Byron Wien: The Dangers of Inward Thinking

There are a number of changes taking place in the investment environment and they are likely to have an influence on the returns on financial assets for some time to come. When the world’s leading economy, with more than a fifth of global GDP, does not participate in major alliances dealing with matters of security and the environment, this has longer-term investment implications. When multilateral trade agreements are in jeopardy, earnings for companies in participating countries are likely to be affected negatively. When the number of public companies materially shrinks, investment opportunities become more limited even if the overall market value for public securities increases. When companies choose to remain private because they can raise money without a public offering, investors are deprived of sharing in the growth of some of America’s most exciting innovations. All of these examples contribute to the theme that the world is becoming a place where inward thinking is on the rise. I worry that countries and companies are thinking short-term and making decisions accordingly. While this may result in favorable quarterly earnings comparisons and temporary solutions to geopolitical problems, the long-term implications of inward thinking may be more problematic.

Let’s start with the shrinkage in the number of public companies. Today there are fewer public companies in the U.S. than at any time over the last 40 years. The peak year for public markets was 1996, when over 8,000 companies were listed on U.S. exchanges. Today that number is down nearly 50% to 4,336, according to the World Federation of Exchanges. This troubling trend isn’t just limited to the United States. The number of companies in developed markets around the world is shrinking: Canada, Switzerland, Germany, France, the U.K. and others have seen the number of listed companies fall 20%– 60% from their peak. Mergers and acquisitions played a major role, but so did leveraged buy-outs. As globalization became a more important factor, competition increased and companies became vulnerable to predators. Many sought refuge by consolidating with businesses in similar or related industries. Let’s face it: being a public company has never been fun. A company is judged by its quarterly earnings performance, which often causes it to make decisions that might not be in its best long-term interest.

Executives of public companies have to spend time talking to security analysts and holding conference calls when they could be working on matters that would improve growth prospects. Legal and investor relations expenses are also a factor. As more companies have deferred or avoided going public, the number of companies investors can choose from has become more limited.

Two basic incentives encourage companies to go public: raising capital and monetizing the value of the company for employees. Now both of these objectives can be satisfied in the private market by venture capitalists and other investors. As a result, major innovative companies like Uber and Airbnb have chosen to remain private for much longer than would have been the case several decades ago. Although the small investor has been deprived of the opportunity of participating in their growth, the companies themselves have enjoyed more flexibility in the early stages of development when their earnings are likely to be volatile; therefore, staying private is not necessarily an example of inward thinking or short-termism. It may be a sound business decision.

