Joe Zidle: US and India versus the World

By Joe Zidle, Chief Investment Strategist

with Taylor Becker, Research Analyst

This year’s rally in risk assets caught many off guard. Investors have been net sellers, preferring defensive assets when they do deploy capital. Yet since the fourth quarter market decline, the S&P 500® has increased 20% and credit spreads have narrowed, delivering a 8% gain for high yield investors.(1) In part, the snapback can be attributed to a recovery from that fourth quarter drawdown, as well as good news on China trade and a more dovish Fed.

But these markets are sensitive, and investors will have to face whatever comes next. Currently, the yield curve is on the hot seat. Much has been made of the fact that an important portion of the yield curve, the 10Y/3M, recently inverted. What the headlines fail to explain is that this spread must invert for 10 consecutive days to produce a reliable recession signal. Until that happens, or the 10Y/2Y portion of the curve inverts, we do not believe they are indicating an end to this cycle.

Corporate profits are also a major cause of investor concern. A profits slowdown or outright decline may increase the volatility of risk assets, particularly with a trade resolution and the Fed priced in. The reality of slower earnings growth and difficult year-overyear comparisons will make further market gains hard to come by in the short term.

However, in a recent Market Insights we concluded that any weakness in risk assets due to a profits recession should be viewed as a longer-term buying opportunity. It has been a while since profits came under such severe pressure—we have seen eight consecutive quarters of double-digit earnings growth. So it is worth remembering that profits and economies work at different speeds.

In other words, earnings growth will slow dramatically this year. We may even see an earnings recession, defined as two quarters of negative year-over-year earnings growth. However, an earnings recession does not inevitably mean an economic recession is around the corner. Around 40% of the time, profits contract when the overall economy continues to expand. Until the leading indicators we watch tell us otherwise, we continue to believe the economic expansion will provide enough time for earnings to recover.

Spotlight on Emerging Markets

Earnings recessions can be bumpy. Historically, the S&P 500 outperforms 12 months after the start of a mid-cycle earnings recession.(2) Still, we believe any pullback will prove to be a good buying opportunity for credit, cyclical sectors in the US and emerging markets, in particular. Conditions have changed markedly for EM in 2019 and it has performed accordingly, up 12% since the 4Q’18 market trough.(3)

EM and the US are the two biggest overweights in our Radical Asset Allocation for the liquid long-only portion of our framework. Our bullish thesis on EM depends on last year’s headwinds becoming this year’s tailwinds. In 2018, EM faced a perfect storm of Fed tightening, balance sheet contraction, a trade war with China, a strong dollar and crises in countries such as Turkey and Argentina.

In 2019, EM faces virtually none of these risks with valuation more attractive and growth rates intact. The Fed is on pause with rate hikes and will stop shrinking its balance sheet this year; the trade war with China is likely to have a favorable resolution in the short–term; the dollar will stabilize in 2019; and the foreign debt crises in Turkey and Argentina appear to be isolated occurrences, not contagion.

Global central bank easing will also benefit EM in 2019. The Fed, the European Central Bank and the People’s Bank of China have shifted back into neutral or outright easing mode. This is a sharp contrast to 2018, when 56% of central banks hiked rates and contributed to a rare contraction in the global monetary base. New central bank–provided liquidity is fuel for risk assets, and EM is positively correlated to US equities and higher beta. Over the last 10 years, EM has averaged a beta to the S&P 500 similar to that of the Russell 2000. If liquidity propels US equities higher, we expect EM to benefit as well.

In addition, the US dollar could be a countervailing force to strong EM performance. In 2017, EM outperformed when the dollar was weak. In 2018, EM lagged when the dollar was strong. In 2019, we expect the dollar to stabilize, which should bolster performance. The absence of dollar strength reduces the pressure on EM central banks to hike rates, creating a virtuous cycle.

