNBC, as of 11/24/2021.

- UK Office for National Statistics, as of 11/23/2021.

- International Monetary Fund, as of 9/27/2021. Represents the combination of “below the line” spending measures (i.e., equity injections, loans, asset purchases, or debt assumptions) and additional spending and foregone revenue.

- Bloomberg consensus forecasts for the United Kingdom, as of 11/29/2021.

The views expressed in this commentary are the personal views of Joe Zidle and do not necessarily reflect the views of Blackstone Inc. (together with its affiliates, “Blackstone”). The views expressed reflect the current views of Joe Zidle as of the date hereof, and neither Joe Zidle or Blackstone undertake any responsibility to advise you of any changes in the views expressed herein.

Blackstone and others associated with it may have positions in and effect transactions in securities of companies mentioned or indirectly referenced in this commentary and may also perform or seek to perform services for those companies. Blackstone and others associated with it may also offer strategies to third parties for compensation within those asset classes mentioned or described in this commentary. Investment concepts mentioned in this commentary may be unsuitable for investors depending on their specific investment objectives and financial position.

Tax considerations, margin requirements, commissions and other transaction costs may significantly affect the economic consequences of any transaction concepts referenced in this commentary and should be reviewed carefully with one’s investment and tax advisors. All information in this commentary is believed to be reliable as of the date on which this commentary was issued, and has been obtained from public sources believed to be reliable. No representation or warranty, either express or implied, is provided in relation to the accuracy or completeness of the information contained herein.

This commentary does not constitute an offer to sell any securities or the solicitation of an offer to purchase any securities. This commentary discusses broad market, industry or sector trends, or other general economic, market or political conditions and has not been provided in a fiduciary capacity under ERISA and should not be construed as research, investment advice, or any investment recommendation. Past performance is not necessarily indicative of future performance.