Joe Zidle: Longer Runway for Growth—and Inflation

The Fed has finally embarked on its aggressive rate hiking cycle, raising rates by 50bps—the largest interest rate increase in over 20 years—and beginning the reduction of its balance sheet. While the moves were highly anticipated, markets have been whipsawed by volatility nonetheless, with the S&P 500 suffering its longest losing streak since 2011 and the 10-year Treasury yield surging above 3.1%.1

There is so much uncertainty on what lies ahead, which is perhaps most evident in Fed Chair Powell’s statement that “we have a good chance to have a soft or softish landing.” (You’d be forgiven for not finding the Fed Chair’s use of the word “softish” very comforting.)

The Fed certainly has a tough needle to thread, with conditions today being extremely different from the ones in prior “soft landings”, such as those in 1983 or 1994. And to be sure, the recent inversion of the 10Y-2Y portion of the yield curve is a major warning sign, and one that I take seriously. But our team considers several other indicators that have historically proved to be preconditions for a recession, and these haven’t fallen into place yet. For this reason, I remain more optimistic about US growth, at least in the near-term, and I don’t see signs of an imminent recession.

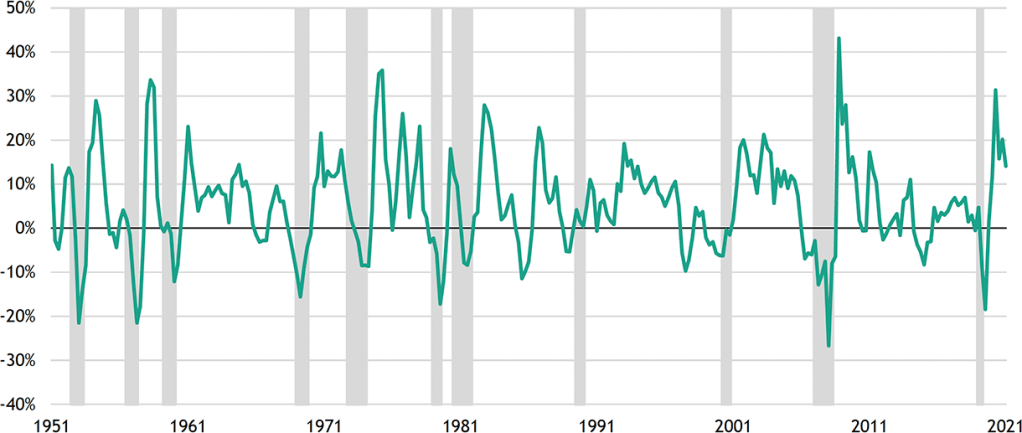

Sufficient conditions for a recession lacking The first condition is an earnings recession. As Figure 1 shows, corporate profit growth turns negative before a recession. The modern US economy has never had a recession when profit growth is positive. Growth slowdowns in Europe and China, from which many large multinational companies derive most of their revenues, are concerning. However, the profits outlook is still relatively strong, despite slowing growth and tougher comps. Blackstone portfolio company CEOs are generally optimistic about revenue EBITDA growth, with the vast majority expecting continued year-over-year growth in both categories this year and in 2023.2

Figure 1: US Corporate Profit Growth

(YoY change)

Source: Blackstone Investment Strategy and Bureau of Economic Analysis, as of December 31, 2021. Represents corporate profits before tax with inventory valuation and capital consumption adjustments.

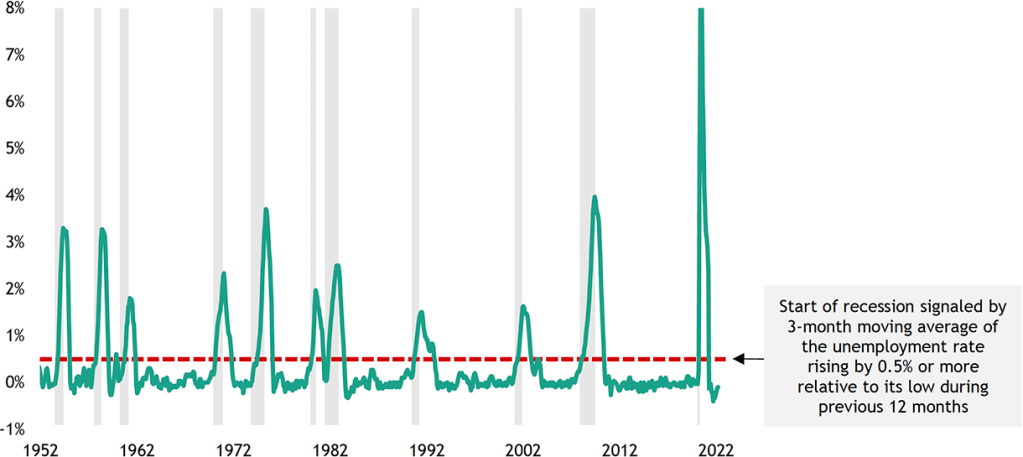

The second precondition is a back-up in the unemployment rate. Figure 2 highlights the Sahm Rule Recession Indicator, named for former Fed researcher Claudia Sahm. This indicator suggests that we remain quite far from labor market conditions that would signal the start of a recession. The number of people filing for first-time unemployment is at historic lows, levels not seen since the 1960s. Meanwhile, the number of job openings remains at historic highs in absolute terms, with roughly 1.7 unfilled jobs for every unemployed person.

Figure 2: Sahm Rule Recession Indicator

(3-month moving average of the unemployment rate, relative to its low during previous 12 months)

Source: Blackstone Investment Strategy, Bureau of Labor Statistics and Claudia Sahm, as of March 31, 2022.

