Essentials of Private Markets

Learn how assets such as private real estate, credit, and equity can fit into investment portfolios.

What Are Private Markets?

Private markets can offer investors access to assets, opportunities

and strategies unavailable through public stocks and bonds.

Private equity funds invest in non-publicly traded companies, ranging from startups to large private enterprises.

Private credit funds issue corporate loans and other credit instruments that do not involve a traditional bank and are not publicly traded.

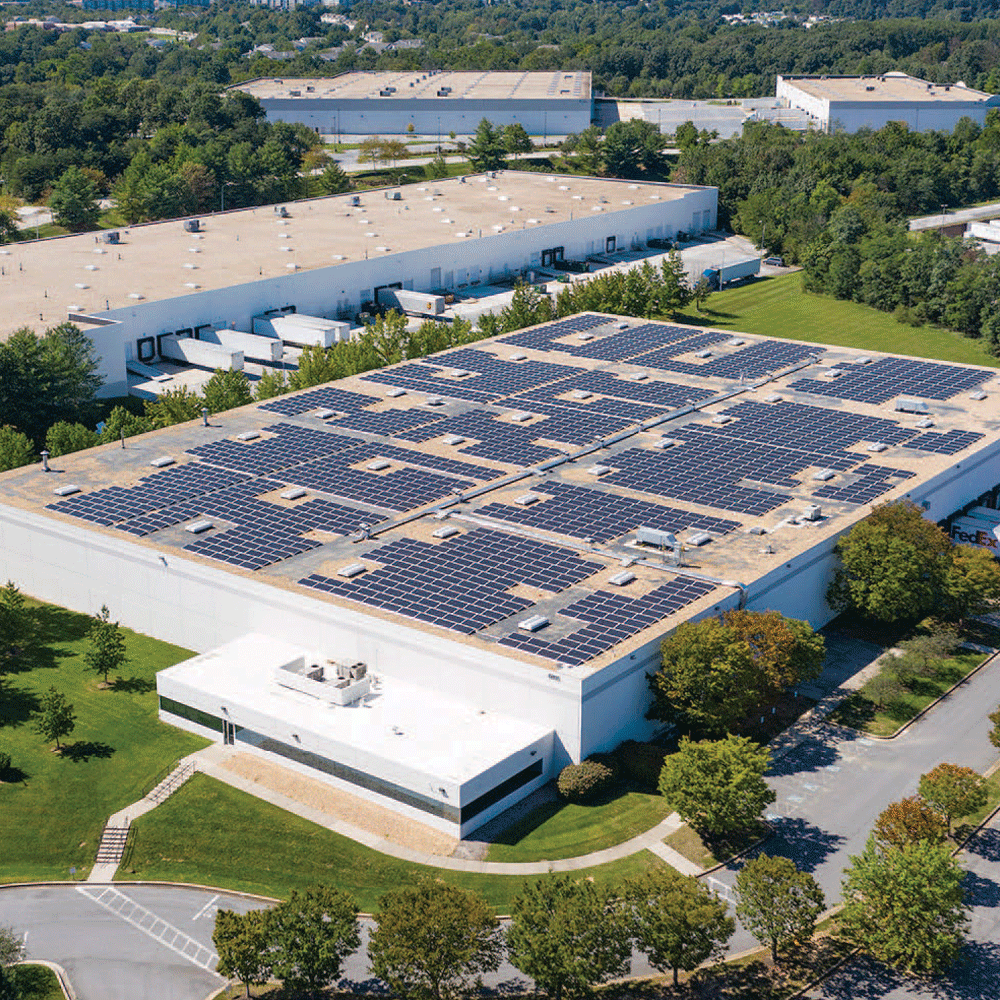

Private real estate funds invest directly in real estate properties ranging from warehouses to apartments.

Closing the Knowledge Gap

Joan Solotar, Global Head of Private Wealth Solutions, explains Blackstone’s commitment to closing the knowledge gap on private markets and the role these markets can play in individual investors’ portfolios.

Why Private Markets?

Private markets may provide attractive return opportunities, as well as more

portfolio diversification and lower volatility than publicly listed securities.1

allocating to private markets

Allocating to asset classes such as private equity, private real estate, and private credit can reshape the risks and returns of investment portfolios.

alternatives exposure

Individual investors are typically underallocated to alternatives, which includes private markets, compared to institutional investors.

allocating to private markets

Allocating to asset classes such as private equity, private real estate, and private credit can reshape the risks and returns of investment portfolios.

alternatives exposure

Individual investors are typically underallocated to alternatives, which includes private markets, compared to institutional investors.

Essentials of Private Equity

Learn MoreEssentials of Private Equity

Essentials of Private Credit

Learn MoreEssentials of Private Credit

Essentials of Private Real Estate

Learn MoreEssentials of Private Real Estate

- There can be no assurance any alternative asset classes will achieve their objectives or avoid significant losses. Diversification is not a guarantee of either a return or protection against loss in declining markets.

PWS202308504R