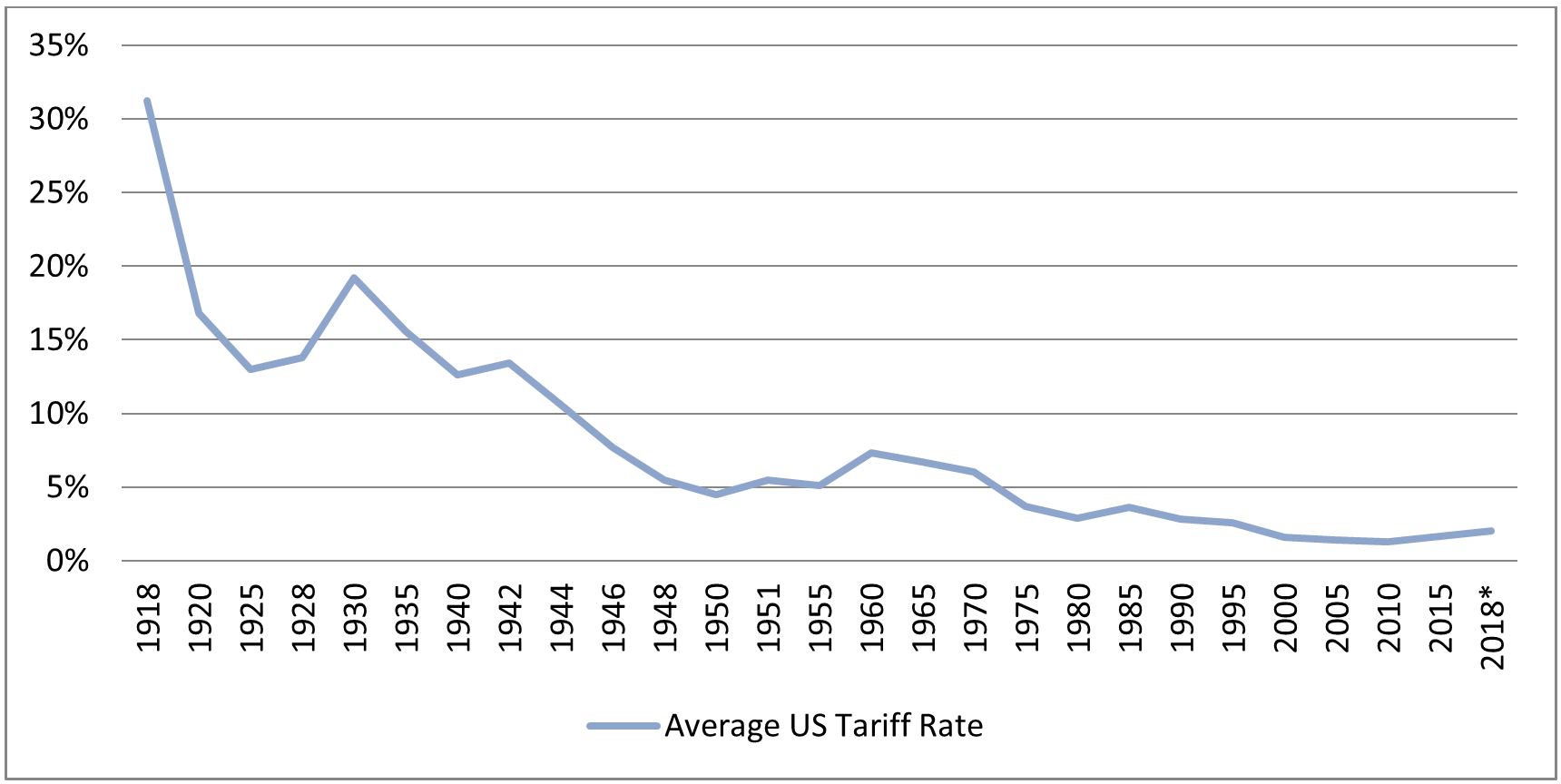

For most of the post–World War II period the world has forged constructive trade agreements that have enhanced the globalization process. Arguably, this trend started with the General Agreement on Tariffs and Trade (GATT) in 1947, when the average tariff rate between participating countries was 22%. But with each successive treaty, including the North American Free Trade Agreement, the European Union, the proposed Trans-Pacific Partnership and others, average rates around the world drew closer to low single-digits. The U.S. saw its tariff rate fall from a high of 30% in 1918 to a low of 1.3% in 2010. The current trade confrontation between the United States and its trading partners around the world represents a potential reversal of that trend (see chart below).

* Estimate as of 6/30/18. Source: Blackstone, USTR.

* Estimate as of 6/30/18. Source: Blackstone, USTR.

In the past, disagreements among countries over trade issues have been negotiated peacefully, but now it appears that a more hostile atmosphere exists. If it persists, the total volume of world trade is likely to be reduced, negatively impacting growth, job creation and return on investment. While there is no question that imbalances exist and attempts should be made to correct them, all the participants are likely to suffer if the approach is severely adversarial. Although the Trump administration pulled away from designating China as an “unusual and extraordinary threat” pursuant to the International Emergency Economic Powers Act and endorsed less onerous amendments to the Committee on Foreign Investment in the United States provisions, our relations with China, our most important trading partner, remain strained. Currently, $50 billion in tariffs have been imposed by the White House, with another $50 billion announced. There could, however, be as much as $675 billion more if the current trade conflict escalates. Despite this being less than 5% of the service-oriented economy GDP of the U.S., the impact on certain industries and countries could be significant. The global turmoil in trade is likely to have an impact on corporate revenues and profits that will become evident in 2019. Even without the trade impact, year over year comparisons are expected to be difficult next year because of the strong earnings performance in 2018.

