Joe Zidle: Friedman’s Lag Suggests Vigilance

At a Glance

- US economy shows surprising resilience in 2023

- Reduced leverage lengthens monetary policy effects’ lag

- Creative approaches to asset allocation amid uncertainties

The resilience of the US economy is unquestionably one of 2023’s big surprises. Coming into this year, I shared the prevailing view among economists calling for a recession, but if anything, economic activity appears to be accelerating. Aided by a stronger economy, and the outperformance of equities and tightening credit spreads, the soft-landing camp is winning the debate for now. A big question, though, is how do we reconcile improving conditions after a 525-basis point (bp) increase in fed funds rates in just 12 regular meetings spanning just 18 months?

In my view, economist Milton Friedman’s “long and variable” lag could, along with current household and corporate debt dynamics, help explain the economy’s muted reaction to this hiking cycle. This reinforces the need for investors to stay vigilant and not to get lulled into a false sense of security about the economy’s growth trajectory from here.

Debt’s different this time In Friedman’s influential 1961 paper, “The Lag in Effect of Monetary Policy,” he estimated the delay at 12 to 18 months. The Fed’s been thinking about the lag, having used the phrase “long and variable” at least 17 times since last year. Some governors suggest the lag could be as short as 9 months, while others argue it could be as long as 2 years.1 That wide range doesn’t offer much in the way of pinpointing the lag.

To assess whether the lag might differ from past cycles, our team sought to quantify the interest rate sensitivity of households and corporations by examining their debt structure. Our findings suggest that both groups have significantly reduced their leverage and restructured their debt at lower interest rates than the prevailing ones. Consequently, the economy shows less sensitivity to interest rate changes than it has had in recent hiking cycles.

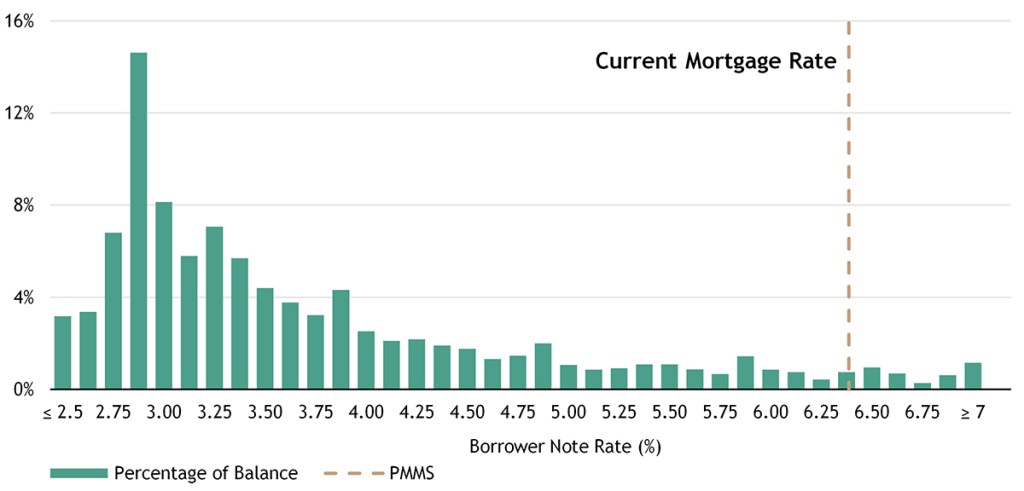

For instance, approximately 42% of owner-occupied houses had no mortgages at all as of 2021.2 Additionally, around 75% of mortgage holders carry 30-year fixed mortgages with interest rates below 4% (see Figure 1). I would argue that these folks don’t care very much about the Fed’s strategies. This scenario is in stark contrast to the previous tightening cycle from 2006 to 2008 when only 32% of owner-occupied houses were debt-free, and the popularity of interest-only loans and HELOCs exposed mortgage holders to greater interest rate risks.

