Joe Zidle: When Earnings and the Economy Diverge

Beginning last year we argued that competing forces would determine market performance in 2019: global central bank easing and a US-China trade war resolution on one side, and the risk of a corporate profits recession on the other. Thus far, the bullish themes of liquidity and trade have propelled the market to its strongest start since 1991.1 But these themes may soon be overshadowed. Analysts forecast S&P 500® earnings will turn negative for the first time since mid- 2016 and decline by 3.6% in 1Q’19.2 Earnings could still surprise to the upside, as the average first quarter earnings surprise is 4.3%.3 Yet the risk of an earnings recession may portend greater market volatility and a broader selloff.

What, me worry? Alfred E. Neuman, the cartoon character who made his debut on the cover of Mad Magazine in 1954, was known for his tagline of “What, me worry?” To this point, the markets have been similarly untroubled about earnings forecasts. Still, it’s important to understand the risk, which involves distinguishing between two very different environments for profits: whether an earnings recession coincides with an economic recession or not. Typically, market performance is quite different under each scenario, a key point that can be lost when volatility starts to cloud investor decisions.

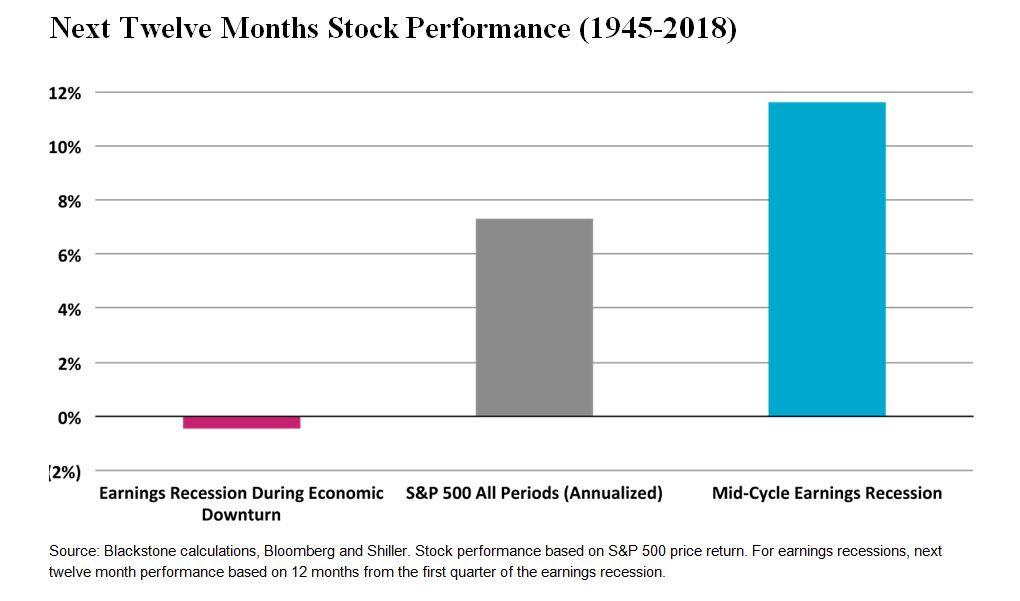

Not all profits recessions are bad There have been 14 earnings recessions since World War II, i.e., two consecutive quarters of negative earnings growth. Six of those earning recessions can be characterized as mid-cycle, meaning they did not coincide with an economic recession.4 In the eight earnings downturns that coincided with broader economic slowdowns, stock performance 12 months later was negative with an average return of -0.4%.5 Conversely, the market was up nearly 12% on average a year after earnings recessions that did not overlap with an economic recession. For reference, the broader market has returned an annualized 7.3% since 1945.

Riskiest parts of the market remain the cheapest Markets have regained most of the 4Q’18 drawdown, but the recovery hasn’t been even. Cyclical and energy sectors are cheaper than their September 21st peak, with P/E ratios 3.8 lower on average. High yield/investment grade spreads, while narrowing, also remain wider than they were at last year’s market peak. Meanwhile, investor skepticism about the longevity of this bull market and the economic cycle has lifted defensive and lower-beta sectors. Defensive sectors are now around 50bp more expensive on a P/E basis.6

Keeping a long view We expect this economic expansion will last long enough to allow for a profits recovery, a view that informs our bullishness on risk assets. On average, profit recessions during economic expansions last five quarters, and seven quarters when they occur during contractions.7 Even if earnings turn negative, buying cyclicals and other risk assets may prove to be a profitable strategy.

1. Source: Blackstone and Bloomberg. Based on the year-to-date price return as of the end of February.

2. Source: FactSet, as of 3/15/2019.

3. Source: Ned Davis Research, S&P Capital IQ and MSCI Inc. Based on the average of the median first quarter S&P 500 surprise percent from 1994-2018.

4. Earnings recession defined as two consecutive quarters of negative year-over-year growth in S&P 500 trailing twelve months earnings. Economic recessions as defined by the National Bureau of Economic Research. An earnings recession coincides with an economic recession if they overlap in the same quarter or if an economic recession follows within four quarters.

5. Source: Blackstone, Bloomberg and Shiller. Represents S&P 500 price return for the period 1/1/1945 through 12/31/2018. For earnings recessions, returns are represented by next twelve months performance from the first quarter of the earnings recession.

6. Source: Blackstone and Bloomberg, as of 3/15/2019.

7. Source: Blackstone, Bloomberg and Shiller. Length of earnings recession reflects the number of consecutive quarters that earnings growth is negative.

* * * * *

The views expressed in this commentary are the personal views of the author and do not necessarily reflect the views of The Blackstone Group L.P. (together with its affiliates, “Blackstone”). The views expressed reflect the current views of the author as of the date hereof and Blackstone undertakes no responsibility to advise you of any changes in the views expressed herein. For more information about how Blackstone collects, uses, stores and processes your personal information, please see our Privacy Policy here: http://go.pardot.com/e/213192/privacy/5qvg1/159241904?h=DLDMCKk_gbLh-dwf0GzGHhVUEfnqCWBvZMKqJJTvPOo. You have the right to object to receiving direct marketing from Blackstone at any time. Please click the link above to unsubscribe from this mailing list.

Blackstone and others associated with it may have positions in and effect transactions in securities of companies mentioned or indirectly referenced in this commentary and may also perform or seek to perform services for those companies. Investment concepts mentioned in this commentary may be unsuitable for investors depending on their specific investment objectives and financial position.

Tax considerations, margin requirements, commissions and other transaction costs may significantly affect the economic consequences of any transaction concepts referenced in this commentary and should be reviewed carefully with one’s investment and tax advisors. All information in this commentary is believed to be reliable as of the date on which this commentary was issued, and has been obtained from public sources believed to be reliable. No representation or warranty, either express or implied, is provided in relation to the accuracy or completeness of the information contained herein.

This commentary does not constitute an offer to sell any securities or the solicitation of an offer to purchase any securities. This commentary discusses broad market, industry or sector trends, or other general economic, market or political conditions and has not been provided in a fiduciary capacity under ERISA and should not be construed as research, investment advice, or any investment recommendation. Past performance is not necessarily indicative of future performance.