At this point, predicting what the economic impact of the tariffs will be is hard. The Administration believes that the U.S. is losing jobs and wealth to other countries and that tariffs will mitigate that trend. Benn Steil of the Council on Foreign Relations has written a paper on tariffs and U.S. competitiveness showing a strong correlation between the trade deficit and growth going back 30 years. The faster we grow, the more we import. Higher tariffs will increase the cost of goods we import, thereby reducing consumer purchasing power and growth. When you analyze what we are importing from China, it turns out that component parts represent a large portion of the total. American companies’ ability to complete manufactured products would be adversely affected without these imports, and our GDP would suffer because of increased costs and reduced competitiveness. The impact of retaliating tariffs is likely to be felt around the world. According to Evercore ISI, Chinese growth in 2018 would likely decline from 6.9% in 2017 to 6.6% in 2018 and to 6.3% in 2019. There is likely to be a negative effect on European growth as well. The last major phase of protectionism, nearly a century ago, saw the value of international trade fall from 30% of global GDP to 10%. Strong inflation initially stemming from shortages gave way to crippling deflation.

More hostility is also evident in the geopolitical arena. By not continuing its involvement in the Iran nuclear agreement, the United States separated from its allies and may have encouraged Iran to intensify support of non-democratic regimes in Syria and Yemen. Iran also was able to continue its nuclear development program. Additional sanctions placed by the U.S. on Iran will worsen relations with an important country in a critical region and cause turmoil within a major oil producer that will be restricted from shipments to our trading partners. Previous sanctions by the Obama administration in 2012–2013 cost Iran one quarter of its exports, though the “success” of those restrictions lay in the cooperation between the U.S. and its allies. Notwithstanding that this time around the White House is pursuing a unilateral strategy, some of Iran’s 4+ million barrels a day will still be at risk. While you can argue that the Iran nuclear agreement was flawed and there were good reasons for withdrawal, it does represent an example of multilateral cooperation. The United Kingdom, France, China, Russia and Germany all participated, making it a milestone. By dropping out, the U.S. became an example of the inward global thinking I am worried about.

Populism has divided countries around the world. Brexit was the first manifestation, and growth in the United Kingdom has been cut in half. While Emmanuel Macron has initiated certain important reforms in France, he is facing the ubiquitous challenge of the Le Pen right wing party. The same is true in Germany and Italy where immigration is the primary issue and right wing parties are gaining influence. A populist wave in Mexico elected Andres Obrador, who may lead the country into a period of disengagement from the rest of the world. His book Listen Up, Trump portends a more confrontational relationship with the United States. The election in Turkey strengthens Recep Erdogan’s authoritarian rule. All of these political developments support the view that we are likely to see less economic cooperation around the world as the major industrialized countries focus on internal problems and nationalism.

The withdrawal from participating in the Paris Climate Accord or the Trans-Pacific Partnership sent the message that the United States preferred to resolve international issues through bilateral agreements rather than multilateral arrangements. Britain’s decision to withdraw from the European Union was another example of the “go it alone” approach. In an increasingly interdependent world these decisions are likely to prove unproductive. The decision not to participate in the Trans-Pacific Partnership turned over economic leadership in Asia to China. All of this is happening when the United States budget deficit is increasing from $700 billion in 2017 to $1 trillion by 2019. We are going to be issuing more Treasury securities at a time when foreign countries are likely to be buying fewer of them because of trade frictions. So far the impact on interest rates has been indiscernible, but that condition could change abruptly.

The breakdown of alliances extends to the political parties in the United States. Democrats are divided between the liberal views of Bernie Sanders and Elizabeth Warren and the more moderate views of Nancy Pelosi and Chuck Schumer. Republicans are divided between the hard-line views of Donald Trump on issues like trade and immigration and the less extreme views of Paul Ryan and Mitch McConnell. The polls have been indicating that the Democrats will become the dominant party in the House of Representatives next year, but the result is more uncertain now with the economy doing well and many voters attributing their prosperity to Trump’s tax cuts and reduction in regulation. If the Democrats do take the House, the result is likely to be another period of legislative gridlock. Many think a Democratic majority would focus on impeachment, but I believe the priority would be restoring healthcare to most Americans. In any case, the November mid-term is likely to result in a less effective legislative process, and further reduce the U.S. role as a world leader.

