Joe Zidle: The 10-Year Yield Just Needs a Demand Push

One of my favorite things about developing the annual list of Ten Surprises with Byron is the reaction we get from readers—both positive and negative. Here we look at Surprise Nine, which makes the case that the 10-year Treasury yield approaches 2% in 2021. Currently, this Surprise is under a bit of scrutiny and being tested by the political realities affecting President Biden’s $1.9T stimulus proposal and new concerns about a more virulent form of COVID. After threatening to break out recently, 10-year yields settled down to a range just above 1%.

But I think the broader US economic recovery will soon have enough self-sustaining momentum to produce a period of above-trend growth, and with it a steeper yield curve.

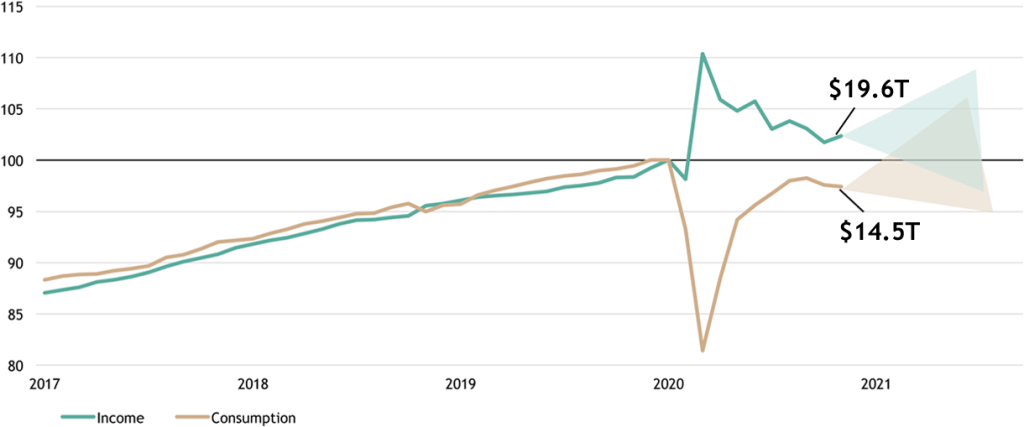

Potential growth underestimated The consensus estimate for real GDP growth in 2Q’21 is currently around 5% QoQ, but the range of forecasts is wide, and understandably so.1 Modeling out the potential spending of a nation that is largely stuck inside and sitting on record savings isn’t easy. Of the current forecasts, we’re taking the “over.” As winter gives way to spring, we expect hospitalization rates to fall, mobility to increase and personal income to hit yet another high. Figure 1 highlights how increases in income have coincided with declines in spending. We expect that gap to close, and result in a burst of consumer demand being unleashed on the economy.

Figure 1: Personal Income and Personal Consumption Expenditures (and Illustrative Convergence)

(indexed to 100 as of Jan-20)

Source: Bureau of Economic Analysis, as of December 31, 2020. Data for 2021 represent hypothetical, illustrative growth paths.

