Real Estate Investing at an Inflation Inflection Point

The Drivers of Elevated Inflation and Rising Rates

Inflation remains elevated due to stubborn supply chain bottlenecks, energy shortages, and rising commodity costs. In the U.S., “sticky” components of inflation continue to accelerate, including shelter prices and wages. Given the strength of the economy and the likelihood of persistent inflation, it’s likely that the Fed will tighten monetary policy significantly. Historically, periods of inflationary upturns suggest a higher 10-year Treasury yield.1 To counter the prevailing headwinds that are likely to challenge market returns, investors may want to consider the potential benefits of shorter-duration assets, industries with secular growth and thematic investing.

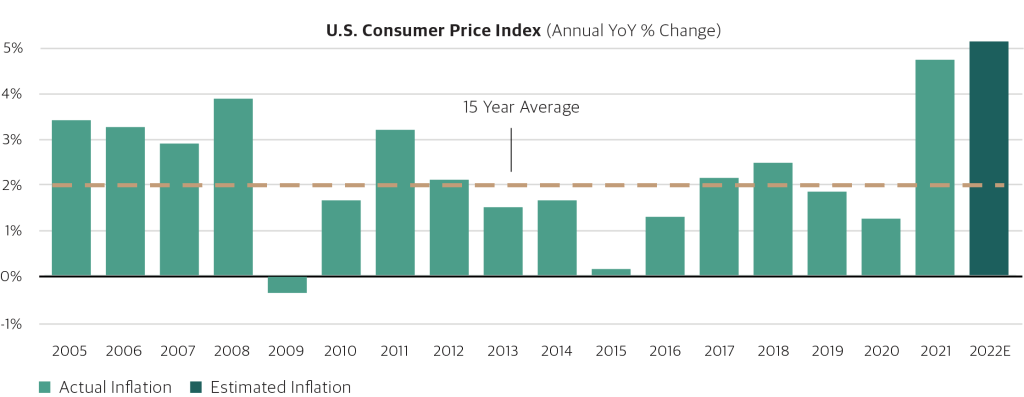

Figure 1: Inflation on the Rise in 2021

Consensus forecast is for inflation in 2022 to reach the highest level since 1990, significantly greater than the 15 year average

Source: The Consumer Price Index (CPI) measure referenced is the Consumer Price Index for All Urban Consumers: All Items in U.S. City Average. Bureau of Labor Statistics, as of 12/31/2021. Estimate for 2022 CPI represents the median consensus economic forecast, as compiled by Bloomberg, as of 2/28/2022.

What does inflation mean for real estate?

Real estate can offer dynamic cash flows. Unlike traditional bonds that generate fixed cash flows, the income streams from real estate can rise over time. Prioritizing assets with shorter lease durations in sectors with strong underlying growth fundamentals can provide the opportunity to regularly reset rents to prevailing market rates in an inflationary environment. Hotels effectively have one-night leases. Other sectors, such as residential and industrial, also tend to have shorter-duration leases. Certain assets with longer duration leases, such as net lease properties, often include contractual rent escalators to mitigate inflationary risks.

Sector selection matters. Residential and industrial are two of the strongest performing sectors where growth is outpacing inflation. Rent growth in these sectors has accelerated, and both are seeing growing demand.2 Bond-like assets that have long-term leases with limited rent resets are more susceptible as rates rise. Sectors facing tenant demand headwinds, such as U.S. regional malls and urban office buildings, may not be able to command near-term rent increases that can keep up with inflation.

Cap rates have room for interest rates to rise. Today, real estate trades at a historically high premium to 10-year Treasuries, with the major sectors cap rate spread significantly wider than the historical average. Given this starting point, rising interest rates may not necessarily result in a commensurate increase in cap rates or decline in real estate values.3,4

Limited supply generally supports valuations. Supply, even within in-demand sectors like industrial5, remains in check. In an inflationary environment, increases in the cost of land, construction, and labor are likely to make new supply less financially feasible, which is generally supportive of higher occupancies and stronger pricing power for existing assets.

