Joe Zidle: The Investor’s Guide to Tapering

In Douglas Adams’s sci-fi masterpiece, The Hitchhiker’s Guide to the Galaxy, a supercomputer named Deep Thought is tasked with providing the answer to the “Ultimate Question of Life, the Universe, and Everything.” After 7.5 million years of analysis, Deep Thought determines that the answer is, of course, 42. My team and I may not constitute a supercomputer, but we have been pondering the “Ultimate Question of Investing during Fed Tapering.” And in our view, the answer may not be as simple as 2013.

In December of that year, the Federal Reserve began tapering its asset purchases to wind down its Global Financial Crisis (GFC)-era quantitative easing program. The Fed finished tapering in January 2015 with its balance sheet at $4.5 trillion. By that December, the Fed’s rate-setting committee lifted its benchmark policy rate for the first time since 2006. Rate hikes continued for the next three years while the Fed maintained the size of its balance sheet.

During this period, the 10-year Treasury yield traded in a range from 1.3% to 3.1% and back again. Equities were lackluster: stocks returned just 7% annualized from the start of the Fed’s tapering to its final rate hike in 2018, well short of their 17% per annum average for the full bull market from 2009 to 2020. Consumer inflation fell, and growth stalled. Ultimately, the economy proved too weak to endure a tightening cycle, forcing the Fed to cut interest rates.

If You Remember Woodstock, You’re in Luck

Now, we’re preparing for another Fed taper as the economy emerges from the COVID crisis. In my view, this environment is more reminiscent of the back half of the 1960s than the post-GFC decade – and not just because we’re launching people into the stratosphere again.

Tie-dye, economic growth, and equity volatility In the late sixties, interest rates and inflation broke out to the upside, in part due to rising oil prices and government spending. Lyndon B. Johnson expanded upon John F. Kennedy’s “New Frontier” by launching important social initiatives, including Medicare and the Food Stamp Program. Taxes increased, but deficit spending still soared. Seventy astronauts went to outer space; four made it to the moon.

Market volatility accompanied this period of major fiscal spending and robust economic growth. Headline equity indices struggled to make much progress; S&P 500 annual returns swung between large corrections (1966, 1969) and double-digit gains (1967, 1968). Against this volatile backdrop, the most cyclical companies, including value stocks, small caps, and industrials, outperformed the overall stock market. As interest rates moved higher, long duration assets underperformed.

Similar colors decades later Today, healthy household and company balance sheets have fueled robust demand, which suggests that the current expansion will feature persistent inflationary pressures and strong economic growth. Taxes are set to rise, though the Biden administration’s push for spending on “social infrastructure” means deficit spending will likely outpace increases in government revenue.

I’ve written at length this year about my expectation for an economic recovery driven by fundamentals. If I’m right, then the Fed won’t be forced to quickly resume policy support after tapering ushers in higher interest rates. Even if markets experience bouts of volatility, an inflationary environment would raise the bar for the Fed to use its balance sheet as a backstop for public markets. For companies, 4Q21 probably marks peak liquidity as the printing of helicopter money starts to slow down. As a result, investors should prepare for the performance implications of these changing macroeconomic conditions in 2022 and beyond.

The Fundamental Investor’s Checklist

Equity duration an important concept We’re all used to the idea of duration in the context of fixed income products, but it’s relevant for stocks, too. For example, consider the most speculative tech company available for purchase in public markets. The more time it takes for that company to become profitable and return stockholders’ initial investment, the longer that stock’s duration. That doesn’t mean portfolios should rotate away from all tech companies or growth stocks as higher rates make it more expensive to do business. Rather, investors should develop a keener eye for companies that have strong fundamentals and can deliver free cash flow sooner rather than later.

Up in quality, down in beta The hiking cycle I’ve described will introduce greater volatility into markets because less liquidity and higher rates imply a higher cost of capital. Over the last cycle, disinflation, falling rates, and policy support helped fuel multiple expansion. In this cycle, higher inflation, rising rates, and the end of COVID stimulus will likely be headwinds for valuations. That means returns in public markets will increasingly rely on earnings growth, resulting in a market environment with greater breadth and opportunities for outperformance by assets with strong alpha.

