Joe Zidle: What to Watch – Zombie Companies

By Joe Zidle, Investment Strategist

I remain bullish on this cycle, maintaining the view that the next US recession will be later than the consensus expects. The US economy has not yet peaked: there are few of the usual excesses, leading economic indicators continue to trend higher and the yield curve (10yr-2yr) is not inverted. The consensus view is that the yield curve will invert next year, with recession to follow in 2020; I will take the over. Still, there are long-term issues which we are watching, especially given fresh highs in the 10 year Treasury yield.

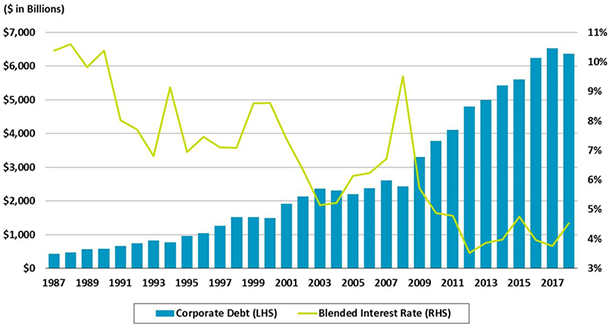

Debt Levels Mounting US Corporate debt has grown to over $6T, at a CAGR of 10% since the global financial crisis, when levels dipped to just under $2.5T.1 This dramatic rise has been fueled in part by historically strong investor demand and low rates.

Cost of Debt Service Increasing In 2009, there was approximately $3.3T in corporate debt at a blended interest rate of 5.7%, implying an annual debt service of $188B. Even though the amount of corporate debt outstanding has nearly doubled, today’s implied annual debt service has increased only 52% to approximately $288B. With the 10-year Treasury set to rise, combined with accelerating growth and widespread inflationary pressures, higher rates loom. Credit spreads may have room to tighten, but spreads are relative, whereas yields are real. Companies with lower debt service ratios in particular will feel the pressure.

US Corporate Debt & Average Interest Rate2

Source: Blackstone and Bloomberg, as of 9/25/18.

Credit Quality Declining Though the vast majority of corporate debt is investment grade (IG), a closer look at this universe shows deterioration in credit quality. The lowest-rated issuers in the IG space—BBB-rated—now account for the largest share of debt outstanding. These companies currently issue approximately 50% of all IG corporate bonds, up from only 20% in 1990.3 Investors in traditional fixed income may not realize the increasing risk profile of owning these assets. A bond’s price might be a better indicator of its true risk rather than its rating.

Rise Of The Zombies The number of companies that don’t generate enough earnings before interest and taxes (EBIT) to cover their debt service is growing. According to the most recent data available from the BIS, the number of “zombie companies” is now 12% of all companies across developed markets, up from approximately 8% in 2008.4 As debt service cost increases and issuer credit quality declines, the number of these firms is likely to grow.

Zombie Apocalypse The growth of “zombies” is not yet a problem, and an accelerating economy could enable these companies to avoid adverse credit events for years; some companies will recover. But the bond bull market is over, and rates and inflationary pressures could push yields higher, which is a fundamentally different environment than the last decade. As such, investors in traditional and purely passive strategies may want to consider seeking alternative sources of fixed income. High quality loans with shorter durations will be more attractive than traditional high yield bonds, and floating rate will beat fixed, in the rising rate environment ahead.

1. U.S. Corporate Debt includes both investment grade and high yield debt.

2. U.S. Corporate Debt is represented by the Bloomberg Barclays U.S. Corporate Index and Bloomberg Barclays U.S. Corporate High Yield Index. “Blended Interest Rate” is the weighted average yield to worst.

3. Source: Morgan Stanley Research, Citigroup Index LLC, as of July 1, 2018.

4. Source: Bank for International Settlements (BIS), study as of 9/23/18. Includes listed firms which are more than 10 years old and have a ratio of EBIT-to-interest expense below 1.0 for three consecutive years. Using a narrower measure, zombie firms would currently

* * * * *

The views expressed in this commentary are the personal views of the author and do not necessarily reflect the views of The Blackstone Group L.P. (together with its affiliates, “Blackstone”). The views expressed reflect the current views of the author as of the date hereof and Blackstone undertakes no responsibility to advise you of any changes in the views expressed herein.

Blackstone and others associated with it may have positions in and effect transactions in securities of companies mentioned or indirectly referenced in this commentary and may also perform or seek to perform services for those companies. Investment concepts mentioned in this commentary may be unsuitable for investors depending on their specific investment objectives and financial position.

Tax considerations, margin requirements, commissions and other transaction costs may significantly affect the economic consequences of any transaction concepts referenced in this commentary and should be reviewed carefully with one’s investment and tax advisors. All information in this commentary is believed to be reliable as of the date on which this commentary was issued, and has been obtained from public sources believed to be reliable. No representation or warranty, either express or implied, is provided in relation to the accuracy or completeness of the information contained herein.

This commentary does not constitute an offer to sell any securities or the solicitation of an offer to purchase any securities. This commentary discusses broad market, industry or sector trends, or other general economic, market or political conditions and has not been provided in a fiduciary capacity under ERISA and should not be construed as research, investment advice, or any investment recommendation. Past performance is not necessarily indicative of future performance.