Joe Zidle: Rhyming with the 1990s, but Don’t Expect a Repeat

The list of Ten Surprises for 2020 is in the final stages. The endeavor is difficult and time-consuming, but one that I really enjoy working on with Byron. Developing the Surprises stretches our thinking, and we hope that they stretch yours, too. We will release them on January 7, 2020.

I first read the Surprises in 1996 when I was just starting out my career at a regional broker-dealer. I didn’t see the Surprises until a bootleg version made the rounds some weeks after the list was released. A colleague made a copy (of a copy) and passed it along to me. I referred to the Surprises often, saving the list in a folder that grew to include many future editions as well.

Not surprisingly, the Ten Surprises for 1996 featured numerous thought-provoking themes (here, with results):

- The US economy gathers positive momentum. (Growth accelerated to 4% in Q4’1996.)

- CPI threatens to move above 4%. (It rose from 2% to 3.4%.)

- The 10-year Treasury climbs above 7%. (It peaked at 7.06%.)

- A growing Bosnian crisis…

- A growing Whitewater crisis…

- Mexico emerges from recession, its stocks become favorites. (MexBol was up 22% in 1996.)

- The Dow Jones Industrial Average jumps to 5,800, for a 12% gain. (Oops! It hit 6,500.)

Heading into my second year doing the Surprises with Byron, I was curious to revisit my bootlegged Ten Surprises for 1996. Unfortunately, the folder with my copies was lost to time. And several months ago, Harvard Business School came calling for Byron’s archives and collected them for its library, so we had to scramble. Luckily, we have a contact at Morgan Stanley who was nice enough to plumb the firm’s old files, helping me turn my nostalgia into a useful exercise.

Similarities between Two Record Bull Markets

The Ten Surprises for 1996 came out midway through a record bull market. It started in October 1990 and lasted 113 months, gaining 417% before reaching its end in 2000.(1) In 1996, valuation became an issue. Then–Fed Chair Alan Greenspan sounded alarms about the rising P/E ratio. But Byron expressed that he was less concerned, prompting Greenspan to summon him to a meeting in Washington. Byron tried to convince Greenspan that the market was reasonably priced. He thought he might have changed Greenspan’s mind. But the next day, the Fed Chair gave a speech questioning whether valuations were the result of “irrational exuberance.” A brief correction followed. Despite Greenspan’s warning, the S&P advanced for another four years and grew another 110%.

Today’s bull market, now officially the longest on record and within a few percentage points of being the largest, shares several important characteristics with the bull market of the late ’90s. The first is narrowing leadership. Currently, the S&P 500’s ten largest companies represent around 22% of the total market capitalization.(2) (Apple has a larger market cap than the entire US energy sector.) The only period that exceeded this level of concentration was the last leg of the ’90s bull market. At their peak in the tech bubble, the ten largest companies commanded 27% of the S&P 500 market cap.(3)

Even though technology stocks still dominate the S&P 500, I do not believe this means we are in a repeat of the tech bubble. Tech deserves to be the largest sector in the stock market today, as it increasingly proves to be the most important driver of productivity growth. The dangers of concentration remain, however. The legendary market technician and strategist Bob Farrell once wrote that the strongest markets have broad leadership while very narrow leadership characterizes the weakest. Equities will probably move higher from here, but they will be at increasing risk of downside unless fundamentals improve.

Support from the Federal Reserve is the second parallel between the two bull markets. The Fed engaged in two easing cycles during the economic expansion in the ’90s. It cut rates by 75bps in 1995 and by another 75bps in 1999. The easing fueled risk assets and stimulated economic growth. The US’s growth rate doubled after that first adjustment in 1995. And from 1995 to 2000, the economy increased in size by one third, from $7.6 trillion to $10.2 trillion.(4) In this late-cycle environment, the Fed’s cutting and balance sheet expansion have fueled financial market gains. But unlike in the late ’90s, the effect on the real economy appears minimal.