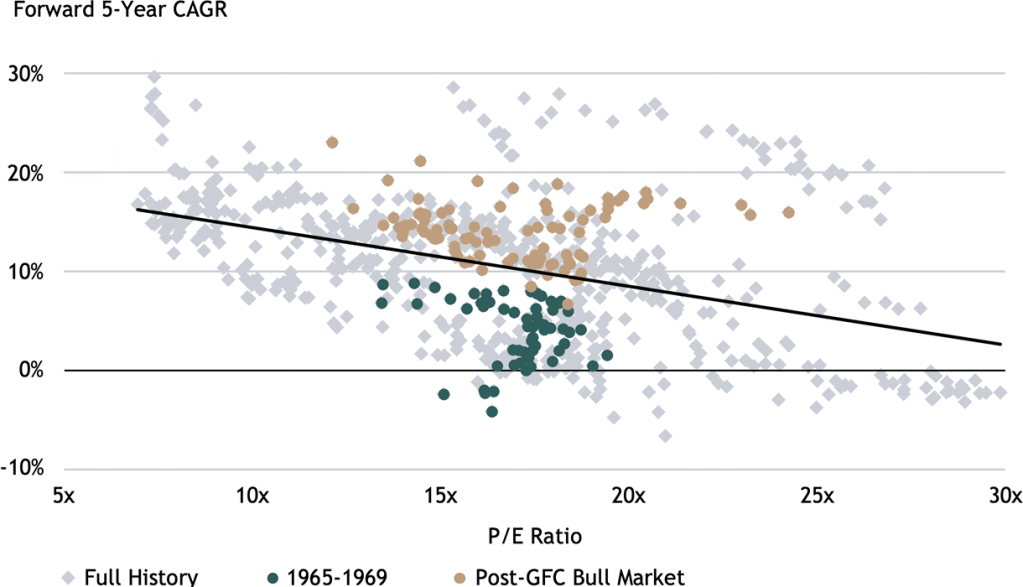

Figure 1 plots monthly S&P 500 valuations against their forward 5-year CAGR. As the black trend line shows, the historical relationship between P/E ratios and forward returns is negative. Looking back once more to the late sixties, we see that valuations were very similar to those observed over the first several years after the Financial Crisis. However, returns following that period all fell below the historical trendline – and, in some cases, were actually negative. Compare that to the post-GFC bull market, when valuations were elevated but forward performance was strong. Given today’s macro and policy background, I think public equity investors are in for a sixties redux, in which average market returns will be muted and margin expansion will become more difficult.

Figure 1: S&P 500 Valuation and Forward 5-Year CAGR

Source: Blackstone Investment Strategy, Bloomberg, and Standard & Poor’s, as of September 30, 2021. “Forward 5-Year CAGR” is computed using monthly total returns (gross of dividends). “P/E Ratio” is the trailing 12-month price-to-earnings ratio. “Full History” begins in January 1957. “Post-GFC Bull Market” spans January 2009 through September 2016, the latest data point from which a forward 5-year CAGR can be computed.

Making a home in good neighborhoods So where should investors look for returns in an environment that will likely feature higher inflation, less policy support, and muted returns? At Blackstone, our answer is to pursue sectors that we believe will experience secular growth, which we call “good neighborhoods.” In recent years, this strategy led us to logistics, housing, life sciences, and digital disruption. Across our business units, many of our investments target these and other secularly strong industries.

To further discuss what it takes to deliver alpha in this macroeconomic environment, I asked one of our leaders to share his thoughts.

Private Equity in a Changing Environment

By Prakash Melwani, Senior Managing Director and Global Chief Investment Officer of Blackstone Private Equity

PE performance in a post-lockdown world Private equity activity has reached record levels this year: by year-end 2021, PE firms will have announced approximately $1.1 trillion of transactions globally, which exceeds the previous full-year record of approximately $800 billion set in 2006 and 2007.1 Several factors explain this elevated activity: optimism about post-COVID earnings growth, abundant and attractive financing, and owners selling their companies ahead of anticipated tax increases.

