Joe Zidle: Conviction in the Recovery Remains Strong

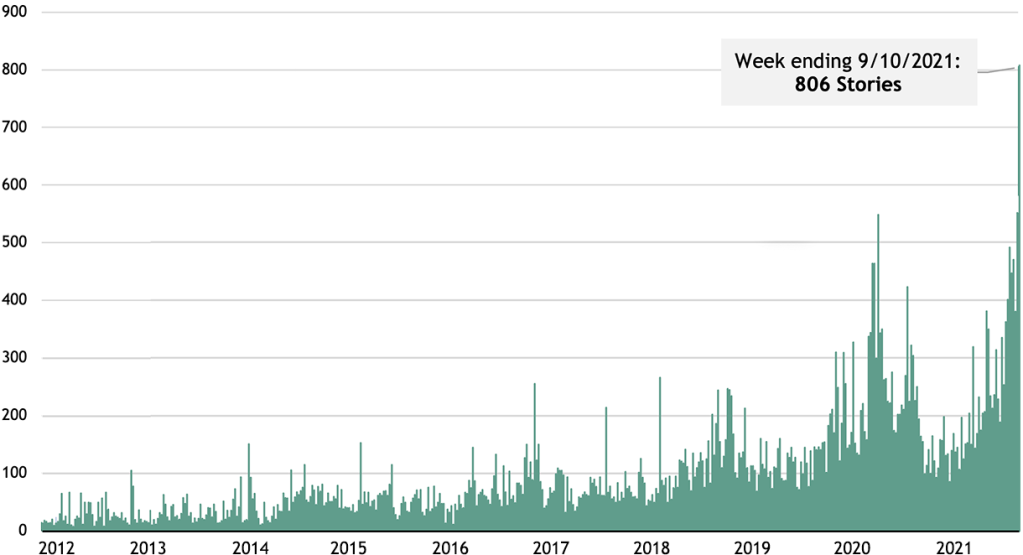

Virtually every economic report we read these days refers to some form of slowing growth. Despite printing what would normally be a strong 6.5% quarter-on-quarter annualized rate in 2Q21, US GDP growth was almost 200 basis points below the consensus expectation.1 In August, the University of Michigan’s consumer sentiment index fell to its lowest level since 2011, well below even the most pessimistic projection.2 In response to these and other notable misses, many economists and banks have revised down their forecasts for GDP growth for the rest of this year. Some more bearish market watchers even claim that the boogeyman of stagflation has returned to the US. Just look at how many recent stories on Bloomberg feature the term.

Figure 1: Total Bloomberg Stories Featuring the Word “Stagflation”

(Weekly)

Source: Blackstone Investment Strategy and Bloomberg, as of 9/10/2021.

But it’s important to contextualize these macro figures. Just as the numbers posted last year frequently qualified as the “worst ever,” this spring and summer’s easy comps produced a series of eye-popping growth numbers, from services to manufacturing activity. Now that we’ve lapped the beginning of the US recovery, year-over-year changes are returning to earth. We discussed our expectation for volatile macro data in the June essay.

Areas of strain, including labor markets, global supply chains, China’s economic deceleration, and COVID-19, do merit concern. However, in my view, the fundamental strength of the economic rebound remains intact, powered by vaccine distribution and the US consumer. The recent growth slowdown is a speed bump on the road to recovery, not a treacherous detour. The distinction between the two has important portfolio implications.

Reasons for Concern

Labor market struggles Firms desperately need workers, but right now they’re simply not there. Nonfarm job openings have posted a new record in every month since March. In July, there were five job openings for every four unemployed Americans.3 The August NFIB Small Business Jobs Report revealed that a record-high 50% of all small business owners had job openings they could not fill, compared to the almost 50-year historical average of 22%.4 On the supply side of the market, labor force participation has hovered between 61.4% and 61.7% since June 2020, 1.6 percentage points lower than in February 2020.5 And a record-high 3.98 million Americans quit their jobs in July.3

