Private Credit Investing in Rising Rate Environments

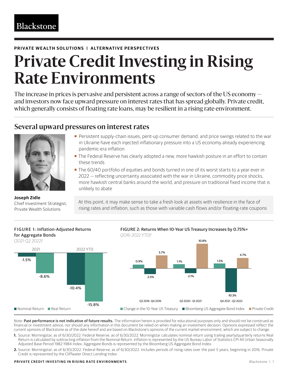

The increase in prices is pervasive and persistent across a range of sectors of the global economy — and investors now face upward pressure on interest rates. Private credit, which generally consists of floating rate loans, may be resilient in a rising rate environment.

Several upward pressures on interest rates

- Persistent supply-chain issues, pent-up consumer demand, and price swings related to the war in Ukraine have each injected inflationary pressure into the global economy already experiencing pandemic-era inflation.

- Globally, most central banks appear committed to a hawkish posture in an effort to contain these trends, even as they acknowledge the risks of slowing growth.

- The 60/40 portfolio of equities and bonds turned in one of its worst starts to a year ever in 2022 — reflecting uncertainty associated with the war in Ukraine, commodity price shocks, more hawkish central banks around the world, and pressure on traditional fixed income that is unlikely to abate.

At this point, it may make sense to take a fresh look at assets with resilience in the face of rising rates and inflation, such as those with variable cash flows and/or floating-rate coupons.

Figure 1: Inflation-Adjusted Returns for Aggregate Bonds (2021-Q2 2022)1

Figure 2: Returns When 10-Year US Treasury Increases by 0.75%+ (2016-2022 YTD)2

Note: Past performance is not indicative of future results. The information herein is provided for educational purposes only and should not be construed as financial or investment advice, nor should any information in this document be relied on when making an investment decision. Opinions expressed reflect the current opinions of Blackstone as of the date hereof and are based on Blackstone’s opinions of the current market environment, which are subject to change.

- Source: Morningstar, as of 6/30/2022. Federal Reserve, as of 6/30/2022. Morningstar calculates nominal return using trailing yearly/quarterly returns Real Return is calculated by subtracting inflation from the Nominal Return. Inflation is represented by the US Bureau Labor of Statistics CPI All Urban Seasonally Adjusted Base Period 1982-1984 Index. Aggregate Bonds is represented by the Bloomberg US Aggregate Bond Index. City Average. Public Fixed Income is represented by the Bloomberg US Aggregate Bond Index.

- Source: Morningstar, as of 6/30/2022. Federal Reserve, as of 6/30/2022. Includes periods of rising rates over the past 5 years, beginning in 2016. Private Credit is represented by the Cliffwater Direct Lending Index.

What makes private credit an attractive consideration for investors in an inflationary and rising rate environment?

Floating Rate Loans may Benefit from Rising Rates. In a cycle of rising interest rates characterized by persistent inflation, fixed income investors may struggle to earn satisfactory yield on their long-duration investments. In a rising rate environment, we believe floating rate loans such as those in private credit are highly attractive, as income can increase with rising interest rates.

Privately Negotiated Terms and Structure. Private transactions are negotiated directly between the lender and the sponsor/borrower, with an extensive focus on due diligence and downside protection. Private lenders aim to negotiate stronger structural protections, including covenants and higher call premiums. Private credit deal flow remains robust as borrowers seek certainty of terms, flexibility in structuring, and a more efficient process than the public market.

Less Volatility, Duration, and Correlation. Private assets are valued based on the fundamentals of the underlying companies and are not subject to mark-to-market volatility. Floating rate loans are often benchmarked to 3-month reference rates and they are among the lowest-duration investments available to investors today. Less volatility and lower correlation are expected in private assets because these investments are not traded in public markets.

Scale and Sector Focus Matter. Blackstone’s scale and size allow the firm to commit to large-scale transactions in changing market environments. Blackstone seeks to offer protection from inflation by focusing on sectors the firm believes exhibit high growth trends and strong cash flow profiles, such as software and healthcare.

Access Private Credit Investing in Rising Rate Environments

Important Disclosure Information and Risk Factors

The views expressed in this commentary are the views of Private Wealth Solutions and Blackstone Credit groups of Blackstone Inc. (together with its affiliates, “Blackstone”) and do not necessarily reflect the views of Blackstone itself. All information in this commentary is believed to be reliable as of the date on which this commentary was issued, and has been obtained from public sources believed to be reliable. No representation or warranty, either express or implied, is provided in relation to the accuracy or completeness of the information contained herein.

Investment concepts mentioned in this commentary may be unsuitable for investors depending on their specific investment objectives and financial position. Tax considerations, margin requirements, commissions and other transaction costs may significantly affect the economic consequences of any transaction. Concepts referenced in this commentary and should be reviewed carefully with one’s investment and tax advisors. This commentary does not constitute an offer to sell any securities or the solicitation of an offer to purchase any securities. This commentary discusses broad market, industry or sector trends, or other general economic, market or political conditions and has not been provided in a fiduciary capacity under ERISA and should not be construed as research, legal, tax or investment advice, or any investment recommendation. Past performance is not necessarily indicative of future performance.

Recipients should bear in mind that past or estimated performance is not necessarily indicative of future results and there can be no assurance that a fund will achieve comparable results, implement its investment strategy, achieve its objectives or avoid substantial losses or that any expected returns will be met.