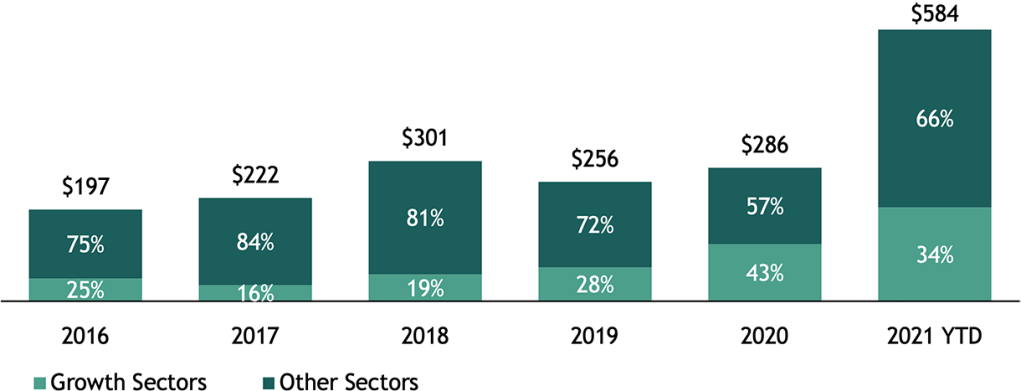

As Figure 2 shows, the PE industry has increasingly focused on growth sectors, including tech, fintech, life sciences, and healthcare IT. Growth investments increased to over 40% of all PE transactions in 2020 as companies in these sectors experienced faster growth after COVID accelerated changes in spending patterns that were already underway. In 2021, the absolute value of growth investments has continued to grow, but dealmaking in COVID-affected sectors has also increased as investors anticipate a return to normalcy.

Figure 2: Sponsor Acquisition Aggregate TEV

(US$ in billion)

Source: Citi GAM, as of September 15, 2021. Includes North American deals over $500 million. Excludes energy and power. Growth sectors consist of tech, fintech, life sciences, and healthcare IT.

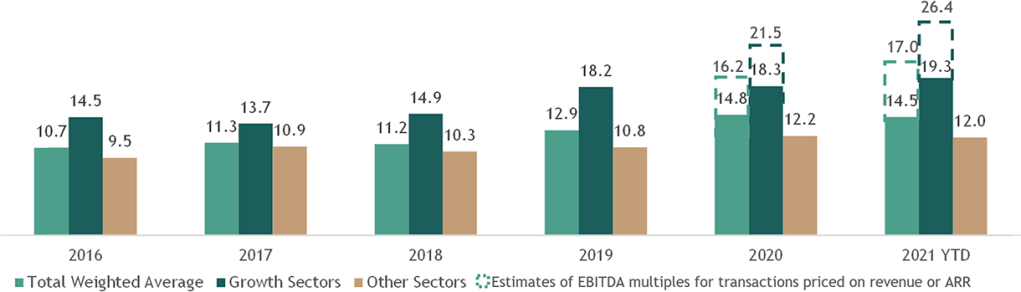

Figure 3: Sponsor Acquisition EBITDA Multiples

Source: Citi GAM, as of September 15, 2021. Includes North American deals over $500 million. Excludes energy and power. Growth sectors consist of tech, fintech, life sciences, and healthcare IT. “ARR” represents annual recurring revenue.

At Blackstone, we have spent many years targeting industries with attractive secular growth prospects, or what we call “good neighborhoods”. Some of the sectors we are currently focused on include online services, software, healthcare and life sciences, energy transition plays, Asian suppliers, and COVID-disrupted secular growers such as travel and leisure. These types of companies have generally already eclipsed their pre-COVID earnings levels, and we remain optimistic about their growth prospects and ability to expand margins in the currently changing economic environment.