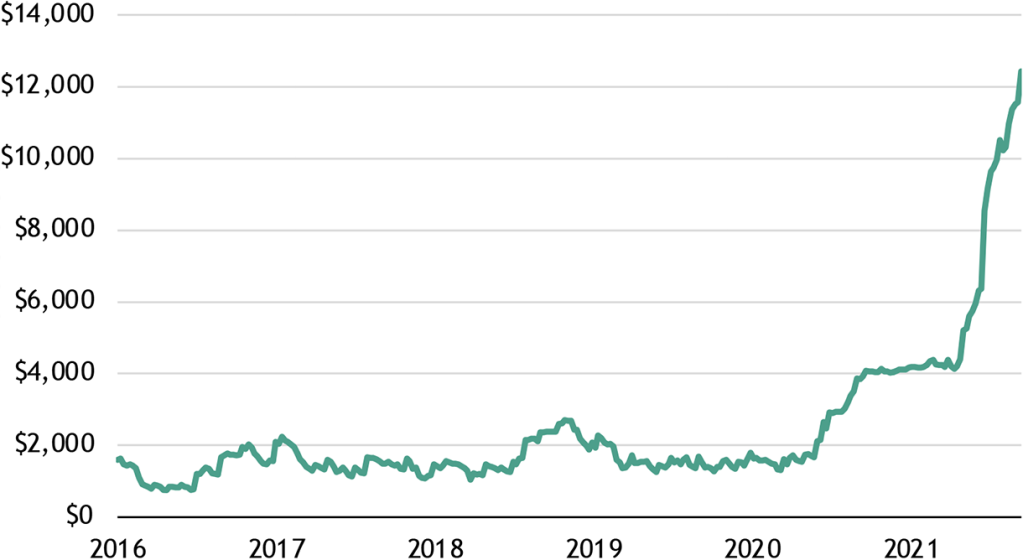

Supply chain problems persist Global supply chains remain stretched, pushing up shipping and input costs and hampering inventories and production. Shipping capacity remains far too limited to satisfy rebounding demand, raising cargo prices to levels previously unimaginable. For example, a relatively small panamax class container ship fetched a daily charter rate of $200,000 in September; a couple of years ago, these ships were being sold for scrap.6 As Figure 2 shows, the spot rate to ship a 40-foot container from Shanghai to Los Angeles is now $12,424, more than eight times higher than pre-pandemic prices.7 And, several US port executives said they expect shipping logjams to continue at least through summer 2022, if not longer.8

Figure 2: Shanghai-to-Los Angeles Container Freight Spot Rate

(US$)

Source: Blackstone Investment Strategy, Bloomberg, and Drewry Supply Chain Advisors, as of 9/16/2021. Represents the spot container freight rate in US dollars for 40-foot container boxes shipped from Shanghai to Los Angeles.

Here at Blackstone, companies in our portfolio are seeing both labor and supply chain constraints materialize in real time. A number of CEOs of our portfolio companies reported in a 2Q’21 survey that, after COVID-19, they are focused on supply chains and the ability to hire and retain qualified workers. Surveyed CEOs in the US described annual inflation of about 4% across wages and raw materials. And an overwhelming majority of respondents to our survey whose firms experienced rising inflation and rates said that this could impact the performance of their companies.9

The world’s second-largest economy slows down Two issues concern me with China. First, it appears the Delta variant precipitated the economy’s current slowdown. Previously, China led the global recovery due to its early actions to curb COVID’s spread. Now, its “zero-COVID” policy has shut down entire regions and sectors in response to small clusters of infections, disrupting many segments of the supply chain. For example, in the Ningbo port complex, the world’s third busiest port, an entire shipping terminal was closed due to one case, leaving dozens of cargo ships stranded.10 China’s issues are unlikely to derail the US’s recovery, but further supply chain complications could damage global demand, especially in emerging markets that rely heavily on Chinese imports.

The second issue is new regulation in the private sector. Perhaps one outcome of China’s slowing recovery will be a renewed focus on short-term growth numbers. But China tends to take a long-term view of domestic dynamics and develop methodological policy changes to effect desired outcomes. We should be prepared for the possibility that China may tolerate slower economic growth in exchange for bold reforms.

18 months later, COVID-19 lingers Our recent conversations with experts lead Byron and me to believe that Delta cases and hospitalizations in the southern US have probably peaked. Delta will likely now move north as the school year starts and as colder weather moves people indoors. Case numbers will rise, but hospital capacity in the Northeast should prove sufficient, largely thanks to those states’ higher vaccination rates.

Globally, low availability of reliable vaccines in emerging markets poses a threat to their recoveries and increases the potential for further mutations of the virus. Our base case assumes that the transmission of future variants to the US and other highly vaccinated countries will be less damaging than Delta, as vaccinations and natural immunity will limit the spread. But, if a significantly more virulent or deadly strain were to develop, it could reduce the efficacy of current vaccines.

