Joe Zidle: Lighter Fluid on a Steady Flame

“The farther back you can look, the farther forward you are likely to see.” —Winston Churchill

The combination of strong growth and low unemployment with fiscal spending and tax cuts may feel novel or unfamiliar. However, today’s environment is not unprecedented. There was another era when such growth-inducing lighter fluid was poured on an already steady economic flame, and the consequences that ensued then may provide important lessons on how investors should think about their portfolios now.

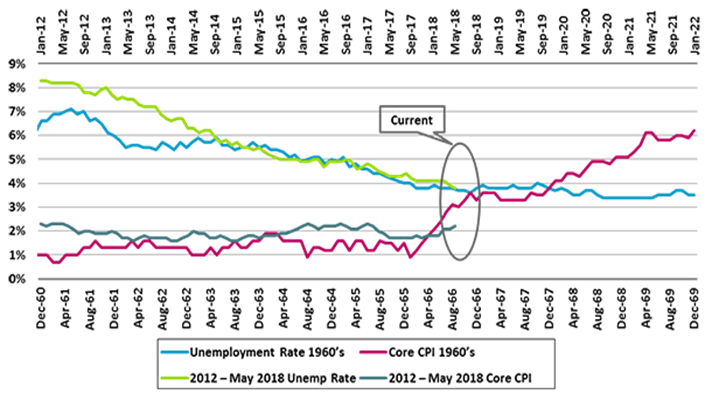

Growing economy, strong labor markets and stable prices From Kennedy’s inauguration through the mid-60s, unemployment had fallen from 7% to a low of 3.8%, yet wages and inflation barely moved higher. Confident that more people could get jobs without triggering higher prices, the government enacted a series of expansionist policies: taxes were cut for the first time in 30 years and government spending took off. Several years into this experiment the US budget had increased 55% and inflation suddenly spiked higher. Today’s unemployment and inflation trends look very similar, before the full impact of government deficits and inflationary spending has appeared in any real way (chart below).

Unemployment and Inflation, 1960’s vs Today

Source: Bureau of Labor Statistics, Federal Reserve, Blackstone (as of Aug 6, 2018)

Asset classes followed the playbook In the period that followed, faster growth companies or assets that could respond positively to pricing pressure were the only protection against accelerating inflation. Stock indices rose — with small cap beating large cap stocks, and value beating growth stocks — while real assets like copper beat both cash and inflation. Meanwhile, bond portfolios suffered a different fate. Because coupons on bonds are fixed, rising rates generally cause prices to fall. Accordingly, long-term corporate and government bonds underperformed.

We are not on the cusp of repeating the 1970s Back then, mild inflation gave way to double-digit price increases, bonds yielding above 10% and a massive double dip recession. That isn’t the likely trajectory of the US in the near future, as today technology and globalization provide a dampening effect on prices, and treasury yields will likely remain tethered to lower sovereign yields abroad. Nevertheless, investor positioning reflects a bygone era of growth with stable prices.

Asset allocations should be revisited Investors may be complacent after nearly a decade of growth with low rates, but history proves that adding stimulus to already tight economic conditions can drive inflation higher. Smaller companies and cyclicals can offset inflation more easily than more mature companies that tend to grow more slowly. I believe income-oriented investments with a growth component (like rising income from real estate leases or similar income-oriented real assets) should outperform traditional sources of fixed income in times of higher rates.

* * * * *

The views expressed in this commentary are the personal views of the author and do not necessarily reflect the views of The Blackstone Group L.P. (together with its affiliates, “Blackstone”). The views expressed reflect the current views of the author as of the date hereof and Blackstone undertakes no responsibility to advise you of any changes in the views expressed herein.

Blackstone and others associated with it may have positions in and effect transactions in securities of companies mentioned or indirectly referenced in this commentary and may also perform or seek to perform services for those companies. Investment concepts mentioned in this commentary may be unsuitable for investors depending on their specific investment objectives and financial position.

Tax considerations, margin requirements, commissions and other transaction costs may significantly affect the economic consequences of any transaction concepts referenced in this commentary and should be reviewed carefully with one’s investment and tax advisors. All information in this commentary is believed to be reliable as of the date on which this commentary was issued, and has been obtained from public sources believed to be reliable. No representation or warranty, either express or implied, is provided in relation to the accuracy or completeness of the information contained herein.

This commentary does not constitute an offer to sell any securities or the solicitation of an offer to purchase any securities. This commentary discusses broad market, industry or sector trends, or other general economic, market or political conditions and has not been provided in a fiduciary capacity under ERISA and should not be construed as research, investment advice, or any investment recommendation. Past performance is not necessarily indicative of future performance.