Joe Zidle: Trade Swings Moods

By Joe Zidle, Investment Strategist

with Taylor Becker, Research Analyst

Trade isn’t binary. It’s a chess game. Understanding the implications of how all the pieces move is critical to understanding the economic outcome; each turn creates multiple derivative effects. If they didn’t know that before third-quarter earnings, S&P 500® CEOs do now. Many of their comments about the effects of the trade war during their earnings calls challenged the standing consensus that stronger growth would protect the US from severe consequences.

For investors, that makes it paramount that they track the right indicator of the trade war’s effects.

Big Companies, Big Risks Sentiment on trade has turned decidedly cautious, particularly for companies with the most foreign exposure. CEOs have amplified the downside risks recently, namely slower revenue growth and higher input prices, i.e., earnings factors that are highly correlated to future profits. According to research firm Evercore ISI, cyclical companies within the Materials, Industrials, Discretionary, Technology and Staples sectors have been the most negative on trade recently.(1)

Small Companies, Bigger Risks But the S&P 500 isn’t the economy. S&P companies get all the attention, but they only employ about 10% of the US workforce.(2) Also, they draw nearly 40% of their revenue from outside the US.(3) Small businesses might not get the headlines, but they are the US’ economic engine. Defined as companies that employ fewer than 500 people, small businesses comprise 99.7% of US employers and about 50% of private sector employment.(4)

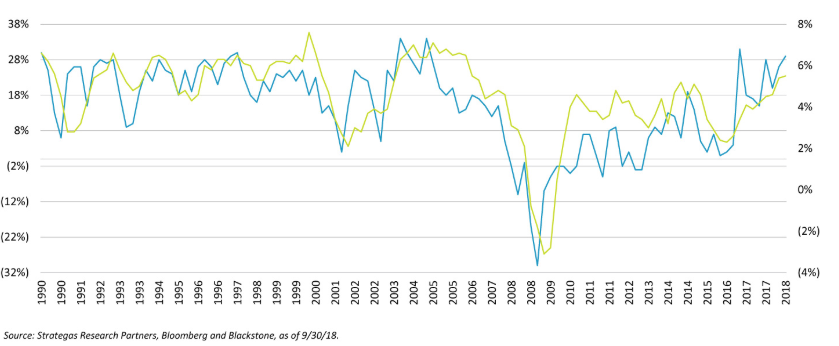

Telltale Chart Right now, small businesses are confident. According to the National Federation of Independent Business (NFIB), small business sales growth expectations notched a 24th straight month with a positive trend in October.(5) That makes sense when assessing the US’ recent economic growth history, as small business sales growth expectations and GDP show high correlation of 0.71 since 1990.(6) In other words, as small business confidence goes, so goes the economy.

Small Business Sales Growth Expectations & GDP Growth

Trade Matters China could face slowing growth as supply chains adjust and move elsewhere. The US could be hit by higher prices and delays, as other countries don’t produce at China’s levels. Modeling all the derivative effects isn’t easy given all the moving parts, so it’s a good strategy to follow those with the most influence, especially the longer this trade war goes on. In chess, the queen is the most powerful piece, given her ability to move across the board. For the US economy, the roughly 30.2 million small businesses are its queen, given their breadth and weight.(4) And it’s their outlook that will likely reveal the symptoms of a trade war gone wrong.

1. Evercore ISI, as of 11/8/18.

2. Deutsche Bank Research, as of November 2018.

3. Strategas Research Partners and Blackstone, as of 9/10/18.

4. U.S. Small Business Administration, Frequently Asked Questions (August 2018), data for the year 2015.

5. National Federation of Independent Business (NFIB), Small Business Economic Trends, as of September 2018.

6. Bloomberg, as of 9/30/18.

The views expressed in this commentary are the personal views of the author and do not necessarily reflect the views of The Blackstone Group L.P. (together with its affiliates, “Blackstone”). The views expressed reflect the current views of the author as of the date hereof and Blackstone undertakes no responsibility to advise you of any changes in the views expressed herein.

Blackstone and others associated with it may have positions in and effect transactions in securities of companies mentioned or indirectly referenced in this commentary and may also perform or seek to perform services for those companies. Investment concepts mentioned in this commentary may be unsuitable for investors depending on their specific investment objectives and financial position.

Tax considerations, margin requirements, commissions and other transaction costs may significantly affect the economic consequences of any transaction concepts referenced in this commentary and should be reviewed carefully with one’s investment and tax advisors. All information in this commentary is believed to be reliable as of the date on which this commentary was issued, and has been obtained from public sources believed to be reliable. No representation or warranty, either express or implied, is provided in relation to the accuracy or completeness of the information contained herein.

This commentary does not constitute an offer to sell any securities or the solicitation of an offer to purchase any securities. This commentary discusses broad market, industry or sector trends, or other general economic, market or political conditions and has not been provided in a fiduciary capacity under ERISA and should not be construed as research, investment advice, or any investment recommendation. Past performance is not necessarily indicative of future performance.