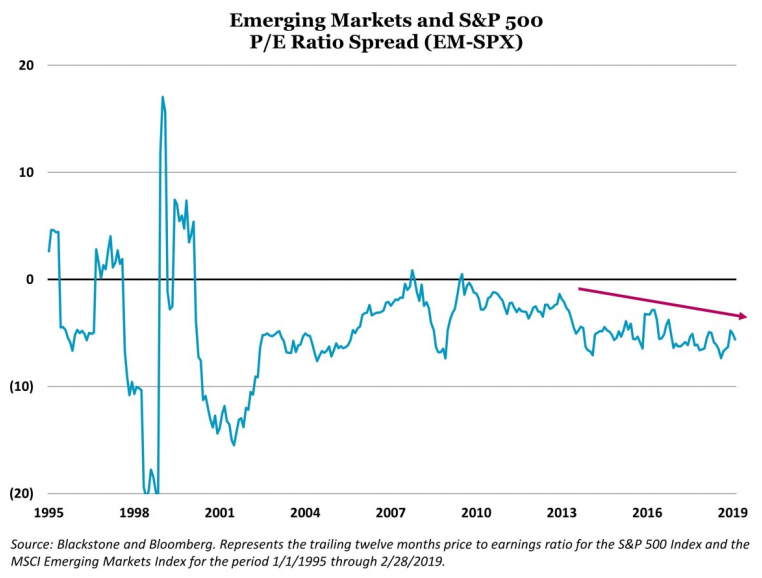

Our bullishness on EM also stems from its valuation, which is relatively cheap compared to that of the US and to its own historical average. EM’s current P/E ratio is nearly two points below its historical average since 1995 and a point below its average since the Global Financial Crisis. By both measures, the S&P is relatively more expensive (see chart below).

India: EM’s Contrarian Growth Story

A deeper look into emerging markets shows that one of its brightest growth stories also seems to be one of the most contrarian. India has suffered outflows from US retail investors even as they plow money into countries with slower growth rates, more debt, weaker currencies and less-robust rules of law.

Investors pulled $1.5 billion from India equity funds in 2018.(4) Compare this to positive net flows of $20.5 billion and $6.7 billion in diversified emerging market equity funds and China equity funds, respectively. In 2019, positive flows for EM and China equity funds are on pace to eclipse last year’s total. The difference is even starker in fixed income, as global EM funds totaled positive inflows of $28.7 billion in 2018, compared to $30.5 billion of outflows from India funds.

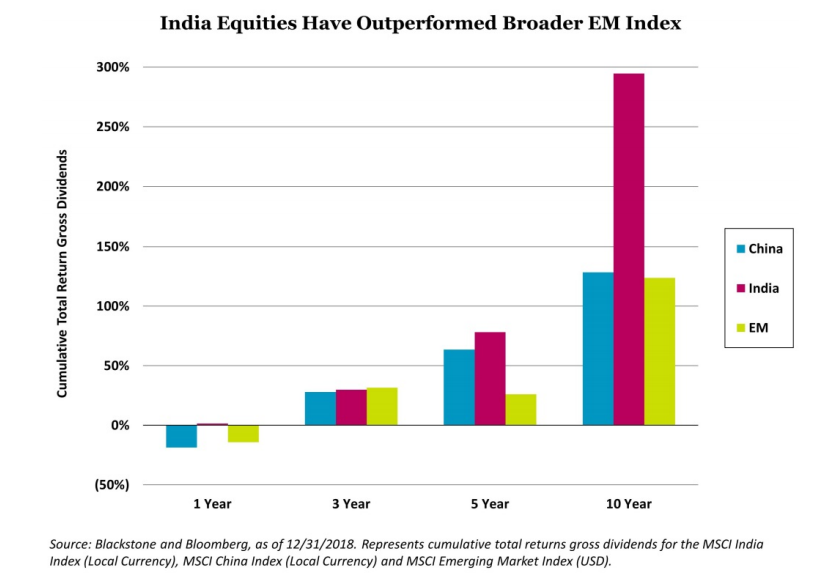

It is interesting that India has not been favored as much as China or emerging markets more broadly, given its historical equity performance. India was one of the few major economies not to experience a drastic decline in its stock market in 2018. In local currency terms, it finished the year up 1%, compared to China and EM declining 19% and 14%, respectively.(5) Now, India has underperformed year-to-date as China and EM recover from their massive drawdowns. But the long-term track record is clear: India has outperformed China and EM consistently throughout this cycle (see chart).

We acknowledge that access to India is still rather nascent. The market capitalization of its listed domestic companies is only $2.3 trillion, about a quarter the size of China’s market cap and only 7% of the $32 trillion in US market cap.(6) For comparison, that’s smaller than the current combined market cap of just the three largest US stocks: Microsoft, Apple and Amazon.(7) Consider also that there are fewer than 300 India-focused funds worldwide (i.e., domiciled elsewhere than India), and over 850 China-focused funds worldwide (i.e., domiciled elsewhere than China.)(8)

China’s Transformation Informative

India’s low base means that there is potential for large-scale and rapid growth, which has significant implications for the prosperity of its people. It may be the third largest economy in the world on a currency-adjusted purchasing power parity basis, but India’s per capita income ranks an abysmal 139th globally.