Reasons to be optimistic about growth As I’ve mentioned, I do find the recent yield curve inversion is troublesome, but the economy still has momentum. Household balance sheets remain strong, labor markets are robust, and companies are reluctant to let go of employees. Also, profit growth remains on track to increase. As a result, I will take the “over” on economic growth and the “under” on recession risk, as I think this cycle has a longer runway still.

“Peak” Inflation, But a Higher Run-Rate

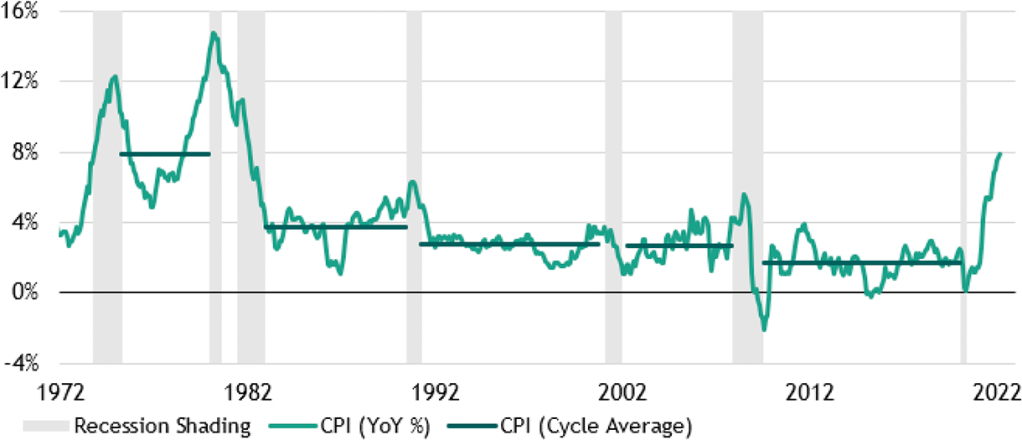

The pandemic resulted in several extraordinary historical events—from excess central bank liquidity and massive stimulus payments to tight labor markets and supply chain disruptions. In their own way, each contributed to today’s inflationary impulse. Most recently, the war in Ukraine caused the commodity price shock that is driving prices higher. Another factor is the confluence of more secular trends, such as China’s worsening demographics and deglobalization. I expect inflation to drift down over time, but over this economic cycle, I think that average inflation will rival that of the 1990s, when CPI increases averaged 2.8%, as Figure 3 shows.

Figure 3: US CPI Increases by Economic Cycle

(YoY % Change)

Source: Blackstone Investment Strategy calculations and Bureau of Labor Statistics, as of February 28, 2022. Recession shading based on NBER recession dates.

Structurally higher interest rates Negative real rates are an historical anomaly; a normal, functioning economy generally has real rates in the 0.75% to 1.00% range. Now that the Fed is removing its pandemic-related support and raising rates to try to tame inflation, I expect the entire yield curve will shift higher and re-steepen. In this scenario, I think that the fair value for the 10-year Treasury yield is somewhere in the mid-3% range.

Shorter duration across asset classes Investing in a world of higher rates and inflation will feel very new for those of us accustomed to the low-growth, low-rate investment environment that dominated the last several cycles. Duration management will be critical. Also critical will be an asset’s ability to increase cash flow. In real estate, for example, this means opting to offer shorter leases rather than long-term ones. Floating rate credit would be expected to outperform fixed rates. In public and private equities, companies that can grow free cash flow across any asset class should beat those investments where the income is weighted to the distant future. Finally, we would revisit the case for MLPs that focus on midstream assets. Fundamentals remain strong in our view, and many of these assets can offer high yields and the potential to grow them.

With data and analysis by Taylor Becker.

- Source: Bloomberg, as of May 6, 2022.

- Source: Blackstone, as of March 31, 2022. Certain information herein has been derived from surveys of certain Blackstone portfolio companies. Such surveys were not scientifically conducted and are not necessarily a representative sample of companies in Blackstone’s portfolio or across industries, geographies, or any other category or metric. The views expressed by the portfolio companies reflect the current views of those companies and may be different if provided by different portfolio companies. Blackstone does not undertake any responsibility to advise you of any changes in the views expressed herein.

The views expressed in this commentary are the personal views of Joe Zidle and do not necessarily reflect the views of Blackstone Inc. (together with its affiliates, “Blackstone”). The views expressed reflect the current views of Joe Zidle as of the date hereof, and neither Joe Zidle or Blackstone undertake any responsibility to advise you of any changes in the views expressed herein.

Blackstone and others associated with it may have positions in and effect transactions in securities of companies mentioned or indirectly referenced in this commentary and may also perform or seek to perform services for those companies. Blackstone and others associated with it may also offer strategies to third parties for compensation within those asset classes mentioned or described in this commentary. Investment concepts mentioned in this commentary may be unsuitable for investors depending on their specific investment objectives and financial position.

Tax considerations, margin requirements, commissions and other transaction costs may significantly affect the economic consequences of any transaction concepts referenced in this commentary and should be reviewed carefully with one’s investment and tax advisors. All information in this commentary is believed to be reliable as of the date on which this commentary was issued, and has been obtained from public sources believed to be reliable. No representation or warranty, either express or implied, is provided in relation to the accuracy or completeness of the information contained herein.

This commentary does not constitute an offer to sell any securities or the solicitation of an offer to purchase any securities. This commentary discusses broad market, industry or sector trends, or other general economic, market or political conditions and has not been provided in a fiduciary capacity under ERISA and should not be construed as research, investment advice, or any investment recommendation. Past performance is not necessarily indicative of future performance.

For more information about how Blackstone collects, uses, stores and processes your personal information, please see our Privacy Policy here: www.blackstone.com/privacy. You have the right to object to receiving direct marketing from Blackstone at any time. Please click the link above to unsubscribe from this mailing list.