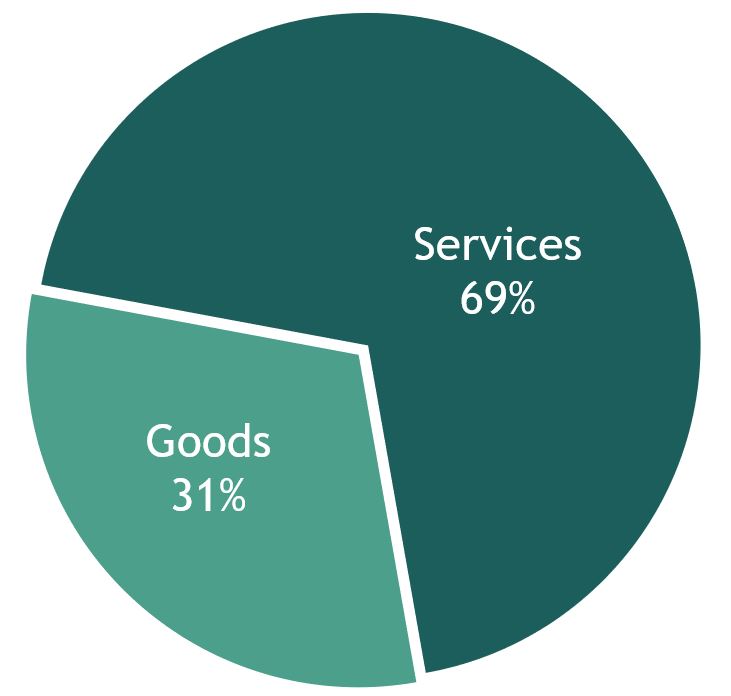

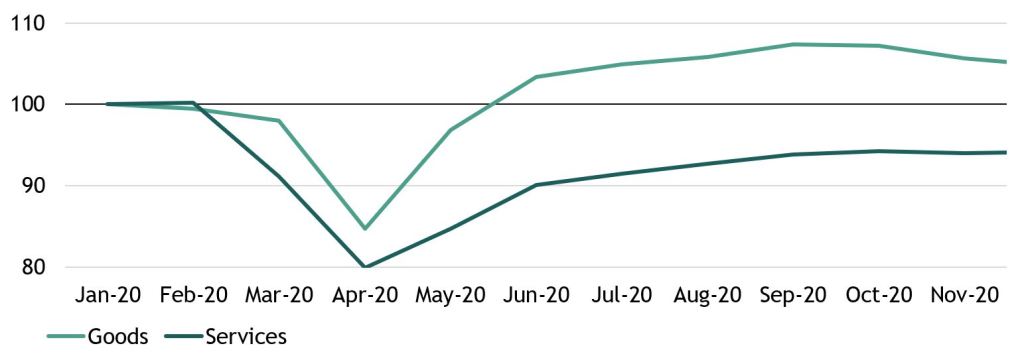

Services will be the star of the show As Figures 2 and 3 show, the services sector is the segment of the economy with the most room to run. Consumer spending on services makes up nearly half of US GDP and 69% of total consumption. Whereas spending on goods established new record highs in recent months, spending on services is 7% below pre-COVID highs. We expect a robust recovery in demand for services to boost growth significantly this year.

Figure 2: Goods vs. Services

(share of PCE as of Jan-20)

Figure 3: Personal Consumption Expenditures: Goods vs. Services

(indexed to 100 as of Jan-20)

Source: Bureau of Economic Analysis, as of December 31, 2020. “PCE” represents “personal consumption expenditures.”

Short-term reflation, long-term disinflation The economy may have difficulty meeting demand growth in the months ahead due to supply chain weakness, which could cause some price pressure. Services should be more resilient to supply chain fragility, but even here the economy has lost capacity, as many companies in particularly hard-hit industries like leisure and hospitality have shuttered for good. In New York City, for example, 20% of the city’s hotels have closed, accounting for over 42,000 hotel rooms—one third of the pre-COVID total.2 The businesses that remain could face record demand, less supply and, perhaps, unprecedented pricing power. Long term, we expect the economy to return to lower-for-longer growth and inflation paths.

Expect market decoupling to reverse The 10-year breakeven inflation rate, representing the market’s long-term inflation expectations, plunged to 0.5% in mid-March but has rebounded to 2.13%, which is the highest level since October 2018 and in the 96th percentile since 2015.3 This represents the tension between the market’s short-term pessimism, indicated by the flat yield curve, and expectations for reflation induced by the coming recovery. As the economy reopens with support from accommodative Fed policy, the groundwork will be laid for the 10-year Treasury to recover to its pre-COVID levels and for the yield curve to steepen. In such an environment, companies with pricing power can benefit from short-term reflation, while “zombie” companies with high debt levels could face challenges in rolling over debt.

In my view, investors should consider the implications of long-term rates doubling from 1% to 2%. Portfolios could benefit from investing in mortgages and high-quality real estate, shortening the duration of fixed income holdings, and focusing on floating rate assets and those with the ability to raise dividends.

With data and analysis by Taylor Becker.

- Source: Bloomberg, represents the median of economic forecasts available as of February 2, 2021. Growth rate is quarter-over-quarter, seasonally adjusted annual rate (SAAR).

- Source: NYC Department of Planning, as of January 1, 2021.

- Source: Federal Reserve Bank of St. Louis, most recent estimate as of January 29, 2021.

The views expressed in this commentary are the personal views of Joe Zidle and Byron Wien and do not necessarily reflect the views of The Blackstone Group Inc. (together with its affiliates, “Blackstone”). The views expressed reflect the current views of Joe Zidle and Byron Wien as of the date hereof, and neither Joe Zidle, Byron Wien, nor Blackstone undertake any responsibility to advise you of any changes in the views expressed herein.

Blackstone and others associated with it may have positions in and effect transactions in securities of companies mentioned or indirectly referenced in this commentary and may also perform or seek to perform services for those companies. Blackstone and others associated with it may also offer strategies to third parties for compensation within those asset classes mentioned or described in this commentary. Investment concepts mentioned in this commentary may be unsuitable for investors depending on their specific investment objectives and financial position.

Tax considerations, margin requirements, commissions and other transaction costs may significantly affect the economic consequences of any transaction concepts referenced in this commentary and should be reviewed carefully with one’s investment and tax advisors. All information in this commentary is believed to be reliable as of the date on which this commentary was issued, and has been obtained from public sources believed to be reliable. No representation or warranty, either express or implied, is provided in relation to the accuracy or completeness of the information contained herein.

This commentary does not constitute an offer to sell any securities or the solicitation of an offer to purchase any securities. This commentary discusses broad market, industry or sector trends, or other general economic, market or political conditions and has not been provided in a fiduciary capacity under ERISA and should not be construed as research, investment advice, or any investment recommendation. Past performance is not necessarily indicative of future performance.