China provides an interesting comparison, though. In the mid 2000’s, the size of China’s economy and its per capita income made it similar to where India is today. Over the next decade, China grew its economy threefold, lifting 400 million people out of poverty and creating one of the largest middle classes in history. Today, China’s per capita income is $8,600 in nominal terms. China’s growth project is not done yet, and its burgeoning middle class and strong productivity growth are notable. While India might be a decade behind, it is rapidly moving in the same direction. In our view, it will be the brightest EM star in the years ahead.

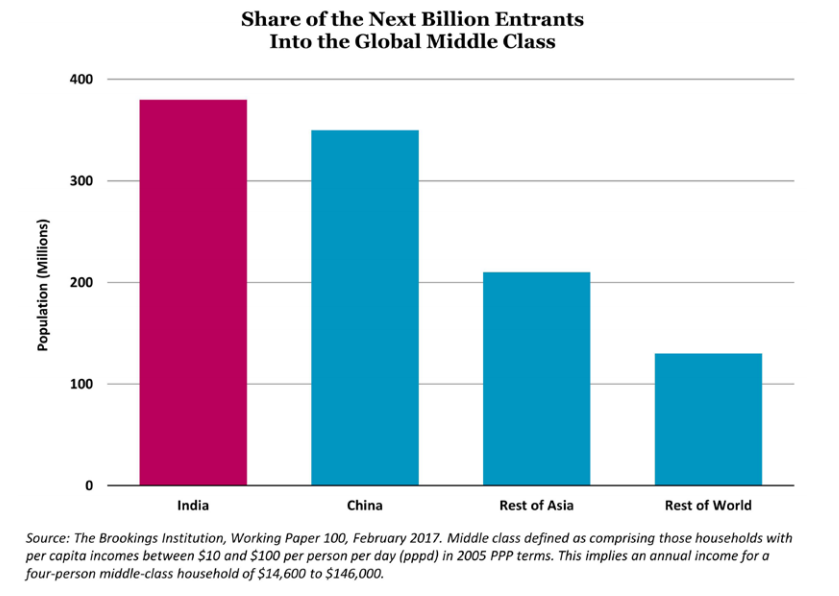

India leads the major economies with the fastest growth rate in the world, relatively tame inflation and double-digit gross fixed capital formation (i.e., infrastructure investment). According to a Brookings report, 88% of the next billion entrants into the global middle class will come from Asia, with 36% of the total coming from India.(9) As shown in the chart below, India is expected to lift more people into the middle class than any other country, and more than twice as many as of the rest of the world ex-Asia.

India’s Demographic Moat

Demographics are the economic moat around India that makes it one of the most compelling long-term investments in the emerging world. The country has the largest youth population globally with over 60% of its population under the age of 35.(10) Sometime in the next decade that will translate into the largest workforce in the world—an estimated 1 billion people between the ages of 15 and 64.

India’s workforce will also be increasingly proficient in English. An estimated 125 million Indians already speak English, second only to the number in the United States.(11) In the next decade, some estimate the number of English-speaking Indians will exceed that of the US.(12) India’s workforce will continue to be educated as well, especially in science, technology, engineering and mathematics (STEM) education; only China graduates more students with STEM degrees.(13)

India’s services exports are another differentiator. Other emerging market countries count low-cost manufacturing as their competitive advantage, but India exports services at nearly twice the rate of merchandise. And services are harder to relocate than traditional low-cost manufacturing.

Short-Term Risks Exist

In conversations with clients, the upcoming election is the main concern. In a rare sign of political solidarity, more than 20 opposition parties banded together to challenge Prime Minister Narendra Modi in the elections beginning April 11 and ending in May. Modi’s support remains strong among larger businesses due to his policies, which have resulted in more transparent government policies, stronger rule of law and a modernized goods and services tax structure.

However, there are many small business owners who traditionally operated in the shadow economy, and their resolve to roll back reforms cannot be underestimated.

Oil prices are a risk to India’s highly energy-consumptive economy. Higher energy prices would negatively affect India’s fiscal deficit and contribute to inflationary pressures due to their reliance on oil imports. It would also burden the country’s micro, small and medium enterprises, which are estimated to comprise over 33% of India’s total manufacturing output and employ more than 111 million people.(14)

These firms generally use inefficient technologies and equipment, and thus consume greater amounts of energy. Subsidization in the agricultural sector is another factor that compromises the natural drive toward increased energy efficiency as well. Overall, poorly run operations are allowed to proliferate, to the long-term detriment of productivity.