What our CEOs are saying Each quarter, we survey a subset of our portfolio company CEOs. In 3Q21, over 60% of our surveyed portfolio companies’ CEOs said that they expected double-digit profit growth in 2021 and 2022. Consistent with these expectations, we remain optimistic about the pace of economic recovery. Our investment teams have meaningful domain expertise in their focus sectors and work with a broad network of experts to anticipate changes in industry trends. Blackstone has also built out a large Portfolio Operations group that strives to help our portfolio companies outperform their peers.

So, what are some of the issues that are our CEOs are concerned about? The ability to hire and retain qualified workers and supply chain problems have now joined COVID at the top of our surveyed CEOs’ list of concerns. Currently, job vacancies are extremely difficult to fill in certain sectors, including leisure and hospitality. Businesses that rely on imports are facing the potential for rising costs as they struggle to find space in shipping containers and locate truck drivers to transport the containers once they arrive at US ports. Finally, the recent spike in energy prices is a headwind for company margins, as it becomes apparent that additional time and capital will be required to transition away from carbon fuels.

These dynamics all feed through to higher inflation. Our surveyed portfolio company CEOs raised their inflation expectations significantly over the past two quarters. Many of them believe that wage and price inflation are running around 4% and expect inflation to remain near these levels over the coming year. As investors, then, we must ask ourselves these questions: How long can the 10-year Treasury yield remain at 1.6% given these inflationary pressures? Moreover, are current negative real interest rates leading to overly aggressive risk appetites that will reverse once rates rise?

Playbook for alpha generation Lower profit margins due to wage and supply chain pressures combined with reduced valuation multiples due to higher interest rates is something to watch out for. Scenarios like these are why Blackstone focuses on generating alpha. In seeking to meet this objective, our alpha playbook includes these five principles:

- Always emphasize sector selection (“good neighborhoods”) and backing great management teams.

- Pre-identify value creation levers that can offset the risks of profit margin and exit multiple compression, and engage early with our Portfolio Operations group to effect changes.

- When multiples in good neighborhoods are too high, find second-order beneficiaries of those secular themes. For example, if electric vehicle companies were too pricey, invest in battery storage.

- Find companies that can be repositioned to achieve a higher valuation multiple upon exit.

- Be disciplined about selling companies when the planned business improvement or exit valuation is achieved.

While it’s always hard to predict the future, our PE investment strategy is designed to perform well despite the inevitable obstacles that markets will face over the coming cycle. We think that our ability to directly influence the business performance of our PE investments enables us to unlock value and generate alpha in a way that many public market investors simply can’t.

With data and analysis by Taylor Becker.

- Source: Bain and Company.

The views expressed in this commentary are the personal views of Joe Zidle and Prakash Melwani and do not necessarily reflect the views of Blackstone Inc. (together with its affiliates, “Blackstone”). The views expressed reflect the current views of Joe Zidle and Prakash Melwani as of the date hereof, and neither Joe Zidle, Prakash Melwani, or Blackstone undertake any responsibility to advise you of any changes in the views expressed herein.

Blackstone and others associated with it may have positions in and effect transactions in securities of companies mentioned or indirectly referenced in this commentary and may also perform or seek to perform services for those companies. Blackstone and others associated with it may also offer strategies to third parties for compensation within those asset classes mentioned or described in this commentary. Investment concepts mentioned in this commentary may be unsuitable for investors depending on their specific investment objectives and financial position.

Tax considerations, margin requirements, commissions and other transaction costs may significantly affect the economic consequences of any transaction concepts referenced in this commentary and should be reviewed carefully with one’s investment and tax advisors. All information in this commentary is believed to be reliable as of the date on which this commentary was issued, and has been obtained from public sources believed to be reliable. No representation or warranty, either express or implied, is provided in relation to the accuracy or completeness of the information contained herein.

This commentary does not constitute an offer to sell any securities or the solicitation of an offer to purchase any securities. This commentary discusses broad market, industry or sector trends, or other general economic, market or political conditions and has not been provided in a fiduciary capacity under ERISA and should not be construed as research, investment advice, or any investment recommendation. Past performance is not necessarily indicative of future performance.