Joe Zidle: Help Wanted for a Sustainable Recovery

The U.S. economy is set to boom with vaccination rates climbing steadily and another $1.9 trillion of stimulus en route. However, labor market dynamics will be critically important in determining the speed and magnitude of the recovery. A tighter-than-expected labor market is a risk despite last year’s historic unemployment. In February’s NFIB small business survey, a record-high 40% of companies reported that job openings were hard to fill.1 Ninety-one percent of those hiring found few or no qualified applicants.1 As businesses reopen, they may need to raise wages to fill positions, potentially putting upward pressure on inflation.

Unemployed and out of the labor market Ten million Americans are unemployed, compared to 5.7 million in February 2020, which suggests that there should be plenty of workers for firms to hire.2 However, the labor force participation rate is at 61.4%, nearly 2% lower than February 2020 and, excluding last year, its lowest level since 1976.2 The labor force participation rate for women was 2.2% lower in January 2021 than in January 2020, compared to 1.6% lower for men.3

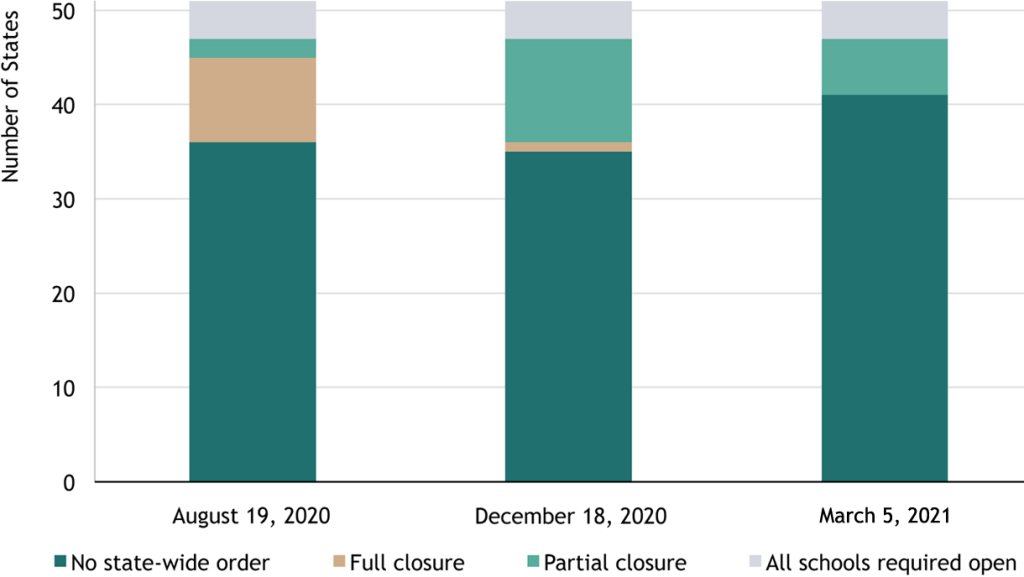

Getting parents back into the workforce is key Women lost 220,000 more jobs than men did last year, only about 20% of which can be explained by gender distribution across industries.3 A more significant driver likely is that mothers bore the brunt of childcare; their labor participation rate was 4% lower this January compared to a year earlier.3 Schools reopening should help caregivers get back to work. That will be critical to loosening the labor market, as enhanced unemployment insurance benefits and other government transfers may allow some people to delay their return to work. Hard-hit industries, including transportation and the arts, may take longer to reopen and keep their workers sidelined. Also, with 10,000 Boomers turning 65 every day, older workers could decide to retire early.4

Figure 1 – U.S. School Closures by State Order

(50 states plus Washington, D.C.)

Source: Education Week, as of 3/5/21. Observations corresponding to 8/19/20 and 3/5/21 are the earliest and latest available, respectively. https://www.edweek.org/ew/section/multimedia/map-covid-19-schools-open-closed.html