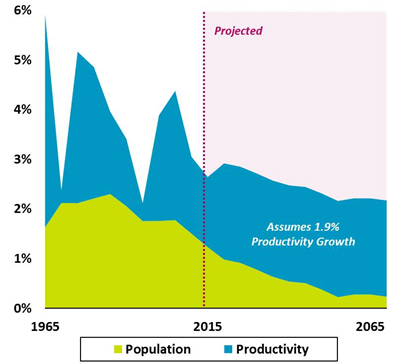

One reason that the Fed’s policies haven’t stimulated similar growth may be the slowing population growth rate. Growth in the working age population averaged 1.2% in the ’90s, whereas this decade it has grown at 0.5%, less than half as fast.(5) Over time, GDP growth is simply the sum of population growth and productivity growth. As Figure 1 shows, these components have slowed around the world, and are projected to continue to decline. In the US in particular, the economy grew at around 3% prior 2008, so today’s 2% growth has resulted in excess capacity, as evidenced by low and falling utilization rates. Without a reacceleration of population growth, or above-trend productivity growth, excess liquidity produced by the Fed is unlikely to result in significant economic gains.

Figure 1: Global GDP Growth Components(6)

My own view reflects greater concern about risks to the downside than many forecasters on the Street. We may not experience a recession in the next 6–12 months. We can’t ignore, however, the growing weaknesses that are evident in the economy.

One of the more common arguments is that President Trump will do everything he can to prevent a recession prior to the 2020 election. From where I sit, it does not seem that there are many tools at his disposal. Most economic policies that would substantially move the needle in terms of growth would require significant government spending, and for that, a president needs Congress to open the purse strings. Assuming President Trump is not removed from office due to impeachment, it goes without saying that we shouldn’t expect too much bipartisan cooperation next year.

One area with true bipartisan support is infrastructure. But even the best infrastructure plan would take years to positively affect the economy in any meaningful way. The US economy doesn’t have many shovel-ready projects, though we do have a long to-do list (a new tunnel for me and all my New Jersey Transit commuter friends, please!). Payroll taxes could be cut via executive directive, but that would be an order of magnitude smaller than the comprehensive Tax Cut and Jobs Act (TCJA), which the nonpartisan Congressional Research Service estimated had only a marginal economic impact.

That the economy will continue to slow isn’t up for much debate. The question is whether weak manufacturing recovers and ends this third mini-recession, or whether its effects spill over to the broader economy and ends this record-long expansion. There is risk of contagion from a weak manufacturing sector to the larger services sector. So far, consumers (whose spending comprises around 70% of the economy) have kept things afloat, but there are reasons to think their strong position is at risk.

Confrontational trade policies are damaging the US and global economies, and in a way that can’t be calculated simply by subtracting the costs of the tariffs from GDP. Second- and third-order effects include the deterioration of CEO and consumer confidence, which has resulted in less capital spending. While other effects remain unknown, we do know that cracks are beginning to show in the labor market. Indicators such as temporary staffing levels, future hiring plans and the number of job openings have all started to roll over.

The “Even Steven” Economy

In a 1994 Seinfeld episode, Jerry can’t lose. He loses twenty dollars, but then he finds a twenty tucked into a coat pocket. He loses a job, but five minutes later gets another one, on the same weekend for the same money. He misses a train, but catches a bus. Kramer asks, “You know who you are? Even Steven.”

The October release of the Conference Board’s Leading Economic Index (LEI) for the US could have come from that Seinfeld episode. The biggest positive contributor to the LEI was building permits at 0.14, and the biggest detractor was ISM new orders at -0.14.

While manufacturing is weakening, housing markets are strengthening, with both permits and new housing starts enjoying something of a renaissance. Perhaps to the surprise of some, housing construction ends up being almost as large as manufacturing when factoring in the direct impacts of construction and other multiplier effects. For example, when one of the 1.3 million homes built annually is sold, the proud owners go shopping.(7) The rule of thumb is that furnishing a new home costs anywhere from 10% of the purchase price up to 50% for high end homes. Construction investment is approximately 6% of GDP and additional purchases contribute another 2% to 3% of GDP.(8)

What I’m Watching

Perhaps strong housing activity offsets weak manufacturing and we see an economy without much upside or downside.