Access Real Estate Investing at an Inflation Inflection Point

- Blackstone Investment Strategy calculations of Bureau of Labor Statistics and Bloomberg data, as of 12/31/2021.

- Two of the best performing sectors based on performance of residential and industrial listed REITs in 2021 represented by FTSE Nareit Equity REITs as of December 31, 2021. Inflation figures provided by the Bureau of Labor Statistics’ Consumer Price Index which can be found at https://fred.stlouisfed.org/series/CPIAUCSL. Rent growth represents year-over-year net asking rents weighted by net absorption for the year.

- Green Street Advisors, as of 1/1/22. Major sectors include apartments, industrial, mall, office, and strip centers. Past performance is not indicative of future results. There is no guarantee that any of these trends will continue or will not reverse. Past events and trends do not imply, predict or guarantee, and are not necessarily indicative of, future events or results. There is no guarantee that any risk can be mitigated in whole or in part. Real Estate products are subject to the risk of capital loss and investors may not get back the amount originally invested.

- Major sectors real estate cap rate was 4.8% as of December 31, 2021. 10-Yr UST was 1.5% as of December 31, 2021. The “long-term average” reflects the period between December 1986 to December 2021. “Major Sectors” is sourced from Green Street Advisors and reflects the equal weighted average of the asset weighted averages for the five major property sectors (apartments, industrial, mall, office, and strip center).

- CBRE-EA, as of 12/31/21. A copy of the source material of such data can be provided upon request.

Key Risk Factors

Certain countries have been susceptible to epidemics which may be designated as pandemics by world health authorities, most recently COVID-19. The outbreak of such epidemics, together with any resulting restrictions on travel or quarantines imposed, has had and will continue to have a negative impact on the economy and business activity globally (including in the countries in which funds invest), and thereby is expected to adversely affect the performance of a fund’s investments. Furthermore, the rapid development of epidemics could preclude prediction as to their ultimate adverse impact on economic and market conditions, and, as a result, presents material uncertainty and risk with respect funds the performance of their investments.

The foregoing information has not been provided in a fiduciary capacity under ERISA, and it is not intended to be, and should not be considered as, impartial investment advice.

Certain information contained in these materials constitutes “forward-looking statements,” which can be identified by the use of forward-looking terminology or the negatives thereof. These may include financial estimates and their underlying assumptions, statements about plans, objectives and expectations with respect to future operations, and statements regarding future performance. Such forward-looking statements are inherently uncertain and there are or may be important factors that could cause actual outcomes or results to differ materially from those indicated in such statements. Blackstone believes these factors include but are not limited to those described under the section entitled “Risk Factors” in its Annual Report on Form 10-K for the fiscal year ended December 31, 2019, and any such updated factors included in its periodic filings with the Securities and Exchange Commission, which are accessible on the SEC’s website at www.sec.gov. These factors should not be construed as exhaustive and should be read in conjunction with the other cautionary statements that are included in these materials and in the filings. Blackstone undertakes no obligation to publicly update or review any forwardlooking statement, whether as a result of new information, future developments or otherwise.

Important Disclosure Information

The views expressed in this commentary are the views of Private Wealth Solutions group of The Blackstone Group Inc. (together with its affiliates, “Blackstone”) and do not necessarily reflect the views of Blackstone itself. All information in this commentary is believed to be reliable as of the date on which this commentary was issued, and has been obtained from public sources believed to be reliable. No representation or warranty, either express or implied, is provided in relation to the accuracy or completeness of the information contained herein.

Investment concepts mentioned in this commentary may be unsuitable for investors depending on their specific investment objectives and financial position. Tax considerations, margin requirements, commissions and other transaction costs may significantly affect the economic consequences of any transaction. Concepts referenced in this commentary and should be reviewed carefully with one’s investment and tax advisors.

