Joe Zidle: The Case Against a Melt-up

With tariffs against Mexico suspended and Fed cuts fully priced in, risk assets are pushing up against their April highs. However, a sustained melt-up—higher highs in equities and tighter spreads in credit—is unlikely in the short term. This is the market playing the part of Goldilocks, and we don’t think that conditions are “just right” for any more significant gains this year.

The Fed could disappoint The market seems to be getting ahead of itself when it comes to rate cuts. Before tariffs on Mexico became an issue, the market priced in one interest rate cut this year; once they did, expectations jumped to three cuts. The threat is gone, for now, but the market’s optimism remains. Fed fund futures suggest the Fed will cut three times this year, beginning as early as next month. The US doesn’t have a growth problem, and Core CPI weakening from 2.1% in April to 2.0% in May hardly seems like a reason for central bankers to panic.(1) It’s unclear if a “Fed put” exists when the S&P 500® is up 16% YTD,(2) but we would take the other side of that bet.

Little clarity on trade Sometime in the next 45 days Mexico must show “substantial” progress on curbing the flow of drugs and illegal immigration. Only President Trump knows what will be accepted as progress; the rest of us are left only to guess. Meanwhile, China retaliated with measures beyond trade, targeting US companies in China and taking steps to reduce Chinese tourism to the US. President Trump also signaled his intentions to target European autos and, apparently, wine. We aren’t panicking yet—after all, California and Oregon produce some epic grapes, The North Fork is improving and New Jersey’s are serviceable.

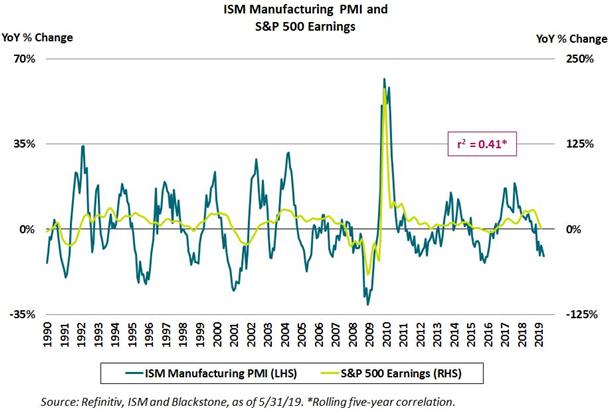

Earnings are still a problem Corporate profits aren’t receiving enough attention. By some estimates, in 1Q’19 S&P 500 profits fell on a year-over-year basis for the first time since early 2016. Earnings growth expectations for 2019 were already low at 2–5% after profits grew faster than 20% last year. But leading profit growth indicators continue to deteriorate, suggesting that an earnings recession is a risk and that earnings forecasts may need to be revised down. The chart below highlights the relationship between manufacturing production and US corporate profits.

****

Footnotes:

1. Source: Bureau of Labor Statistics, as of 5/31/19. Core CPI represented by the Consumer Price Index for All Urban Consumers: All items less food and energy, seasonally adjusted (1982-84=100).

2. Source: Bloomberg, as of 6/17/19. Represents total return with dividends reinvested.

The views expressed in this commentary are the personal views of the author and do not necessarily reflect the views of The Blackstone Group L.P. (together with its affiliates, “Blackstone”). The views expressed reflect the current views of the author as of the date hereof and Blackstone undertakes no responsibility to advise you of any changes in the views expressed herein. For more information about how Blackstone collects, uses, stores and processes your personal information, please see our Privacy Policy here. You have the right to object to receiving direct marketing from Blackstone at any time. Please click the link above to unsubscribe from this mailing list.

Blackstone and others associated with it may have positions in and effect transactions in securities of companies mentioned or indirectly referenced in this commentary and may also perform or seek to perform services for those companies. Investment concepts mentioned in this commentary may be unsuitable for investors depending on their specific investment objectives and financial position.

Tax considerations, margin requirements, commissions and other transaction costs may significantly affect the economic consequences of any transaction concepts referenced in this commentary and should be reviewed carefully with one’s investment and tax advisors. All information in this commentary is believed to be reliable as of the date on which this commentary was issued, and has been obtained from public sources believed to be reliable. No representation or warranty, either express or implied, is provided in relation to the accuracy or completeness of the information contained herein.

This commentary does not constitute an offer to sell any securities or the solicitation of an offer to purchase any securities. This commentary discusses broad market, industry or sector trends, or other general economic, market or political conditions and has not been provided in a fiduciary capacity under ERISA and should not be construed as research, investment advice, or any investment recommendation. Past performance is not necessarily indicative of future performance.