Joe Zidle: Inflationary Clues for the 10-Year

When it’s released, people scramble for the Consumer Price Index (CPI) report like it’s the Sports Illustrated after the Super Bowl. Typically, people don’t get nearly as excited for the Bureau of Labor Statistics (BLS) report on the CPI, a comparatively drab government press release. But these are atypical inflationary times, so step aside Tom Brady—BLS statisticians get the limelight now.

In November, CPI rose by 6.8% year-over-year (YoY), the fastest rate in nearly 40 years. Base effects weren’t the culprit, given the 0.8% month-over-month increase. Energy and COVID-related categories continue to have an outsized impact, but core CPI (excluding volatile food and energy) rose 4.9% YoY, the fastest such print in 30 years. All this caused the Fed to finally acknowledge that “transitory” is not an apt description for this inflation, which feels—and prints—ever-more persistent. Still, the 10-year Treasury yield remains stubbornly low. But maybe not for long.

“Inflationary upturns” suggest a higher 10-year Out of curiosity, we went back to 1962 and found that the 10-year yield increases by an average of 1.5% in inflationary upturns. We define these upturns as at least 12 consecutive months of CPI growth in excess of the average of the prior 2 years. By this definition, we can expect to enter an inflationary upturn next month, as CPI YoY growth exceeded the prior 2-year average for 11 consecutive months through November.

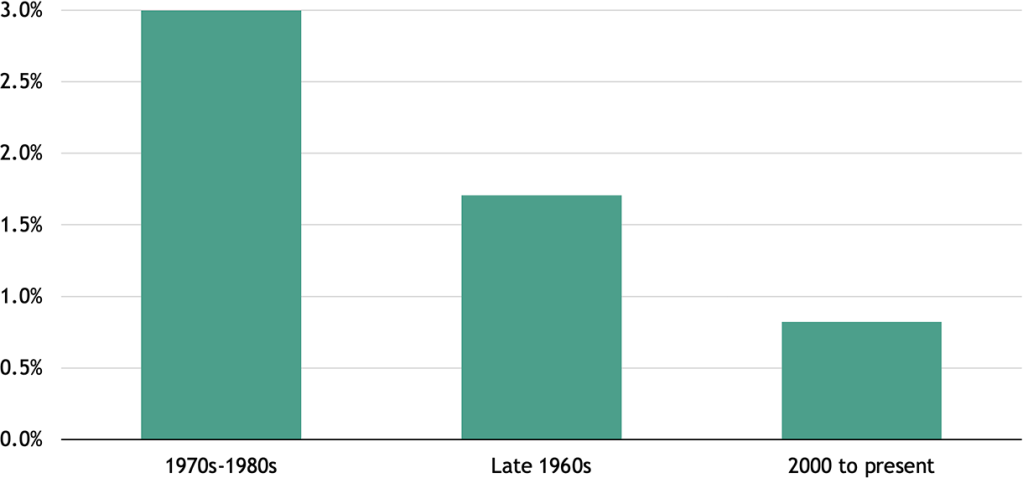

Of course, the secular decline in interest rates and inflation in the U.S. is four decades long, which means the long-term average might not be the best proxy. So we looked at various kinds of inflationary upturns in different inflation and interest rate environments: the 1960s, the 1970s–80s, and 2000 to present. And we found that in all three periods, rising inflation corresponded with a higher 10-year (see Figure 1).

Figure 1: Average Maximum Increase in 10Y Treasury Yield During “Inflationary Upturns”

(from start of inflationary upturn to maximum during the period)

Source: Blackstone Investment Strategy calculations of Bureau of Labor Statistics and Bloomberg data. Note: An “inflationary upturn” is defined as a period in which CPI YoY growth exceeds the preceding 24-month moving average for at least 12 consecutive months. The period ends when CPI YoY growth no longer exceeds the preceding 24-month moving average. Based on monthly observations from January 1962 to November 2021. The following time periods are represented in each category: 1966-1967 and 1968-1970 (“Late 1960s”); 1974-1975, 1978-1980, and 1988-1989 (“1970s to 1980s”); 2000-2001, 2005, 2006, 2008, 2011-12, and 2016-18 (“2000 to present”).

The late 60s say the same In our November essay, we wrote about how today’s economic and market dynamics look similar to the late 60s. Then, like today, economic growth was strong, inflation was rising and fiscal spending programs were large. That period also featured market volatility and rising rates. If the 10-year yield follows the pattern of the late 60s, it would rise by about 1.7% (see Figure 1). Dynamics like globalization and aging demographics are obvious differences between then and now. But even if these factors put a ceiling on inflation and rates, as many argue was the case from 2000 to today, history says the 10-year could still rise by over 80 basis points.

I would caution investors about focusing too much on stark differences between periods rather than their similarities. I would also say the same about extremes, like the hyper-inflation and sky-high rates of the 1970s and 80s, which we do not expect now. I think that investors should avoid the tendency to assume that financial history began when that period ended. Because it didn’t.

Portfolio moves if history repeats I continue to believe that risks for the 10-year yield are skewed to the upside. Investors should benefit from fortifying their portfolios against persistent inflation and a backup in rates. As we highlighted in our latest piece, potential solutions for this scenario include assets with shorter durations, floating rate coupons, and private real estate.

With data and analysis by Taylor Becker.

The views expressed in this commentary are the personal views of Joe Zidle and do not necessarily reflect the views of Blackstone Inc. (together with its affiliates, “Blackstone”). The views expressed reflect the current views of Joe Zidle as of the date hereof, and neither Joe Zidle or Blackstone undertake any responsibility to advise you of any changes in the views expressed herein.

Blackstone and others associated with it may have positions in and effect transactions in securities of companies mentioned or indirectly referenced in this commentary and may also perform or seek to perform services for those companies. Blackstone and others associated with it may also offer strategies to third parties for compensation within those asset classes mentioned or described in this commentary. Investment concepts mentioned in this commentary may be unsuitable for investors depending on their specific investment objectives and financial position.

Tax considerations, margin requirements, commissions and other transaction costs may significantly affect the economic consequences of any transaction concepts referenced in this commentary and should be reviewed carefully with one’s investment and tax advisors. All information in this commentary is believed to be reliable as of the date on which this commentary was issued, and has been obtained from public sources believed to be reliable. No representation or warranty, either express or implied, is provided in relation to the accuracy or completeness of the information contained herein.

This commentary does not constitute an offer to sell any securities or the solicitation of an offer to purchase any securities. This commentary discusses broad market, industry or sector trends, or other general economic, market or political conditions and has not been provided in a fiduciary capacity under ERISA and should not be construed as research, investment advice, or any investment recommendation. Past performance is not necessarily indicative of future performance.