Joe Zidle: Yield – The Scarcest Resource

The global economy has bounced back robustly from the COVID-induced lockdowns, but the pace of growth is expected to gradually slow. The Federal Reserve and other central banks will likely respond by keeping interest rates at historically low levels in order to support economic growth. For investors, one of the greatest challenges they will face in this cycle is how to invest for income during the prolonged period of low rates that I expect. This income challenge will be particularly daunting for the older generation, which continues to grow globally.

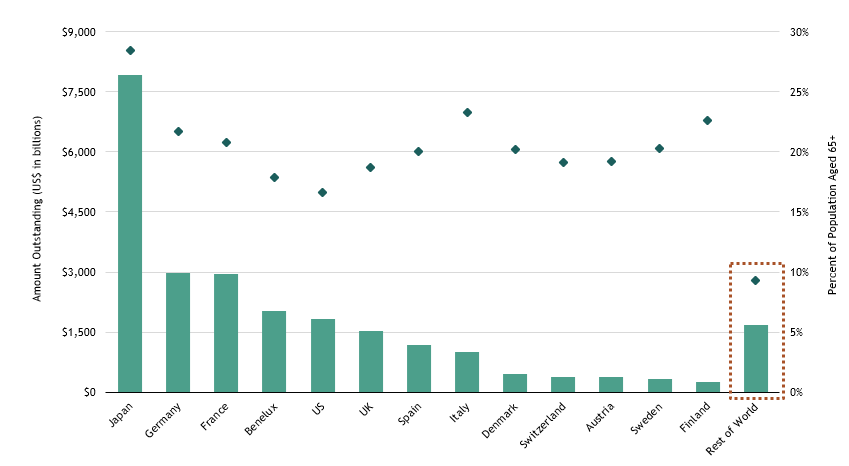

Older society, lower rates One out of every five people in developed countries is aged 65 or older. Countries with the greatest proportion of their populations over the age of 65 are many of the same countries maintaining zero or negative rates. Japan, with approximately 28% of its population 65 or older, has pegged rates at zero or below since 2005. With approximately 20% of their populations 65 and older, Sweden, Denmark and Switzerland all have benchmark rates at zero or below. The numbers are similar across the eurozone. The US isn’t far behind with a benchmark rate of zero and 16% of the population aged 65+, including 53 million baby boomers.1

Negative rates, negative debt Where there’s negative interest rates, there’s negative-yielding debt. Globally, over $15 trillion of debt carries negative rates, and the majority of that is in the world’s oldest countries.

Negative-Yielding Debt and Aging Populations2

But where’s the inflation? With record-low rates and record-high central bank balance sheets, policymakers believe they can create inflation. And shouldn’t they? After all, inflation is always and everywhere a monetary phenomenon, as economist Milton Friedman wrote in The Counter-Revolution in Monetary Theory in 1970. However, experience—not theory—from Japan, Europe and so many other areas shows policymakers failing to raise inflation, even with unlimited, open-ended monetary policy activities. Whether Friedman’s theory is relevant in today’s environment is a conversation best suited for another forum. But it seems that demographics may play a larger role in creating inflation than Friedman was aware of in his day.

Looking far and wide As aging populations seek the security and yield of fixed income investing, the traditional 60/40 portfolio of public market assets looks increasingly inadequate in today’s lower-for-longer world. That traditional portfolio mix delivered a 3.5% yield after the Great Financial Crisis ended in 2009 but has since declined to less than 1.5%.3 Today, most of that yield is derived from stock dividends, potentially a variable and volatile income stream. Investors have been trying to solve for these issues by seeking yield in lower-quality assets. In August, for example, a high-yield bond was priced with a coupon of 2.875%, the lowest ever.4 And it was oversubscribed. Alternative forms of income that don’t compromise credit quality should be considered in an asset allocation, in our view. Private credit and private real estate are examples of alternative assets that have historically provided attractive income in a low-yielding environment.

1. Source: United Nations Population Statistics. Estimates for the year 2020, based on UN World Population Prospects (2019).

2. Source: Bloomberg and United Nations Population Statistics. Negative-yielding debt as of 9/15/20, and represents total amount of debt outstanding with yield to maturity less than zero, by country of domicile. Population statistics are estimates for the year 2020, based on UN World Population Prospects (2019). Note: “Rest of World” population estimate based on average of total global population.

3. Source: Bloomberg, as of 8/31/20. “Traditional portfolio mix” refers to a model portfolio with 60% allocation to the S&P 500 Index and 40% allocation to the Bloomberg Barclays U.S. Aggregate Bond Index.

4. Source: Bloomberg, as of 8/10/20. Represents the lowest-ever yield for a U.S. high-yield bond with a maturity of five years or longer.

The views expressed in this commentary are the personal views of Joe Zidle and do not necessarily reflect the views of The Blackstone Group Inc. (together with its affiliates, “Blackstone”). The views expressed reflect the current views of Joe Zidle as of the date hereof, and neither Joe Zidle nor Blackstone undertake any responsibility to advise you of any changes in the views expressed herein.

Blackstone and others associated with it may have positions in and effect transactions in securities of companies mentioned or indirectly referenced in this commentary and may also perform or seek to perform services for those companies. Investment concepts mentioned in this commentary may be unsuitable for investors depending on their specific investment objectives and financial position.

Tax considerations, margin requirements, commissions and other transaction costs may significantly affect the economic consequences of any transaction concepts referenced in this commentary and should be reviewed carefully with one’s investment and tax advisors. All information in this commentary is believed to be reliable as of the date on which this commentary was issued, and has been obtained from public sources believed to be reliable. No representation or warranty, either express or implied, is provided in relation to the accuracy or completeness of the information contained herein.

This commentary does not constitute an offer to sell any securities or the solicitation of an offer to purchase any securities. This commentary discusses broad market, industry or sector trends, or other general economic, market or political conditions and has not been provided in a fiduciary capacity under ERISA and should not be construed as research, investment advice, or any investment recommendation. Past performance is not necessarily indicative of future performance.