The activity of identifying, completing and realizing attractive investments is highly competitive, and involves a high degree of uncertainty. There can be no assurance that a fund will be able to locate, consummate and exit investments that satisfy its objectives or realize upon their values or that a fund will be able to fully invest its committed capital. There is no guarantee that investment opportunities will be allocated to a fund and/or that the activities of a sponsor’s other funds will not adversely affect the interests of such fund.

Recipients should be aware that an investment in a fund is speculative and involves a high degree of risk. There can be no assurance that a fund will achieve comparable results, implement its investment strategy, achieve its objectives or avoid substantial losses or that any expected returns will be met. A fund’s performance may be volatile. An investment in a private equity fund or other alternative investment should only be considered by sophisticated investors who can afford to lose all or a substantial amount of their investment. A fund’s fees and expenses may offset or exceed its profits.

Certain countries have been susceptible to epidemics which may be designated as pandemics by world health authorities, most recently COVID-19. The outbreak of such epidemics, together with any resulting restrictions on travel or quarantines imposed, has had and will continue to have a negative impact on the economy and business activity globally (including in the countries in which funds invest), and thereby is expected to adversely affect the performance of a fund’s investments. Furthermore, the rapid development of epidemics could preclude prediction as to their ultimate adverse impact on economic and market conditions, and, as a result, presents material uncertainty and risk with respect funds the performance of their investments.

The foregoing information has not been provided in a fiduciary capacity under ERISA, and it is not intended to be, and should not be considered as, impartial investment advice.

Certain information contained in these materials constitutes “forward looking statements,” which can be identified by the use of forward-looking terminology or the negatives thereof. These may include financial estimates and their underlying assumptions, statements about plans, objectives and expectations with respect to future operations, and statements regarding future performance. Such forward-looking statements are inherently uncertain and there are or may be important factors that could cause actual outcomes or results to differ materially from those indicated in such statements. Blackstone believes these factors include but are not limited to those described under the section entitled “Risk Factors” in its Annual Report on Form 10-K for the fiscal year ended December 31, 2021, and any such updated factors included in its periodic filings with the Securities and Exchange Commission, which are accessible on the SEC’s website at www.sec.gov. These factors should not be construed as exhaustive and should be read in conjunction with the other cautionary statements that are included in these materials and in the filings. Blackstone undertakes no obligation to publicly update or review any forward-looking statement, whether as a result of new information, future developments or otherwise.

There can be no assurances that any of the trends described herein will continue or will not reverse. Past events and trends do not imply, predict or guarantee, and are not necessarily indicative of, future events or results.

Certain information herein has been obtained from sources outside Blackstone, which in certain cases have not been updated through the date hereof. While such information is believed to be reliable for purposes used herein, no representations are made as to the accuracy or completeness thereof and none of Blackstone, its funds, nor any of their affiliates takes any responsibility for, and has not independently verified, any such information.

Blackstone Securities Partners L.P. (“BSP”) is a broker-dealer whose purpose is to distribute Blackstone managed or affiliated products. BSP provides services to its Blackstone affiliates, not to investors in its funds, strategies or other products. BSP does not make any recommendation regarding, and will not monitor, any investment. As such, when BSP presents an investment strategy or product to an investor, BSP does not collect the information necessary to determine—and BSP does not engage in a determination regarding—whether an investment in the strategy or product is in the best interests of, or is suitable for, the investor. You should exercise your own judgment and/or consult with a professional advisor to determine whether it is advisable for you to invest in any Blackstone strategy or product. Please note that BSP may not provide the kinds of financial services that you might expect from another financial intermediary, such as overseeing any brokerage or similar account. For financial advice relating to an investment in any Blackstone strategy or product, contact your own professional advisor.

In the United Kingdom and the European Economic Area: issued by The Blackstone Group International Partners LLP (“BGIP”), authorised and regulated by the Financial Conduct Authority (FRN: 520839) in the United Kingdom. This communication does not constitute a solicitation to buy any security or instrument, or a solicitation of interest in any Blackstone fund, account or strategy. The content of this communication should not be construed as legal, tax or investment advice.

This material is exclusively for use by persons who are Professional Clients or Eligible Counterparties for the purposes of the European Markets in Financial Instruments Directive (Directive 2014/65/EU) and must not be distributed to retail clients or distributed onward.

Russian Invasion of Ukraine. On February 24, 2022, Russian troops began a full-scale invasion of Ukraine and, as of the date of this Material, the countries remain in active armed conflict. Around the same time, the United States, the United Kingdom, the European Union, and several other nations announced a broad array of new or expanded sanctions, export controls, and other measures against Russia, Russia-backed separatist regions in Ukraine, and certain banks, companies, government officials, and other individuals in Russia and Belarus as well as a number of Russian individuals. The ongoing conflict and the rapidly evolving measures in response could be expected to have a negative impact on the economy and business activity globally (including in the countries in which the Fund invests), and therefore could adversely affect the performance of the Fund’s investments. The severity and duration of the conflict and its impact on global economic and market conditions are impossible to predict, and as a result, could present material uncertainty and risk with respect to the Fund and the performance of its investments and operations, and the ability of the Fund to achieve its investment objectives. Similar risks will exist to the extent that any portfolio entities, service providers, vendors or certain other parties have material operations or assets in Russia, Ukraine, Belarus, or the immediate surrounding areas.