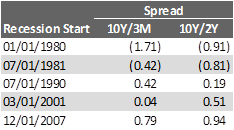

However, we still need to respect the messages from all the yield curves that inverted in late August through early September. As readers of this publication know, I view the curves as the most significant recessionary signal we have. That the curves re-steepened doesn’t mean we should forget that they did invert. In fact, the re-steepening is exactly what you would expect. As economist David Rosenberg recently pointed out in a CNBC interview, the curves de-inverted in 2007, just prior to the Global Financial Crisis. By the start of the recession, the 10-year to 3-month and 10-year to 2-year Treasury spreads were 79bps and 98bps steep, respectively.(9) In fact, both portions of the yield curve were positively sloped at the start of each of the last three recessions, as Table 1 shows.

Table 1: Treasury Yield Curves at Start of Recessions(10)

In the short term, falling profits, fewer job openings, tighter lending standards and decreasing demand for loans should be monitored. These seem to have contributed to widening spreads among below–investment grade issuers, but they have had little impact on equity markets so far. Investors are pricing in a combination of historically low interest rates and the inevitable increase in profits in 2020 as a rationale for the market’s inexorable rise. In my view, profits growth can’t get here soon enough if the longest bull market in history is to continue.

Our next publication will be the Ten Surprises on January 7, 2020, followed by our Q1 webinar on January 9, 2020. We also just released a new podcast yesterday.

Best wishes for a happy and healthy holiday season.

1. Bloomberg.

2. Ned Davis Research, as of 11/30/19.

3. Goldman Sachs Research, WSJ/The Daily Shot.

4. Bureau of Economic Analysis.

5. OECD, as of 12/31/18.

6. Blackstone analysis of data from the Conference Board and United Nations Population Division, as of April 2019, and August 2019, respectively. “Population” represents growth in the working age population. “Productivity” represents growth in labor productivity per hour worked. Based on CAGR at 5-year intervals from 1960 to 2015. Estimates for 2015-2065 assume 1.9% productivity growth, which is the average growth rate from 1965 to 2015. Credit for chart concept to McKinsey Global Institute.

7. US Census Bureau and US Department of Housing and Urban Development, as of 10/31/19. Based on new privately owned housing units started.

8. Blackstone Investment Strategy estimates.

9. Bloomberg, Federal Reserve and Blackstone Investment Strategy.

10. Bloomberg, Federal Reserve and Blackstone Investment Strategy. Based on yields at the end of the month prior to the official start of the recession, as indicated by NBER Business Cycle Dating Committee. Based on the last five recessions due to data availability for the 2-year Treasury bond.

The views expressed in this commentary are the personal views of the author and do not necessarily reflect the views of The Blackstone Group Inc. (together with its affiliates, “Blackstone”). The views expressed reflect the current views of the author as of the date hereof and Blackstone undertakes no responsibility to advise you of any changes in the views expressed herein. For more information about how Blackstone collects, uses, stores and processes your personal information, please see our Privacy Policy here: http://go.pardot.com/e/213192/privacy/68f9x/182811975?h=L3PDlTnbE2h0R6yw-jpiXWquHwiOdKAOzy99H3DK9f8.

Blackstone and others associated with it may have positions in and effect transactions in securities of companies mentioned or indirectly referenced in this commentary and may also perform or seek to perform services for those companies. Investment concepts mentioned in this commentary may be unsuitable for investors depending on their specific investment objectives and financial position.

Tax considerations, margin requirements, commissions and other transaction costs may significantly affect the economic consequences of any transaction concepts referenced in this commentary and should be reviewed carefully with one’s investment and tax advisors. All information in this commentary is believed to be reliable as of the date on which this commentary was issued, and has been obtained from public sources believed to be reliable. No representation or warranty, either express or implied, is provided in relation to the accuracy or completeness of the information contained herein.

This commentary does not constitute an offer to sell any securities or the solicitation of an offer to purchase any securities. This commentary discusses broad market, industry or sector trends, or other general economic, market or political conditions and has not been provided in a fiduciary capacity under ERISA and should not be construed as research, investment advice, or any investment recommendation. Past performance is not necessarily indicative of future results.