Figure 1: 30-Year Conventional Mortgage Rate Distribution

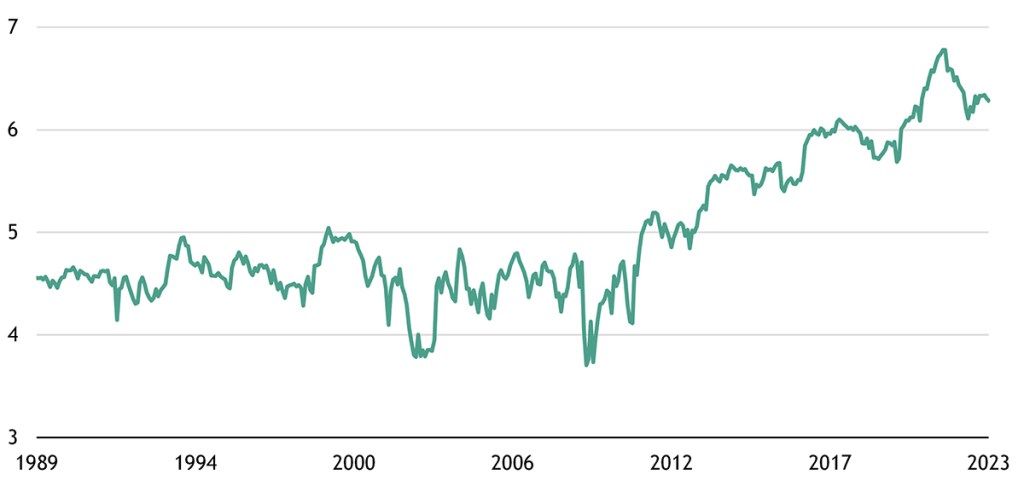

Similarly, corporations capitalized on record-low interest rates during the COVID period by accumulating precautionary cash, leading to record-high cash percentages of liabilities on corporate balance sheets. Debt issuance surged, and the duration of the Bloomberg US Aggregate Bond Index reached an all-time high.

Figure 2: Bloomberg US Aggregate Bond Index Duration

(years)

Asset allocation should be different too Now, these reductions in leverage and extended debt maturities do not render the US economy impervious to the impact of the most aggressive tightening cycle since the 1980s. Rather, they suggest that the lag in monetary policy effects could be lengthier than in previous cycles.

As for investors, I believe the potential for a lengthier lag and further volatility should encourage them to think about more creative approaches to asset allocation than traditional strategies like the 60/40 portfolio. Location and nerve matters in this still-uncertain environment, and disciplined, high-conviction investing can differentiate a portfolio. Instead of cause for fear, dislocations can be seen as opportunities for capital deployment. I believe private market alternatives offer compelling diversification opportunities.

With data and analysis by Taylor Becker.

- Source: Federal Reserve Bank of St. Louis, as of 5/24/2023. https://www.stlouisfed.org/publications/regional-economist/2023/may/examining-long-variable-lags-monetary-policy

- Source: US Census Bureau, American Housing Survey 2021.

The views expressed in this commentary are the personal views of Joe Zidle and Taylor Becker and do not necessarily reflect the views of Blackstone Inc. (together with its affiliates, “Blackstone”). The views expressed reflect the current views of Joe Zidle and Taylor Becker as of the date hereof, and neither Joe Zidle, Taylor Becker, or Blackstone undertake any responsibility to advise you of any changes in the views expressed herein.

Blackstone and others associated with it may have positions in and effect transactions in securities of companies mentioned or indirectly referenced in this commentary and may also perform or seek to perform services for those companies. Blackstone and others associated with it may also offer strategies to third parties for compensation within those asset classes mentioned or described in this commentary. Investment concepts mentioned in this commentary may be unsuitable for investors depending on their specific investment objectives and financial position.

Tax considerations, margin requirements, commissions and other transaction costs may significantly affect the economic consequences of any transaction concepts referenced in this commentary and should be reviewed carefully with one’s investment and tax advisors. All information in this commentary is believed to be reliable as of the date on which this commentary was issued, and has been obtained from public sources believed to be reliable. No representation or warranty, either express or implied, is provided in relation to the accuracy or completeness of the information contained herein.

This commentary does not constitute an offer to sell any securities or the solicitation of an offer to purchase any securities. This commentary discusses broad market, industry or sector trends, or other general economic, market or political conditions and has not been provided in a fiduciary capacity under ERISA and should not be construed as research, investment advice, or any investment recommendation. Past performance is not necessarily indicative of future performance.

For more information about how Blackstone collects, uses, stores and processes your personal information, please see our Privacy Policy here: www.blackstone.com/privacy.