Reasons for Optimism

Vaccine uptake, efficacy point to continued recovery Thankfully, doctors, epidemiologists, and policymakers continue to make strides against COVID-19 and its variants. COVAX, a United Nations-backed program to distribute vaccines, is expected to deliver a total of 1.4 billion doses to 139 participating economies this year, with 1.1 billion of those doses being delivered between September and December.11

Importantly, we know that the vaccines work. In the US, data from Washington state show that only 0.5% of fully vaccinated residents have contracted breakthrough infections. Just 9% of those cases required hospitalization.12 Vaccine efficacy is a major reason why I’m bullish on the US’s situation, especially in regions with strong vaccination rates and natural immunity. That includes California and New York City, two engines of the economy. Another positive is the coming Food & Drug Administration (FDA) approval of vaccine distribution to young children. Most importantly, this approval will protect our kids. But it will also increase parents’ willingness to return to normal activities, like dining indoors or going to the movies.

The US consumer is a good bet My conviction in the US recovery is attributable largely to the consumer. We’re a nation of spenders, and we began this cycle from a position of historic strength due to low interest rates, pandemic debt forbearance programs, and generous government transfers over the past 18 months. Household net worth is at a record high in terms of absolute level and growth, compared to the five years it took to recover after the Financial Crisis. Meanwhile, the household debt service ratio, which tracks the amount of disposable income spent servicing mortgages and other forms of consumer debt, fell to 8.2% in 1Q21, its lowest level since tracking began in 1980.13

This strength is evident on household ledgers. A JPMorgan Chase Institute study of over 1.7 million families who actively use checking accounts showed that median cash balances were more than 50% higher at the end of July 2021 compared to the same period in 2019. For families at all income levels, cash balances increased with each round of stimulus and remain elevated relative to pre-pandemic levels.14

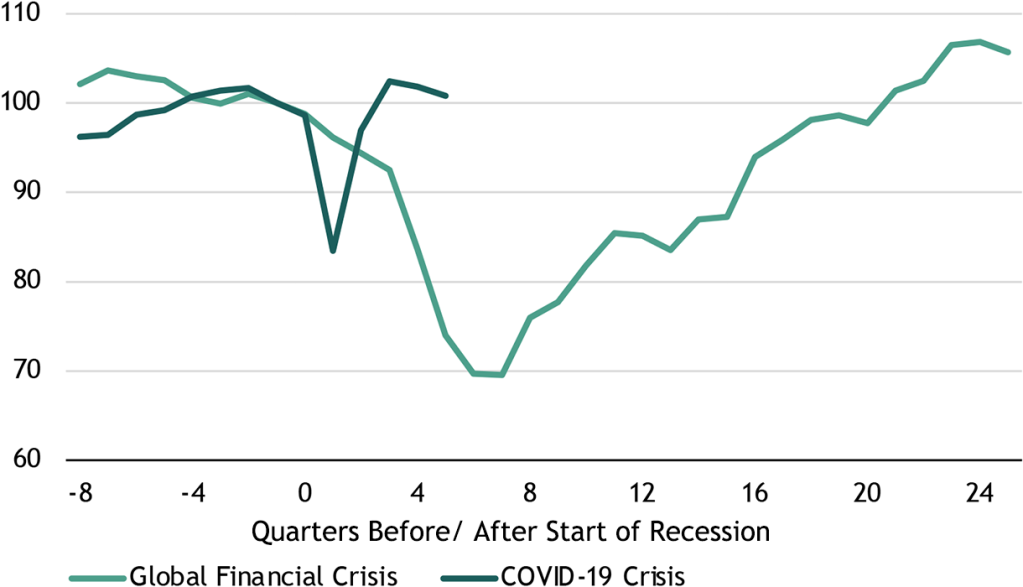

Firms spending again This cycle won’t just be powered by households. Much like consumer spending, capital expenditures experienced a dismal decade following the Financial Crisis. As prices, rates, and growth all struggled to recover, businesses had little incentive to invest for growth. But conditions are different today: the Fed’s measure of total capacity utilization is already back to its pre-COVID level.15 I think capital expenditures will break out in this cycle, driving up output and spurring healthy growth in the real economy. For example, according to The Economist, global tech firms will boost CapEx by 42% in 2021 relative to 2019.16

Figure 3: Real Gross Private Domestic Investment

(indexed to 100 as of 1 quarter before start of recession, seasonally adjusted annual rate)

Source: Blackstone Investment Strategy and US Bureau of Economic Analysis, as of 6/30/2021. “Global Financial Crisis” is indexed to 100 as of 3Q07; “COVID-19 Crisis” is indexed to 100 as of 4Q19.

Investor Positioning for the Cycle

Real assets for a real recovery Investors should consider assets with exposure to the real economy, especially those that can benefit from an historically strong US consumer and rising business spending. This means housing and ancillary goods and services, which I discussed in my August essay. Concurrent housing and CapEx cycles are an unambiguous tailwind for US manufacturers, commodity producers, and energy firms. Another promising area is e-commerce, which claimed an increasingly large share of retail sales even before the pandemic pushed consumers online in droves.