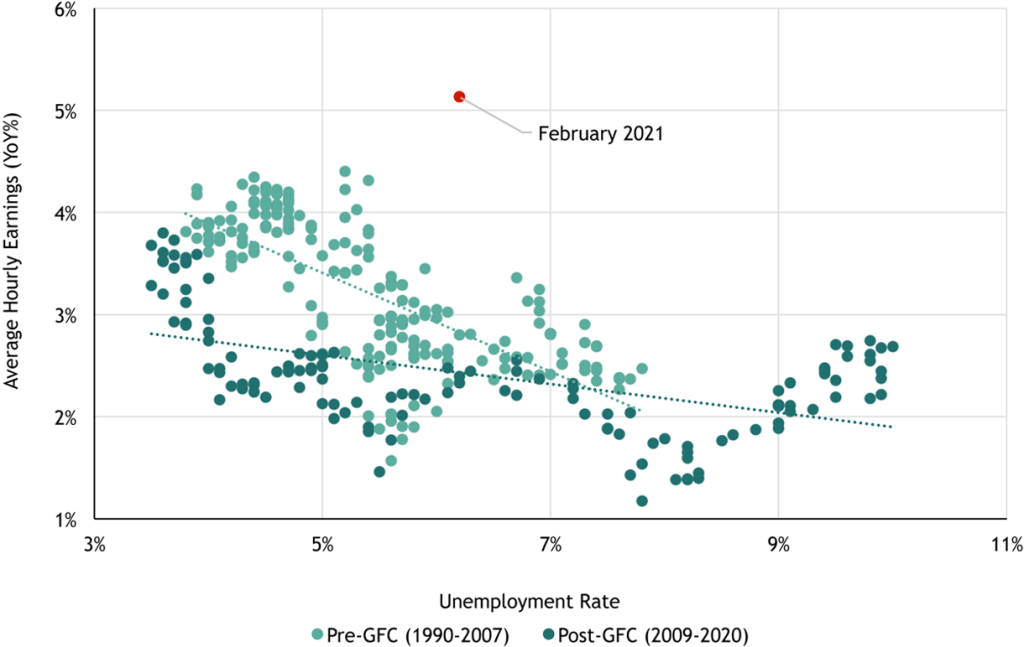

Similar inflation concerns, but different drivers In the last expansion, some suspected that low unemployment would lead to higher wages, but 112 consecutive months of job growth failed to push up headline CPI.5 Rumors of the Phillips curve’s death began to spread as a result. Figure 2 highlights that, prior to the Global Financial Crisis, tight labor markets naturally led to wage gains. The flatter line, which represents the last expansion, contradicts that idea, as wages stayed low despite lower unemployment. Today, lower labor force participation will force firms to compete for fewer workers than were available in the last recovery, potentially resulting in higher wages. That would be a positive for household income, but companies could move to offset the higher costs by raising prices.

Figure 2 – Phillips Curve: Nominal Wage Inflation vs. Unemployment Rate

(monthly observations from Jan 1990 through Feb 2021, excluding recessions; seasonally adjusted)

Source: Bureau of Labor Statistics, as of February 28, 2021. Average hourly earnings are for all private production and nonsupervisory employees. Recessions, as defined by the National Bureau of Economic Research, are excluded.

Watching labor markets amid a strong recovery In-person activities—from dining out and shopping, to work and education—will become more accessible by the summer. Consumer spending will soar. Household net worth already hit an all-time high of $130.2 trillion in Q4’2020.6 And in January, for every dollar of personal income that has been lost due to COVID, $11 in personal transfers were delivered.7 Businesses will be eager to ramp up to meet consumer demand, making labor force participation a key indicator of the recovery’s sustainability.

With data and analysis by Taylor Becker.

- National Federation of Independent Business, as of 3/9/21. https://www.nfib.com/surveys/small-business-economic-trends/

- Bureau of Labor Statistics, as of 3/5/21.

- The Economist, as of 2/27/21. https://www.economist.com/finance-and-economics/2021/02/27/the-pandemic-has-pushed-working-mums-out-of-the-labour-force

- Census Bureau, as of 12/10/19. https://www.census.gov/library/stories/2019/12/by-2030-all-baby-boomers-will-be-age-65-or-older.html

- Bureau of Labor Statistics, as of 2/28/21. “Months of job growth” are months in which the unemployment rate was lower than in July 2009, defined by the National Bureau of Economic Research as the first month of the recovery.

- Federal Reserve, as of 12/31/20.

- Bureau of Economic Analysis and Blackstone Investment Strategy, as of 2/26/21. “Personal income” is the sum of employee compensation, proprietors’ income with inventory valuation and capital consumption adjustments, rental income of persons with capital consumption adjustment, and personal income receipts on assets less contributions for government social insurance. “Transfers” are income payments received by persons for which no current services are performed and are the sum of government social benefits and net current transfer receipts from businesses. Observations are monthly, seasonally adjusted, and non-annualized.

The views expressed in this commentary are the personal views of Joe Zidle and do not necessarily reflect the views of The Blackstone Group Inc. (together with its affiliates, “Blackstone”). The views expressed reflect the current views of Joe Zidle as of the date hereof, and neither Joe Zidle, nor Blackstone undertake any responsibility to advise you of any changes in the views expressed herein.

Blackstone and others associated with it may have positions in and effect transactions in securities of companies mentioned or indirectly referenced in this commentary and may also perform or seek to perform services for those companies. Blackstone and others associated with it may also offer strategies to third parties for compensation within those asset classes mentioned or described in this commentary. Investment concepts mentioned in this commentary may be unsuitable for investors depending on their specific investment objectives and financial position.

Tax considerations, margin requirements, commissions and other transaction costs may significantly affect the economic consequences of any transaction concepts referenced in this commentary and should be reviewed carefully with one’s investment and tax advisors. All information in this commentary is believed to be reliable as of the date on which this commentary was issued, and has been obtained from public sources believed to be reliable. No representation or warranty, either express or implied, is provided in relation to the accuracy or completeness of the information contained herein.

This commentary does not constitute an offer to sell any securities or the solicitation of an offer to purchase any securities. This commentary discusses broad market, industry or sector trends, or other general economic, market or political conditions and has not been provided in a fiduciary capacity under ERISA and should not be construed as research, investment advice, or any investment recommendation. Past performance is not necessarily indicative of future performance.

For more information about how Blackstone collects, uses, stores and processes your personal information, please see our Privacy Policy here: www.blackstone.com/privacy. You have the right to object to receiving direct marketing from Blackstone at any time. Please click the link above to unsubscribe from this mailing list.