This commentary does not constitute an offer to sell any securities or the solicitation of an offer to purchase any securities. This commentary discusses broad market, industry or sector trends, or other general economic, market or political conditions and has not been provided in a fiduciary capacity under ERISA and should not be construed as research, legal, tax or investment advice, or any investment recommendation. Past performance is not necessarily indicative of future performance.

Blackstone Securities Partners L.P. (“BSP”) is a broker-dealer whose purpose is to distribute Blackstone managed or affiliated products. BSP provides services to its Blackstone affiliates, not to investors in its funds, strategies or other products. BSP does not make any recommendation regarding, and will not monitor, any investment. As such, when BSP presents an investment strategy or product to an investor, BSP does not collect the information necessary to determine—and BSP does not engage in a determination regarding—whether an investment in the strategy or product is in the best interests of, or is suitable for, the investor. You should exercise your own judgment and/or consult with a professional advisor to determine whether it is advisable for you to invest in any Blackstone strategy or product. Please note that BSP may not provide the kinds of financial services that you might expect from another financial intermediary, such as overseeing any brokerage or similar account. For financial advice relating to an investment in any Blackstone strategy or product, contact your own professional advisor.

In the United Kingdom and the European Economic Area: issued by The Blackstone Group International Partners LLP (“BGIP”), authorised and regulated by the Financial Conduct Authority (FRN: 520839) in the United Kingdom. This communication does not constitute a solicitation to buy any security or instrument, or a solicitation of interest in any Blackstone fund, account or strategy. The content of this communication should not be construed as legal, tax or investment advice.

This material is exclusively for use by persons who are Professional Clients or Eligible Counterparties for the purposes of the European Markets in Financial Instruments Directive (Directive 2014/65/EU) and must not be distributed to retail clients or distributed onward. Recipients should bear in mind that past or estimated performance is not necessarily indicative of future results and there can be no assurance that a fund will achieve comparable results, implement its investment strategy, achieve its objectives or avoid substantial losses or that any expected returns will be met. The activity of identifying, completing and realizing attractive investments is highly competitive, and involves a high degree of uncertainty. There can be no assurance that a fund will be able to locate, consummate and exit investments that satisfy its objectives or realize upon their values or that a fund will be able to fully invest its committed capital. There is no guarantee that investment opportunities will be allocated to a fund and/or that the activities of a sponsor’s other funds will not adversely affect the interests of such fund.

Recipients should bear in mind that past or estimated performance is not necessarily indicative of future results and there can be no assurance that a fund will achieve comparable results, implement its investment strategy, achieve its objectives or avoid substantial losses or that any expected returns will be met.

The activity of identifying, completing and realizing attractive investments is highly competitive, and involves a high degree of uncertainty. There can be no assurance that a fund will be able to locate, consummate and exit investments that satisfy its objectives or realize upon their values or that a fund will be able to fully invest its committed capital. There is no guarantee that investment opportunities will be allocated to a fund and/or that the activities of a sponsor’s other funds will not adversely affect the interests of such fund.

Recipients should be aware that an investment in a fund is speculative and involves a high degree of risk. There can be no assurance that a fund will achieve comparable results, implement its investment strategy, achieve its objectives or avoid substantial losses or that any expected returns will be met. A fund’s performance may be volatile. An investment in a private equity fund or other alternative investment should only be considered by sophisticated investors who can afford to lose all or a substantial amount of their investment. A fund’s fees and expenses may offset or exceed its profits.

There can be no assurances that any of the trends described herein will continue or will not reverse. Past events and trends do not imply, predict or guarantee, and are not necessarily indicative of, future events or results.

Certain information herein has been obtained from sources outside Blackstone, which in certain cases have not been updated through the date hereof. While such information is believed to be reliablefor purposes used herein, no representations are made as to the accuracy or completeness thereof and none of Blackstone, its funds, nor any of their affiliates takes any responsibility for, and has not independently verified, any such information.

Issued by The Blackstone Group International Partners LLP (“BGIP”), which is authorised and regulated by the Financial Conduct Authority (firm reference number 520839) in the United Kingdom.