Some observers are arguing that our democracy is in danger. I won’t go that far, but there certainly has been a decline in respect for opposing points of view, which is another characteristic of inward thinking. When government officials are accosted in public places, you have to believe that the decline in civility is not a step forward. The retirement of Anthony Kennedy from the Supreme Court could represent another move toward inward thinking. He was the unpredictable “swing voter” and his replacement by an avowed conservative could tilt the balance toward a more rigid, ideological point of view. The possible retirement of Ruth Bader Ginsburg could exacerbate that trend. The Supreme Court has almost always been viewed as a place of relatively objective judgment. If Americans believe the Court is doctrinaire, their confidence in a critical institution will be diminished. Many are already suspicious that universities are too liberal and the press has permitted its ideological orientation to creep into its reporting. The alienation of people from these institutions reduces optimism about the future and adds to investor uncertainty. It creates a state of melancholy which is not conducive to risk-taking.

The financial markets seem unsure how to value the shift toward inward thinking. In the second quarter small caps beat large caps as the Russell 2000 rose nearly 7.5%, and cyclicals like Energy and Discretionary stocks beat defensives. Those characteristics are typical in an environment of accelerating growth. But overseas equity markets were much more defensive, and those indices most sensitive to global growth and a rising dollar, such as emerging markets, are decidedly in negative territory. I do not think this non-performance can be blamed on valuation. Bond markets displayed the same uncertainty. Despite stronger growth and inflation, the 10-year Treasury yield, a barometer of future growth, moved from a high of 3.13% in May to 2.83% at the end of the quarter. I am still optimistic for a rally in the fourth quarter due to strong earnings growth of 20% year over year, but I expect the market this summer to continue to make little progress. Enjoy your August vacation, but beware of inward thinking. Consumer confidence in the outlook is still high, but be alert to a change in mood.

* * * * *

Please see the Investor tab of our website for future webcasts and information: http://ir.blackstone.com/investors/events/default.aspx

Click here to view the Third Quarter 2018 Blackstone Webinar: “The Market Implications of Global Disarray” featuring Byron Wien, Vice Chairman, Multi-Asset Investment Group and Joe Zidle, Investment Strategist.

Click here to view the replay of the Thursday, April 12, 2018 11:00 am ET Blackstone Webcast: “Triumphant Equity Returns Are Over” featuring Byron Wien, Vice Chairman, Multi-Asset Investment Group.

Click here to view the replay of the Thursday, January 4, 2018 11:00 am ET Blackstone Webcast: “The Ten Surprises of 2018” featuring Byron Wien, Vice Chairman, Multi-Asset Investment Group.

Click here to view the replay of the Thursday, October 5, 2017 11:00 am ET Blackstone Webcast: “Some Troubling Worries in a Positive Outlook” featuring Byron Wien, Vice Chairman, Multi-Asset Investment Group.

The webcast presentation is downloadable from the interface.

Please click here to unsubscribe from Byron Wien’s Monthly Commentary mailing list at any time.

* * * * *

The views expressed in this commentary are the personal views of Byron Wien and do not necessarily reflect the views of The Blackstone Group L.P. (together with its affiliates, “Blackstone”). The views expressed reflect the current views of Byron Wien as of the date hereof,and neither Byron Wien nor Blackstone undertake any responsibility to advise you of any changes in the views expressed herein.

Blackstone and others associated with it may have positions in and effect transactions in securities of companies mentioned or indirectly referenced in this commentary and may also perform or seek to perform services for those companies. Investment concepts mentioned in this commentary may be unsuitable for investors depending on their specific investment objectives and financial position.

Tax considerations, margin requirements, commissions and other transaction costs may significantly affect the economic consequences of any transaction concepts referenced in this commentary and should be reviewed carefully with one’s investment and tax advisors. All information in this commentary is believed to be reliable as of the date on which this commentary was issued, and has been obtained from public sources believed to be reliable. No representation or warranty, either express or implied, is provided in relation to the accuracy or completeness of the information contained herein.

This commentary does not constitute an offer to sell any securities or the solicitation of an offer to purchase any securities. This commentary discusses broad market, industry or sector trends, or other general economic, market or political conditions and has not been provided in a fiduciary capacity under ERISA and should not be construed as research, investment advice, or any investment recommendation. Past performance is not necessarily indicative of future performance.