Joe Zidle: The Beginning of a Secular Bear Market in Bonds

By Joe Zidle, Investment Strategist

The Great Bond Bull Market is Over June 2016 will most likely be remembered as the end of the great bond bull market. 34 years earlier in 1982, when then Fed Chair Paul Volker turned the full force of the Federal Reserve to fighting inflation, both the 10 year Treasury yield and the Consumer Price Index (CPI) stood at approximately 15%. Over the ensuing years investors experienced the biggest bull market in history. The Bloomberg Barclays Agg Bond Index returned an average of 8.4% annually. Over that time the economy experienced booms and busts, but the near constants were falling rates and slowing inflation.

From Deflation to Inflation The economy is accelerating and inflationary pressures are picking up. Not yet strong, they are broad based. This past week’s unemployment numbers (3.8%) and wage gains (+2.7%) are confirmation of the trend that has been building for 2 years. Other forms of inflation are emerging including higher oil and gas prices, and more subtly is the current trade spat which could increase the price of imports.

The key question What will be the impact on fixed income holdings? Using the last 34 years as a guide, one would have little reason to worry about secularly higher rates. Experience argues the economy will roll over, the Fed will reduce interest rates and bond prices will rally (yields will fall). Using that logic, one would argue that the 10 year treasury can’t sustain itself very long at these yields. It will soon revert to 1.5%-2.0%.

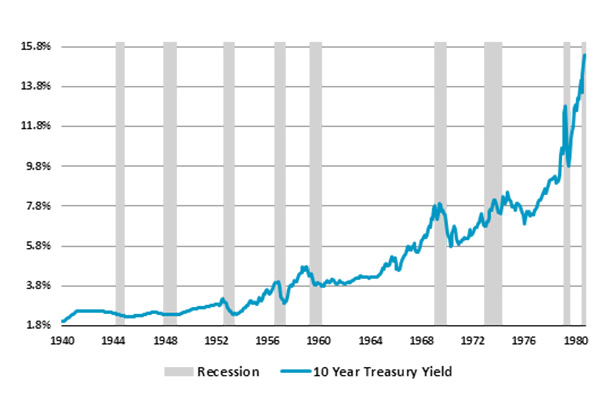

A very dangerous assumption Very few people have invested in an environment of structurally higher yields. Prior to 1982, there was a 40 year bear market in which the yield on the 10 year went from 1.97% to 15%. Over that time the US experienced 9 recessions. The chart below highlights the trend: 10 year treasury yields came down during recessions but would very quickly rebound. Over this period, bond total returns failed to keep pace with inflation, returning an average of 2.4%, well below the 5.6% for the Consumer Price Index.

Source: Blackstone and Bloomberg

The data has changed, portfolios haven’t Since June 2016 data from the Investment Company Institute (ICI) indicates that investors have added over $560 billion to taxable fixed income mutual funds and ETFs. An analysis of the largest inflows indicates that investors are taking more duration risk, maybe even unintentionally as the underlying durations of the indices for many fixed income ETFs increased. For example, the duration of the Bloomberg Barclays Agg Bond Index moved from 4.4 years in 2016 to 6.3 years (as of 5/2018). The biggest risk to investors is not recognizing that the data changed. History proves bond yields do move higher.

* * * * *

The views expressed in this commentary are the personal views of the author and do not necessarily reflect the views of The Blackstone Group L.P. (together with its affiliates, “Blackstone”). The views expressed reflect the current views of the author as of the date hereof and Blackstone undertakes no responsibility to advise you of any changes in the views expressed herein.

Blackstone and others associated with it may have positions in and effect transactions in securities of companies mentioned or indirectly referenced in this commentary and may also perform or seek to perform services for those companies. Investment concepts mentioned in this commentary may be unsuitable for investors depending on their specific investment objectives and financial position.

Tax considerations, margin requirements, commissions and other transaction costs may significantly affect the economic consequences of any transaction concepts referenced in this commentary and should be reviewed carefully with one’s investment and tax advisors. All information in this commentary is believed to be reliable as of the date on which this commentary was issued, and has been obtained from public sources believed to be reliable. No representation or warranty, either express or implied, is provided in relation to the accuracy or completeness of the information contained herein.

This commentary does not constitute an offer to sell any securities or the solicitation of an offer to purchase any securities. This commentary discusses broad market, industry or sector trends, or other general economic, market or political conditions and has not been provided in a fiduciary capacity under ERISA and should not be construed as research, investment advice, or any investment recommendation. Past performance is not necessarily indicative of future performance.