This communication is directed only at persons: (a) who are “Professional Clients” as defined in the Glossary to the UK Financial Conduct Authority Handbook; or (b) to whom it may otherwise lawfully be communicated. It is intended only for the person to whom it has been sent, is strictly confidential and must not be distributed onward.

So far as relevant, the only clients of BGIP are its affiliates. No investor or prospective investor is a client of BGIP and BGIP is not responsible for providing them with the protections afforded to clients. Investors and prospective investors should take their own independent investment, tax and legal advice as they think fit. No person representing BGIP is entitled to lead investors to believe otherwise.

If communicated in Belgium, Denmark, Finland, the Republic of Ireland, Lichtenstein or Norway, to per se Professional Clients or Eligible Counterparties for the purposes of the European Union Markets in Financial Instruments Directive (Directive 2014/65/EU), this communication is made by The Blackstone Group International Partners LLP (“BGIP”) of 40 Berkeley Square, London, W1J 5AL (registration number OC352581), which is authorised and regulated by the Financial Conduct Authority (firm reference number 520839) in the United Kingdom and which maintains appropriate licences in other relevant jurisdictions.

If communicated in any other state of the European Economic Area or to elective Professional Clients for the purposes of the European Union Markets in Financial Instruments Directive (Directive 2014/65/EU), this communication is made by Blackstone Europe Fund Management S.à r.l. (“BEFM”) of 2-4 Rue Eugène Ruppert, L-2453, Luxembourg (registration number B212124), which is authorized by the Luxembourg Commission de Surveillance du Secteur Financier (reference number A00001974). This communication is exclusively for use by persons identified above and must not be distributed to retail clients. It is intended only for the person to whom it has been sent, is strictly confidential and must not be distributed onward.

This communication does not constitute a solicitation to buy any security or instrument, or a solicitation of interest in any Blackstone fund, account or strategy. The content of this communication should not be construed as legal, tax or investment advice.

In Switzerland, this material is for the exclusive use of qualified investors as defined in article 10(3) Swiss Collective Investment Schemes Act (“CISA”). This communication does not constitute a solicitation to buy any security or instrument, or a solicitation of interest in any Blackstone fund, account or strategy. The content of this communication should not be construed as legal, tax or investment advice.

No action has been or will be taken in Israel that would permit the distribution of this document to the public in Israel. This document has not been approved by the Israel Securities Authority. This document is being distributed only to and is directed only at persons

who are Qualified Investors within the meaning of The Securities Law, 5728-1968 (Israel).

Persons who are not Qualified Investors must not act on or rely on this document or any of its contents. Any investment or investment activity to which this document relates is available only to Qualified Investors and will be engaged in only with Qualified Investors. Qualified Investors in receipt of this document must not distribute, publish, reproduce, or disclose this document (in whole or in part) to any person who is not a Qualified Investor. Neither the general partner, nor the investment advisor, is registered or intends to register as an investment adviser or an investment portfolio manager under the Israeli regulation of investment advice and investment portfolio management law, 5755-1995 (the “investment law”). Furthermore, these interests are not being offered by a licensed marketer of securities pursuant to the investment law.

This communication relates to a fund which is not subject to any form of regulation or approval by the Dubai Financial Services Authority (“DFSA”).

The DFSA has no responsibility for reviewing or verifying any document or other documents in connection with this fund. Accordingly, the DFSA has not approved this document or any other

associated documents nor taken any steps to verify the information set out in this document, and has no responsibility for it. This document is intended for distribution only to persons of a type as classified by the DFSA’s Rules (i.e. “Professional Client”) and must not, therefore, be delivered to, or relied on by, any other type of person

Blackstone Securities Partners L.P., a subsidiary of The Blackstone Group Inc. (“Blackstone”) through which Blackstone conducts its capital markets business and certain of its fund marketing and distribution, is a member of FINRA.

PWS202105086S