Joe Zidle: That Confident Feeling

“Confidence is that feeling you have before you are fully aware of the situation.” I got that from the back of a SkyMall™ catalog once. (Some people read books back in the days of no electronics during takeoff and landing. I read SkyMall.) Rather tongue in cheek—adapted from a Woody Allen quote—the phrase appeared alongside an image of a skier leaning over the tips of his skis with nothing but an endless expanse of sky underneath him. This skier seemed in control but maybe not fully aware of his situation.

The market is out over its skis

The S&P 500 ® would not be up nearly 20% in 2019 if investors weren’t expecting the Federal Reserve to cut interest rates 75bp by year-end. Market performance currently ignores declining leading indicators and anemic profit growth, hoping that an aggressive Fed cutting cycle will solve for weakening fundamentals. Maybe it’s the more transparent Federal Open Market Committee (FOMC) that makes the market think it can guess the Fed’s next moves. In our view, that’s wishful thinking.

Not the best predictors

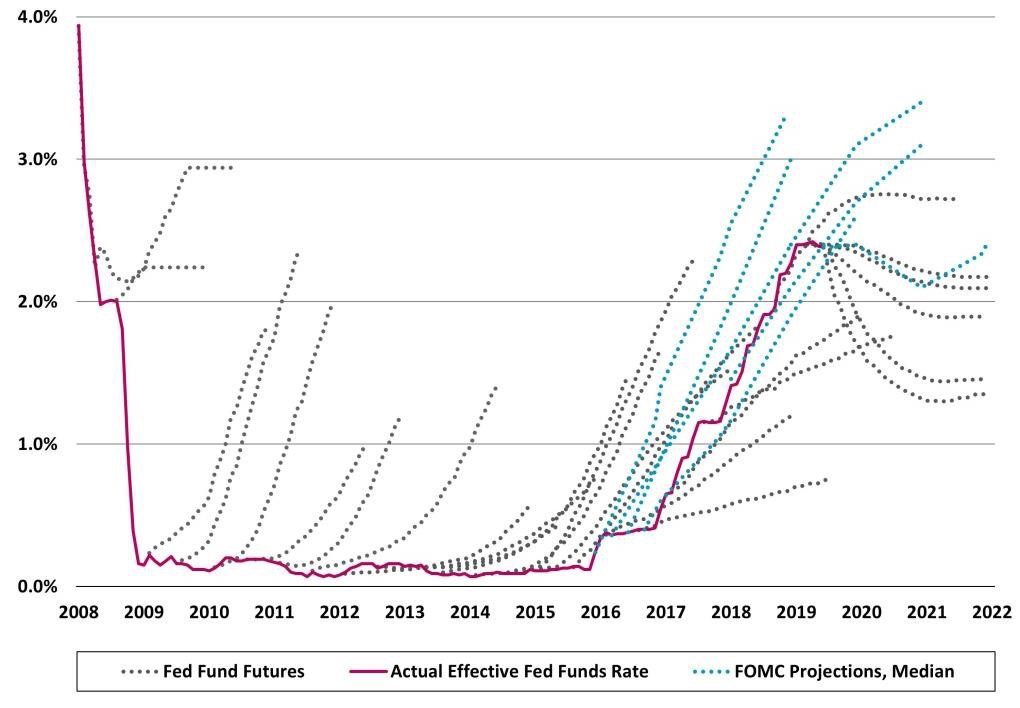

History is not on the market’s side. Investors do not have a good track record in predicting the magnitude and timing of Fed rate actions. And it turns out, the Fed’s track record isn’t much better. The chart below includes the market’s fed funds rate expectations at various points in time and the Fed’s own best guesses, the so-called “dot plot.” We would bet against the argument that “this time will be different” when it comes to accurately predicting future rate actions beyond next week’s presumed cut.

Market and FOMC Expectations

Consistently Undershoot or Overshoot Actual Fed Funds Rate(1)

Cautious on risk assets in the near term

We estimate that the market could end the year within +/- 5% of current levels, but with downside volatility along the way. Two quarters of flat or declining earnings this year have pushed valuations above five- and 10-year averages. Yet the S&P 500 ® has climbed to new all-time highs. It’s important to remember that earnings cycles work at different speeds than economic cycles. Occasionally they line up. But as we’ve written previously, earnings declines occur outside of economic recessions around 40% of the time.2

Bent, not broken

One way or another, fundamentals always realign with prices. We don’t expect the type of severe slowdown in the US that would precipitate Fed cuts at the velocity or magnitude priced in by markets. So if additional Fed cuts don’t come and markets are disappointed, the most likely path for risk assets is a decline in equities and a widening of credit spreads. This won’t be the end of the bull market. But investors should prepare for and lean into any weakness. Volatility can be a friend.

_____________________________________________________________________

(1) Source: Blackstone Investment Strategy, Bloomberg and Federal Reserve, as of 6/30/19. Credit for chart concept to DB Global Research. Note: The FOMC projections for the federal funds rate are the value of the midpoint of the projected appropriate target range for the federal funds rate or the projected appropriate target level for the federal funds rate at the end of the specified calendar year or over the longer run.

(2) Source: Blackstone Investment Strategy, Bloomberg and Shiller, represents the period 1/1/1945 through 12/31/2018.

* * * * *

The views expressed in this commentary are the personal views of the author and do not necessarily reflect the views of The Blackstone Group Inc. (together with its affiliates, “Blackstone”). The views expressed reflect the current views of the author as of the date hereof and Blackstone undertakes no responsibility to advise you of any changes in the views expressed herein. For more information about how Blackstone collects, uses, stores and processes your personal information, please see our Privacy Policy here: http://go.pardot.com/e/213192/privacy/68f9x/182811975?h=L3PDlTnbE2h0R6yw-jpiXWquHwiOdKAOzy99H3DK9f8.

Blackstone and others associated with it may have positions in and effect transactions in securities of companies mentioned or indirectly referenced in this commentary and may also perform or seek to perform services for those companies. Investment concepts mentioned in this commentary may be unsuitable for investors depending on their specific investment objectives and financial position.

Tax considerations, margin requirements, commissions and other transaction costs may significantly affect the economic consequences of any transaction concepts referenced in this commentary and should be reviewed carefully with one’s investment and tax advisors. All information in this commentary is believed to be reliable as of the date on which this commentary was issued, and has been obtained from public sources believed to be reliable. No representation or warranty, either express or implied, is provided in relation to the accuracy or completeness of the information contained herein.

This commentary does not constitute an offer to sell any securities or the solicitation of an offer to purchase any securities. This commentary discusses broad market, industry or sector trends, or other general economic, market or political conditions and has not been provided in a fiduciary capacity under ERISA and should not be construed as research, investment advice, or any investment recommendation. Past performance is not necessarily indicative of future performance.