Fed watch Thanks to quantitative easing, the Fed has purchased almost three-fourths of net Treasury issuance year-to-date, compared to just 5% of net issuance in 2019.17 That level of demand makes it difficult to discern any kind of signal from rates markets about investor sentiment and economic fundamentals. But tapering will start soon, and the debt ceiling’s inevitable extension will free up greater debt issuance.

In my view, the marginal reduction of Fed demand, combined with inflationary pressures that will prove stickier than the doves think, will likely lead interest rates to grind higher. That would deteriorate the value of cash and traditional fixed income products. But investors aren’t yet positioning their portfolios for that possibility, as fixed income prices remain elevated. The dollar value of global negative-yielding debt currently sits at $14.5 trillion, down from its December high but still an historical extreme.18

In summary: Get cyclical I favor more cyclical positioning in equity and fixed income. That view flies in the face of recent weaker data, but I believe that lapping the recovery’s beginning has brought too much attention to data “misses” while obscuring high levels of activity in the real economy. While stagflation fears may keep making headlines, we are likely at the beginning of a consumer and business investment cycle that will drive secular outperformance among companies levered to the real economy and real assets.

Additionally, I remain convinced that rates will grind higher, especially once tapering begins. That leads me to favor assets and sectors with positive exposure to interest rates, including financial stocks and short-duration or floating rate assets. There could also be potential opportunities in real estate, a sector which has historically featured strong current income and can return capital to investors in the near term for deployment in a higher-rate environment.

We’ll take a closer look at market performance in the November essay, which will also feature insights from Prakash Melwani, Senior Managing Director at Blackstone and Chief Investment Officer of the Private Equity group.

With data and analysis by Taylor Becker.

- Based on a Bloomberg survey of economists, whose median expectation for 2Q’21 GDP growth was 8.4%.

- University of Michigan, as of 8/27/2021.

- Bureau of Labor Statistics, as of 9/8/2021.

- National Federation of Independent Business (NFIB), as of August 2021.

- Bureau of Labor Statistics, as of 9/3/2021.

- Euroseas, as of 9/8/2021.

- Drewry Supply Chain Advisors, as of 9/16/2021.

- Wall Street Journal, as of 9/5/2021.

- Blackstone proprietary data.

- Reuters, as of 8/13/2021.

- COVAX Global Supply Forecast, as of 9/8/2021.

- Washington State Department of Health, as of 9/8/2021.

- Federal Reserve Board, as of 3/31/2021. Data available on a one-quarter lag.

- JPMorgan Chase Institute, as of September 2021.

- Federal Reserve Board, as of 9/15/2021.

- The Economist, as of 5/25/2021.

- Blackstone Investment Strategy, Securities Industry and Financial Markets Association (SIFMA), and Federal Reserve Board, as of 8/31/2021. SIFMA provides monthly net Treasury issuance data. Federal Reserve Board Treasury purchases are measured as the change in US Treasury securities held outright; weekly data are aggregated at a monthly frequency by averaging.

- Bloomberg, as of 9/20/2021.

The views expressed in this commentary are the personal views of Joe Zidle and do not necessarily reflect the views of Blackstone Inc. (together with its affiliates, “Blackstone”). The views expressed reflect the current views of Joe Zidle as of the date hereof, and neither Joe Zidle nor Blackstone undertake any responsibility to advise you of any changes in the views expressed herein.

Blackstone and others associated with it may have positions in and effect transactions in securities of companies mentioned or indirectly referenced in this commentary and may also perform or seek to perform services for those companies. Blackstone and others associated with it may also offer strategies to third parties for compensation within those asset classes mentioned or described in this commentary. Investment concepts mentioned in this commentary may be unsuitable for investors depending on their specific investment objectives and financial position.

Tax considerations, margin requirements, commissions and other transaction costs may significantly affect the economic consequences of any transaction concepts referenced in this commentary and should be reviewed carefully with one’s investment and tax advisors. All information in this commentary is believed to be reliable as of the date on which this commentary was issued, and has been obtained from public sources believed to be reliable. No representation or warranty, either express or implied, is provided in relation to the accuracy or completeness of the information contained herein.

This commentary does not constitute an offer to sell any securities or the solicitation of an offer to purchase any securities. This commentary discusses broad market, industry or sector trends, or other general economic, market or political conditions and has not been provided in a fiduciary capacity under ERISA and should not be construed as research, investment advice, or any investment recommendation. Past performance is not necessarily indicative of future performance.