Joe Zidle: This Capex Cycle is Just Getting Started

The beginning of a capex cycle may not generate headlines like fighting at the G7, a North Korea Summit, and hikes by the Fed, but that doesn’t mean it’s any less important for investors.

This past week brought fresh evidence that business investment is accelerating. In a recent survey by Oscar Sloterbeck of Evercore ISI, CEOs reported the highest capex plans in the 16-year history of the survey. The 24% year over year increase in capex by S&P 500 ® companies in the first quarter is just the beginning of something much bigger. Spending on property, plant and equipment could be a key driver of growth for the next leg of this cycle, perhaps contributing to the strongest economic growth seen yet.

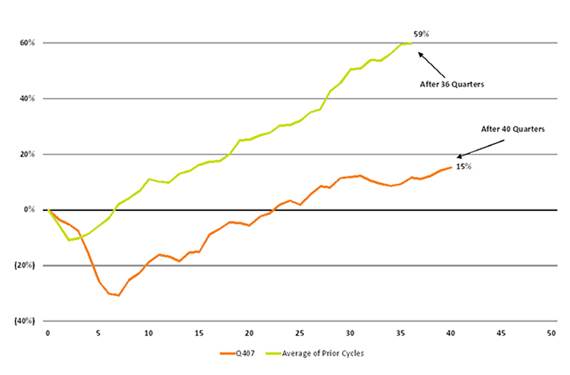

Capex has been absent in the current cycle Since the economy bottomed in 2009, companies prioritized just about everything but reinvesting for growth; share buybacks, dividends and M&A growth all exceeded capex. Perhaps it was short-term thinking or overcapacity from the days before the great recession, but the conclusion was the same: companies underinvested. The chart below highlights the amount of capex spending in this cycle compared to the average of other cycles.

How Much Potential Capex?

Source: Strategas

CEOs say the time is now But that trend looks about to shift. Historically there has been a strong correlation between announced plans and actual deployment of capital. The combination of aging equipment, rising expectations for growth, tight labor markets and finally an incentive in last year’s Tax Cuts and Jobs Act that rewards higher capex, could meaningfully shift spending into a higher gear extending out the cycle.

Bullish investment implications One of the most pressing issues is replacing old equipment. Perhaps it is because for the first time ever in US history there are more open jobs than people out of work, according government figures. Industrials and manufacturers that supply equipment enabling greater worker productivity could see the biggest boost. Within the Institute for Supply Management’s PMI numbers, new orders and production are showing acceleration. Within Blackstone, non-residential capex is looked at as one of the leading indicators used for hotel room demand. Look for faster economic growth, perhaps some of the strongest that we’ve seen at any point in this nine-year old expansion.

* * * * *

The views expressed in this commentary are the personal views of the author and do not necessarily reflect the views of The Blackstone Group L.P. (together with its affiliates, “Blackstone”). The views expressed reflect the current views of the author as of the date hereof and Blackstone undertakes no responsibility to advise you of any changes in the views expressed herein.

Blackstone and others associated with it may have positions in and effect transactions in securities of companies mentioned or indirectly referenced in this commentary and may also perform or seek to perform services for those companies. Investment concepts mentioned in this commentary may be unsuitable for investors depending on their specific investment objectives and financial position.

Tax considerations, margin requirements, commissions and other transaction costs may significantly affect the economic consequences of any transaction concepts referenced in this commentary and should be reviewed carefully with one’s investment and tax advisors. All information in this commentary is believed to be reliable as of the date on which this commentary was issued, and has been obtained from public sources believed to be reliable. No representation or warranty, either express or implied, is provided in relation to the accuracy or completeness of the information contained herein.

This commentary does not constitute an offer to sell any securities or the solicitation of an offer to purchase any securities. This commentary discusses broad market, industry or sector trends, or other general economic, market or political conditions and has not been provided in a fiduciary capacity under ERISA and should not be construed as research, investment advice, or any investment recommendation. Past performance is not necessarily indicative of future performance.