Joe Zidle: Winter is Here

Game of Thrones established that winter’s chill would be a major theme right from the get-go. In Season 1, a young Jon Snow forebodingly told his father, Lord Eddard Stark, “Winter is coming.” Five seasons later in the heart-stopping Season 6 finale, a white raven delivered the icy confirmation to the Seven Kingdoms of Westeros: “Winter is here.” Coincidentally, the same June 2016 week that viewers discovered the truth about Snow’s forecast, a cold settled into the bond market and capped a record 34-year bull run.

A Wintry Mix for Bonds In my view, we are in the early stages of a secular bear market in bonds, where yields push higher amid a stark supply and demand imbalance. The ballooning federal budget deficit could produce $1T in new US Treasury debt next fiscal year alone, without obvious buyers.(1) The biggest buyer in recent years, the Fed, is reducing its holdings. The second and third largest holders, Japan and China, are unlikely to buy amid trade tensions. Inflation is another complication, with nearly every input cost for US producers rising, including labor, materials, oil and gas. Increasing supply and weaker demand may force the Treasury to pay higher yields as the private market absorbs the growing debt.

A Winter of Old The current market pullback has been driven, at least in part, by rising rates and a hawkish Fed. Many investors haven’t seen conditions like this in quite some time (or ever). The last bear market in bonds ended way back in October 1981, when it started to give way to the price appreciation that shaped the bond market for a generation. The yield on the 10-Yr back then was a robust 15.8%. Today, it’s on the rise and hovering around 3.15%, which is actually quite a sea change from the record low of 1.35% it hit at the end of GoT Season 6.

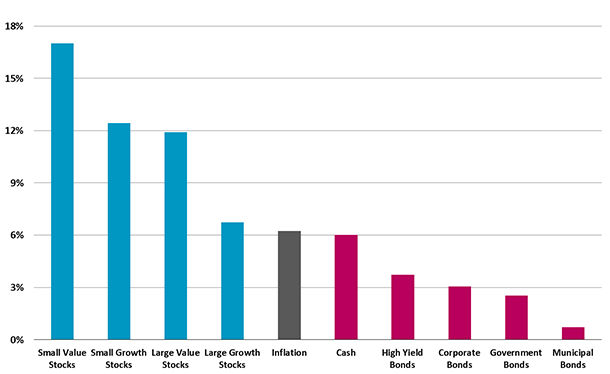

Annualized Total Return by Asset Class: 1964-1980(2)

Source: Blackstone Investment Strategy, Morningstar, Fama/French, Ibbotson Associates and Bloomberg.

Portfolio Positioning: Small Caps, Values, Cyclicals and Increasing Yield The last secular bear market in bonds offers a guide to investors. Moderate at first, inflation started to accelerate in the late 1960s and drove bond yields higher. In that period, equities beat corporate and government bonds; in particular, small caps and value outperformed by a significant margin. When rates rise, cyclical sectors such as technology, industrials, materials and consumer discretionary are well-positioned, as they have a greater ability to pass through price increases. Look for assets that can grow faster than inflation, have pricing power or provide non-traditional sources of fixed income that can increase yields.

(1) Source: Congressional Budge Office projections, as of April 2018.

(2) Note: All returns are annualized total returns. Fama/French benchmarks utlizied for historical stock performance. Ibbotson Associates indices utilized for cash and bonds performance. Inflation represented by the Consumer Price Index for Urban Consumers, not seasonally adjusted.

* * * *

The views expressed in this commentary are the personal views of the author and do not necessarily reflect the views of The Blackstone Group L.P. (together with its affiliates, “Blackstone”). The views expressed reflect the current views of the author as of the date hereof and Blackstone undertakes no responsibility to advise you of any changes in the views expressed herein.

Blackstone and others associated with it may have positions in and effect transactions in securities of companies mentioned or indirectly referenced in this commentary and may also perform or seek to perform services for those companies. Investment concepts mentioned in this commentary may be unsuitable for investors depending on their specific investment objectives and financial position.

Tax considerations, margin requirements, commissions and other transaction costs may significantly affect the economic consequences of any transaction concepts referenced in this commentary and should be reviewed carefully with one’s investment and tax advisors. All information in this commentary is believed to be reliable as of the date on which this commentary was issued, and has been obtained from public sources believed to be reliable. No representation or warranty, either express or implied, is provided in relation to the accuracy or completeness of the information contained herein.

This commentary does not constitute an offer to sell any securities or the solicitation of an offer to purchase any securities. This commentary discusses broad market, industry or sector trends, or other general economic, market or political conditions and has not been provided in a fiduciary capacity under ERISA and should not be construed as research, investment advice, or any investment recommendation. Past performance is not necessarily indicative of future performance.