Joe Zidle: Whatever It Takes (Part II)

European Central Bank (ECB) Chair Mario Draghi arrived for a global investment conference in London’s West End on July 26, 2012 with a message that electrified financial markets. Normally, the opening ceremony of the 2012 London Olympic Games a day later would have been the most memorable event that week; after all, it’s not every day the Queen and Daniel Craig as James Bond “parachute” into a packed stadium. But for investors, Draghi uttered three little words that changed history. Nearly seven years later, we expect those words to prove prescient once again.

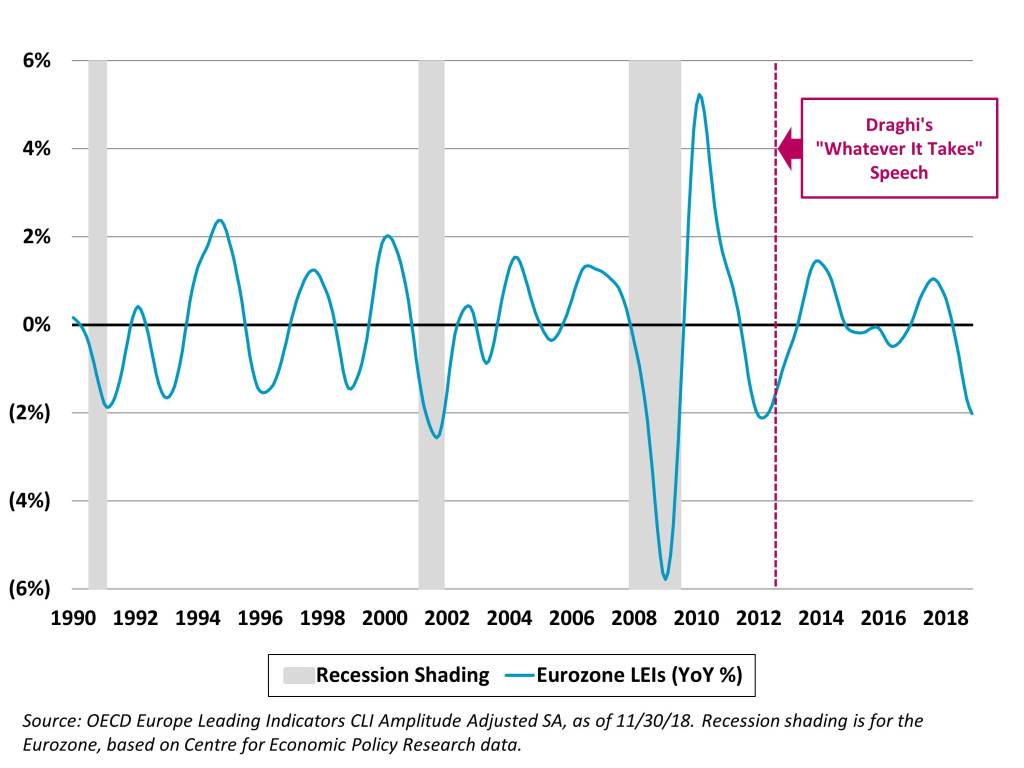

Course reversed That day, Draghi finally admitted that the euro faced an existential crisis. He likened the euro to a bumblebee, calling both mysteries of nature because the laws of physics said they shouldn’t be able to fly. Unlike the bumblebee, though, there was no natural reason why the euro should fly. It needed help. And with that, Draghi said that the ECB would do “whatever it takes” to preserve the Eurozone. The rest is history: the ECB cut rates, tapped its balance sheet and flooded the system with more than €2.6 trillion. It was quite the reversal for an ECB that until that point had been somewhat conservative with its balance sheet and actually raised interest rates amid collapsing leading indicators.

Sequel potential The ECB ended that quantitative easing (QE) program last December, and the market has priced in the bank’s first rate increase since 2011 toward the end of this year. However, one of our surprises for 2019 is that weakening global growth amid rising geopolitical uncertainty across Europe causes the ECB to restart QE. Eurozone leading economic indicators declined 2.0% year over year in November and the Citi Economic Surprise Index is negative, indicating that data releases have been worse than expected.1 Notably, since the Eurozone’s formation in 1999, every instance of a 2% YoY decline in leading indicators has been followed by a recession or QE (see chart

below.)

Eurozone Leading Economic Indicators

When bad news is good Disappointing economic data can have a silver lining for risk assets—and investors—when central banks respond with accommodative policies. After Draghi’s 2012 speech, financial markets rallied substantially. For context, an investment in European equities would have yielded a 45% cumulative total return through 2017.2 An investment in European corporate high yield bonds would have brought a 63% cumulative total return.3 As we anticipate that the ECB will see the similarities between now and 2012 and respond accordingly, investors should consider positioning to benefit from a reboot of dovish European monetary policy.

(1) Source: OECD, Citigroup and Bloomberg. Leading Indicators based on the OECD Euro Area Leading Indicators CLI Amplitude Adjusted, as of 11/30/18. Citi Economic Surprise Index data, as of 1/21/19.

(2) Source: Bloomberg. Based on the cumulative total return (gross dividends) for the MSCI Europe USD Index over the period 7/26/12 through 12/31/17. Index hedged to USD.

(3) Source: Bloomberg. Based on the cumulative total return (gross dividends) for the Bloomberg Barclays Pan-European High Yield Total Return USD Index over the period 7/26/12 through 12/31/17. Index hedged to USD.

The views expressed in this commentary are the personal views of the author and do not necessarily reflect the views of The Blackstone Group L.P. (together with its affiliates, “Blackstone”). The views expressed reflect the current views of the author as of the date hereof and Blackstone undertakes no responsibility to advise you of any changes in the views expressed herein.

Blackstone and others associated with it may have positions in and effect transactions in securities of companies mentioned or indirectly referenced in this commentary and may also perform or seek to perform services for those companies. Investment concepts mentioned in this commentary may be unsuitable for investors depending on their specific investment objectives and financial position.

Tax considerations, margin requirements, commissions and other transaction costs may significantly affect the economic consequences of any transaction concepts referenced in this commentary and should be reviewed carefully with one’s investment and tax advisors. All information in this commentary is believed to be reliable as of the date on which this commentary was issued, and has been obtained from public sources believed to be reliable. No representation or warranty, either express or implied, is provided in relation to the accuracy or completeness of the information contained herein.

This commentary does not constitute an offer to sell any securities or the solicitation of an offer to purchase any securities. This commentary discusses broad market, industry or sector trends, or other general economic, market or political conditions and has not been provided in a fiduciary capacity under ERISA and should not be construed as research, investment advice, or any investment recommendation. Past performance is not necessarily indicative of future performance.