An Emerging Theme to Know

India has been a strong conviction theme for Blackstone, and it has paid off. India has been one of the top-performing geographies in our private equity portfolio in recent years. Investments in India from our private equity and real estate funds total nearly $10 billion. Our real estate platform employs more than 1.3 million people in India, and we are the largest commercial real estate owner in the country, with over 120 million square feet of property. Since 2005, our private equity group’s investments in India have totaled around $5 billion across 26 portfolio companies, collectively employing around 200,000 people.

Retail investors may be unaware of the full scope of India’s story. The US and China receive most of the attention in discussions about global economic leadership in the years to come. But it is important that investors get up to speed on India as factors align for it to become one of the great secular growth stories.

Demographics are on India’s side. They distinguish India from its emerging market peers, giving it an advantage similar to the one that the US has over other developed markets. While the population growth rates slowed in the US over the last decade, it is still better than that of all major Eurozone countries and Japan, where populations are significantly older and the workforces are rapidly shrinking. Remember, over the long term, GDP growth is simply the combination of growth in the labor force and growth in productivity. India and the US have the best combination of those two factors among their respective peer groups.

(1) Source: Bloomberg. Bloomberg Barclays US Corporate High Yield Index used for high yield returns. Based on total return gross dividends over the period 12/24/2018 through 3/22/2019.

(2) Source: Blackstone analysis.

(3) Source: Bloomberg and Blackstone. MSCI Emerging Markets Index data used for emerging markets returns. Based on total return gross dividends over the period 12/24/2018 through 3/22/2019.

(4) Source: Morningstar Direct. 2019 YTD flows are through 3/15/2019. Equity funds represent US-domiciled open-end funds and ETFs. Fixed income funds represent open-end funds, money market funds and ETFs for all domiciles.

(5) Source: Bloomberg and Blackstone, as of 12/31/2018. Represents cumulative total returns gross dividends for the MSCI India Index (Local Currency), MSCI China Index (Local Currency) and MSCI Emerging Market Index (USD).

(6) Source: World Bank, as of 12/31/2017.

(7) Source: Bloomberg, as of 3/21/2019.

(8) Source: Morningstar Direct, as of 3/20/2019. Based on open-end funds and ETFs that have Investment Areas in either India or China, and are not domiciled in the same country.

(9) Source: The Brookings Institution, Working Paper 100, February 2017. Middle class defined as comprising those households with per capita incomes between $10 and $100 per person per day (pppd) in 2005 PPP terms. This implies an annual income for a four-person middle-class household of $14,600 to $146,000.

(10) Source: United Nations, World Population Prospects 2017.

(11) Source: Times of India and 2011 Census of India.

(12) Source: “English or Hinglish – Which Will India Choose?” BBC News, as of November 2012.

(13) Source: World Economic Forum and Forbes, as of 2016.

(14) Source: The Energy and Resources Institute, as of 1/22/2018.

* * * * *

The views expressed in this commentary are the personal views of the author and do not necessarily reflect the views of The Blackstone Group L.P. (together with its affiliates, “Blackstone”). The views expressed reflect the current views of the author as of the date hereof and Blackstone undertakes no responsibility to advise you of any changes in the views expressed herein. For more information about how Blackstone collects, uses, stores and processes your personal information, please see our Privacy Policy here: http://go.pardot.com/e/213192/privacy/5qvg1/159241904?h=DLDMCKk_gbLh-dwf0GzGHhVUEfnqCWBvZMKqJJTvPOo. You have the right to object to receiving direct marketing from Blackstone at any time. Please click the link above to unsubscribe from this mailing list.

Blackstone and others associated with it may have positions in and effect transactions in securities of companies mentioned or indirectly referenced in this commentary and may also perform or seek to perform services for those companies. Investment concepts mentioned in this commentary may be unsuitable for investors depending on their specific investment objectives and financial position.

Tax considerations, margin requirements, commissions and other transaction costs may significantly affect the economic consequences of any transaction concepts referenced in this commentary and should be reviewed carefully with one’s investment and tax advisors. All information in this commentary is believed to be reliable as of the date on which this commentary was issued, and has been obtained from public sources believed to be reliable. No representation or warranty, either express or implied, is provided in relation to the accuracy or completeness of the information contained herein.

This commentary does not constitute an offer to sell any securities or the solicitation of an offer to purchase any securities. This commentary discusses broad market, industry or sector trends, or other general economic, market or political conditions and has not been provided in a fiduciary capacity under ERISA and should not be construed as research, investment advice, or any investment recommendation. Past performance is not necessarily indicative of future performance.